Shriram Finance Share Price Target From 2025 to 2030

Shriram Finance Ltd. is India’s top financial services firm offering commercial vehicle financing, retail loans, and SME finance. It is India’s established group, Shriram Group, in the non-banking financial segment (NBFC) space. The firm has millions of customers across India’s rural and semi-urban markets, to whom it provides business and personal loans.

Leadership Team

- CEO: Executive Vice Chairman – Umesh Revankar

- Managing Director: Y.S. Chakravarti

- Chairman: Arun Duggal

Market Presence

- Market Capitalization: INR 1.02 lakh crore

- Number of Employees: Over 50,000

- Industry: Non-Banking Financial Services (NBFC)

- Competitors: Bajaj Finance, Muthoot Finance, Mahindra Finance, Cholamandalam Investment & Finance

2. Financial Health: How Strong Is It?

Revenue & Profit Growth

- Shriram Finance has registered consistent revenue and profit growth in the last five years. The EPS of the company is 50.09, and the ROE is 15.34%, indicating a profitable, well-managed business.

Debt vs. Equity

- Company’s debt-to-equity ratio stands at 3.97, which is high but normal for an NBFC running the lending business. Despite the fact that the company is highly leveraged, it is keeping the loans and repayments in control.

Cash Flow & Dividend Yield

- Dividend Yield: 1.87%

- P/E Ratio: 10.78, which is lower than the industry average of 17.41, indicating that it could be an undervalued stock.

Key Financial Statements

- Balance Sheet: Strong asset base with high book of loans

- Income Statement: Stable bottom line with consistent revenue growth

- Cash Flow Statement: Sufficient cash flow to support future operations

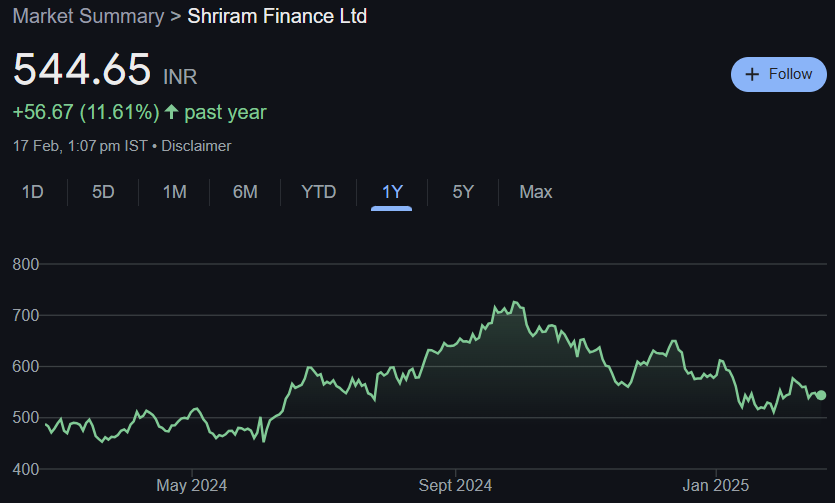

3. Stock Performance: How Does It Behave?

- Current Market Price: INR 544.60

- 52-Week High: INR 730.45

- 52-Week Low: INR 438.60

- Upper Circuit: INR 593.05

- Lower Circuit: INR 485.25

Market Sentiment

- Buy Recommendations: 81% (by 32 analysts)

- Hold Recommendations: 16%

- Sell Recommendations: 3%

Technical Indicators

- RSI (14-Day): 45.5 (Neutral)

- MACD: -2.9 (Bearish)

- ADX: 14.8 (Weak trend strength)

- ATR (Average True Range): 24.6 (Moderate volatility)

4. Dividends & Returns: What Do Investors Get?

Shriram Finance has been paying dividends to investors at regular intervals, and its dividend yield stands at 1.87%. It does not incur share buyback costs but is a safe long-term investment since it has a stable payout ratio.

5. Growth Opportunities: What Next?

Growth strategies

Shriram Finance is keen on:

- Increased penetration in rural and semi-urban areas

- Building digital loan platforms

- Growing its lending book to new sectors

- Licensing arrangement with fintech companies

Mergers & Acquisitions

The company is actively pursuing strategic mergers and acquisitions to boost its market share, particularly in the vehicle finance and microfinance sectors.

6. External Factors: What Can Influence the Stock?

- Economic Trends: Interest rates, inflation, and growth in GDP stimulate loan demand.

- Regulatory Changes: RBI regulation of NBFCs can impact lending operations.

- Competition: Increased competition from banks and fintech companies.

