HUDCO Share Price Target From 2025 to 2030

HUDCO Share Price Target From 2025 to 2030: Housing and Urban Development Corporation Ltd. (HUDCO) is a state-owned Indian corporation that offers funding to housing schemes and developments of urban infrastructure. HUDCO was established in 1970 for low-cost housing and ecologically sound urban development. HUDCO is governed by the Ministry of Housing and Urban Affairs and offers funding to housing schemes, slum resettlement, water supply, and urban transport.

Leadership and Market Position

HUDCO is led by seasoned leadership with a public infrastructure development focus. The company’s competitive edge is its strong government backing, and therefore it is a stable player in the housing finance sector. It competes with private housing finance companies such as HDFC and LIC Housing Finance but benefits from policy-based schemes and low-risk lending.

Market Capitalization

HUDCO has a market capitalization of around INR 33,790 Crore and is a mid-cap in the Indian market. The 52-week high for the company was INR 353.70 and the 52-week low at INR 152.55, which definitely shows the humongous range of movement of the stock.

2. Financial Health: How Strong Is It?

Revenue & Profit Growth

- HUDCO has registered steady top-line growth over the past five years. The firm has a steady stream of revenues from housing and urban development schemes underpinned by government policies and programs.

Debt vs. Equity

- Very high debt-to-equity ratio of 5.48 of HUDCO indicates high leverage on borrowed money. Although very high, it is manageable owing to high government link and cautious lending policy of the firm.

Earnings Per Share (EPS)

- The EPS (TTM) of the company is 13.40, reflecting steady profitability. Rising EPS reflects good profitability and future growth potential.

Cash Flow

- There is steady cash flow in HUDCO, which has to be used for long-term infrastructure development projects. The balance sheet is strong with a book value of INR 85.53, reflecting a strong financial foundation.

3. Stock Performance: How Does It Behave?

Historical Trends

- The price of HUDCO has been up and down during the last 12 months and dipped by -13.70%, which perhaps won’t be too attractive for some investors. It is caused by general market and economic concerns partially.

Technical Indicators

- Momentum Score: 25.4 (Technically weak)

- RSI (14): 29.0 (Oversold, possible rebound pending)

- MACD: -12.1 (Bearish trend, but reversal potential)

- ADX: 28.1 (Reflecting moderate strength of trend)

Though weak technical charts, the stock will bounce back as it has government-sponsored projects and room for long-term expansion.

4. Dividends & Returns: What Shareholders Receive

- Dividend Yield: 2.49%, offering regular dividends to investors.

- P/E Ratio: 12.61 (Less than industry P/E of 17.33, reflecting company stock undervaluation).

- Institutional Investors: 11.82% holding, depicting increasing interest among financial institutions.

5. Growth Potential: What’s Ahead?

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹350 |

| 2026 | ₹550 |

| 2027 | ₹750 |

| 2028 | ₹950 |

| 2029 | ₹1150 |

| 2030 | ₹1350 |

Key Growth Drivers

- Government Schemes: HUDCO is aided by urban housing schemes such as PMAY (Pradhan Mantri Awas Yojana).

- Expansion Plans: Other infra financing such as metro and smart city plans.

- Institutional Holding: Mutual fund and institutional holding rise reflects the hope in the company’s growth in the future.

- Sector Growth: Indian urbanization is expanding, thereby creating long-term housing finance demand.

6. External Factors: What Can Influence the Stock?

Economic & Industry Trends

- Interest Rates: Rise in interest rates can impact cost of borrowing and profit margins.

- Inflation: Impact the interest rate to repay the loan as well as the construction cost.

- Government Policies: Government decisions regarding urban development can influence the operations of HUDCO.

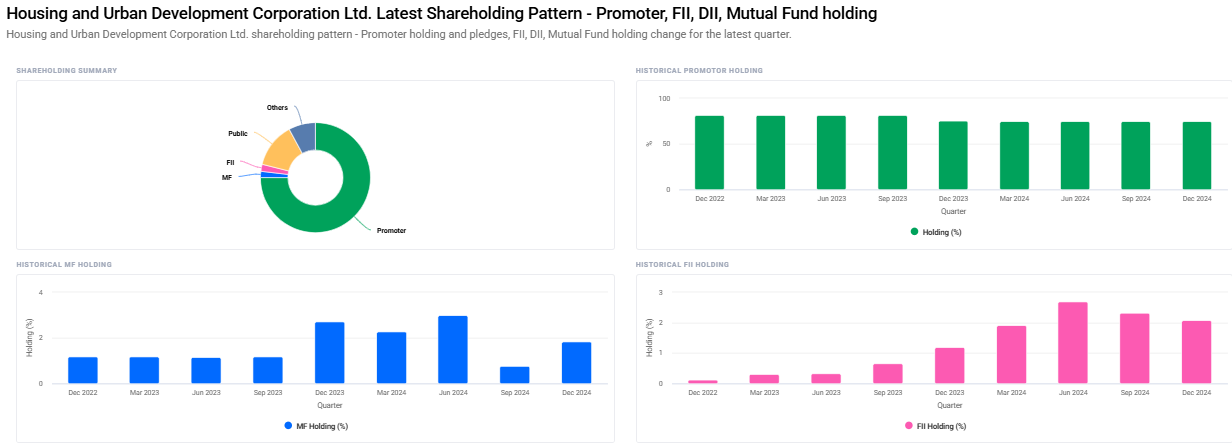

Activity of Institutional Investors

- FII Holdings: FIIs decreased holding from 2.32% to 2.08%, indicating short-term concerns.

- Mutual Fund Holdings: From 0.77% to 1.83%, indicating good sentiments in the stock.

7. Risk Factors: What Can Go Wrong?

- Market Risk: Stagnation of economy can affect funding of the project.

- Regulatory Risk: Government regulations influence funding and operation.

- Debt Levels: Fiscal risk of excess debt-equity ratio in case of rise in interest rates.

- Stock Volatility: Investors must estimate fluctuation.

FAQs For HUDCO Share Price

1. Is HUDCO a good long-term investment?

Yes, with government support, disciplined finances, and urban housing demand, HUDCO has healthy room for long-term growth.

2. What will be HUDCO’s target price in 2025?

The target price in 2025 is INR 350.

3. Does HUDCO distribute dividends?

Yes, the dividend yield of HUDCO is 2.49%, and it is suitable for income seekers.

4. How risky is a holding of HUDCO?

Although the company is good, risk involves high debt, market volatility, and government policy change.

5. Will HUDCO share reach INR 1000 in 2028?

Growth projection basis, HUDCO will be INR 950 by 2028 and INR 1150 by 2029.

6. Is it wise to invest in HUDCO today?

As there are already oversold levels (RSI 29.0), the price will bounce back. You have to look for technical and fundamental analysis before investment.

HUDCO is a market leader in the urban development finance sector with stable finances, stable growth track record, and stable government backing. Long-term investors might consider HUDCO after hedging externalities and market risk prior to making an investment choice.