Cochin Shipyard Share Price Target From 2025 to 2030

Cochin Shipyard Share Price Target From 2025 to 2030: Cochin Shipyard Ltd. (CSL) is India’s top shipbuilding and ship maintenance company, engaged majorly in ship building and ship repair operations, ranging from defense to commercial vessels. The organization functions under the umbrella of the Ministry of Ports, Shipping, and Waterways, Government of India.

Highlights:

- Industry: Shipbuilding, ship repairing, and marine engineering.

- Leadership: CEO Madhu S. Nair is spearheading the company with a strong interest in defense as well as commercial shipbuilding.

- Market Capitalization: Around ₹32,031 Crore.

- Competitive Position: CSL competes with Mazagon Dock Shipbuilders, Garden Reach Shipbuilders, and global shipbuilding companies.

2. Financial Health:

Cochin Shipyard has had good financial past with consistent revenue growth, low debt, and stable profitability.

Key Financials:

- Revenue & Profit Growth: The company has seen good revenue and net profit growth in the last five years.

- Debt-to-Equity Ratio: 0.10, which reflects very low financial risk.

- EPS (Earnings Per Share): 30.37, profitable.

- ROE (Return on Equity): 16.42%, showing high returns on equity shareholders.

- Cash Flow: Positive operating cash flow, reflecting smooth business operation.

3. Stock Performance: How Does It Behave?

Cochin Shipyard has been volatile in share price in the last one year, depending on defense orders, new orders, and overall market movement.

Stock Details:

- 52-Week High: ₹2,979.45

- 52-Week Low: ₹713.35

- Current Price: ₹1,205.10

- P/E Ratio: 40.09 (Industry average: 32.88)

- P/B Ratio: 6.07

Technical Analysis

- Momentum Score: 25.9 (Weak technical trend)

- MACD: -47.0 (Bearish signal)

- RSI (14): 33.5 (Near oversold zone)

- ADX: 15.4 (Weak trend strength)

4. Dividends & Returns: What Do Investors Get?

Cochin Shipyard pays dividends and thus is a good choice for long-term investors.

- Dividend Yield: 0.80%

- Dividend Stability: Had paid regular dividends in the recent years.

5. Growth Potential: What’s Next?

Strong order books, government orders, and internationalization are driving long-term growth at Cochin Shipyard.

Growth Drivers

- Defense Contracts: Government defence expenditure is driving demand.

- Ship Repair Business: Domestic and international market expansion.

- New Shipbuilding Projects: Low-carbon shipping and LNG-fuelled ship focus.

- Internationalization: Shipbuilding orders with international company partnerships.

- Privatization & Policy Support: Indigenous shipbuilding policy support by government.

6. External Factors: What Can Affect the Stock?

- Economic Trends: Interest rates, inflation, and foreign trade drive stock price.

- Government Policies: Shipping business and defence-supporting policies.

- Industry Trends: Increasing demand for energy-efficient ships and green shipping.

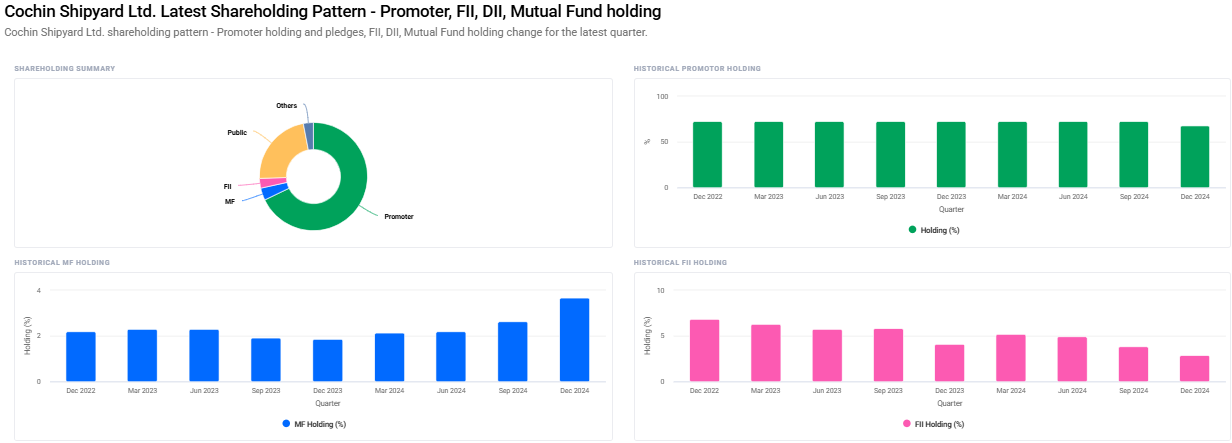

- Institutional Investors: Large investors have recently accumulated their holding in CSL.

7. Risk Factors: What Can Go Wrong?

- Market Risk: General stock market trend may impact prices.

- Business Risk: Dependence on defense orders and government contracts.

- Global Competition: International players in China and Korea are threats.

- Regulatory Risk: Maritime regulatory reforms and regulation compliance.

Cochin Shipyard Share Price Target (2025-2030)

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹3000 |

| 2026 | ₹5300 |

| 2027 | ₹7600 |

| 2028 | ₹9900 |

| 2029 | ₹12200 |

| 2030 | ₹14500 |

FAQs For Cochin Shipyard Share Price

1. Is Cochin Shipyard a good long-term investment?

Yes, Cochin Shipyard is financially stable, government-sponsored, and growth potential as well, and therefore it is a good long-term investment.

2. What are the principal risks of investing in Cochin Shipyard?

Dependence on government orders risk, international competition risk, and regulation risk are principal risks.

3. Where does Cochin Shipyard stand in comparison with its peers?

It is India’s premier shipbuilding company with sufficient government backing, though confronted with international competition.

4. Does Cochin Shipyard pay dividends?

Yes, it also boasts a dividend yield of 0.80% and quarterly dividend payouts.

5. What will Cochin Shipyard’s share price be in 2030?

Based on growth expectations, it can easily reach ₹14,500 by 2030.

Cochin Shipyard is a decent bet with promising prospects in the merchant and defense shipbuilding sector. Even though worldwide competition and market vagaries are issues, the company’s strong financials and room for expansion give it good possibilities of becoming a decent bet.