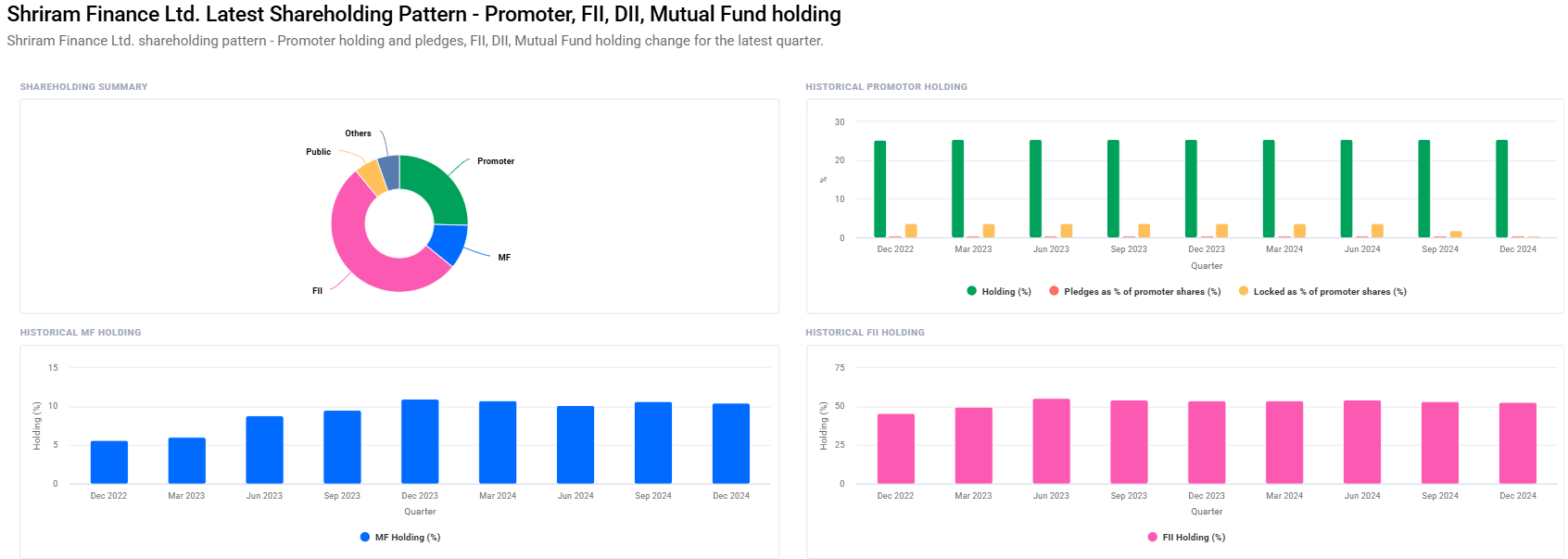

Institutional Holdings:

- Foreign Institutions: 53.08%

- Promoters: 25.40% (no change)

- Mutual Funds: 10.51% (decreases slightly)

- Retail & Others: 5.58%

- Other Domestic Institutions: 5.43%

7. Risk Factors: What Can Go Wrong?

- Market Risk: General stock market movement on NBFCs

- Business Risk: Increased competition from banks and fintech players

- Financial Risk: High debt-equity ratio

- Global Risks: Economic slowdown or change in regulations affecting lending business

Shriram Finance Share Price Target 2025 to 2030

Considering past performance, analyst expectations, and future growth expectations, the following share price targets can be expected:

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹750 |

| 2026 | ₹1050 |

| 2027 | ₹1350 |

| 2028 | ₹1650 |

| 2029 | ₹1950 |

| 2030 | ₹2250 |

All these have been calculated considering steady growth in the financial sector, regulated inflation, and supportive lending policies.

FAQ For Shriram Finance Share Price

1. Is Shriram Finance a good long-term investment stock to buy?

Yes, with its steady growth, robust market presence, and fair valuation, Shriram Finance seems to be a good long-term investment stock.

2. What is the largest risk of investing in Shriram Finance?

The largest risk is the high debt equity and possible regulatory changes to the NBFC segment.

3. Shriram Finance vs Bajaj Finance: comparison?

While Bajaj Finance does have business model diversification, Shriram Finance has excellent commercial vehicle finance and rural loans business and hence is a strong player in its space.

4. Will Shriram Finance share price hit INR 1650 in 2030?

With the use of analyst estimates and historical trends, the share can reach INR 1650 by 2030 with stable market growth and positive economic environment.

5. Does Shriram Finance pay dividends?

Yes, in the past, the company has paid dividends, and currently it has a dividend yield of 1.87%.

Shriram Finance is a good play in Indian finance sector with consistent growth prospects. Even though it has risk factors, due to its good financials and growth strategies it’s a good bet to make in long term. Always do proper analysis and include market conditions before investing.