Hyundai Motor Share Price Target From 2025 to 2030

Hyundai Motor Share Price Target From 2025 to 2030: Hyundai Motor Company is Seoul’s world-class automaker. Hyundai is a local name to produce a huge quantity of cars like sedans, sport-utility vehicles (SUVs), electric vehicles (EVs), and commercial vehicles. Hyundai has different brands like Genesis (luxury vehicles) and Ioniq (electric vehicles). With its strongest overseas network, Hyundai has been expanding worldwide, especially in India, the US, and Europe on the back of leadership in green energy and autonomous driving technology.

Leadership Team

Hyundai is headed by Executive Chairman Euisun Chung. Hyundai has been spending big on EVs, hydrogen fuel cell, and autonomous tech to spearhead the revolutionized auto world under his guidance.

Company Size and Market Position

- Market capitalization: ₹1.40 Lakh Crore

- Employees: More than 120,000 globally

- Industry peers: Toyota, Tesla, Volkswagen, Maruti Suzuki, Tata Motors

2. Financial Health: How Strong Is It?

Revenue & Profit Growth

- Hyundai showed consistent revenue growth over the last five years with strong demand for electric vehicles and SUVs. Hyundai also increased manufacturing facilities and R&D spending to keep pace.

Key Financial Indicators

- Debt-to-Equity Ratio: 0.08 (Strong balance sheet with little dependence on borrowed funds)

- Return on Equity (ROE): 44.12% (Very efficient in the context of return delivery)

- Earnings Per Share (EPS): 70.19 (Consistent increasing earnings per share)

- P/E Ratio (TTM): 24.46 (Reasonable valuation relative to industry peers)

- Dividend Yield: 7.74% (Attractive return for income-focused investors)

Hyundai’s strong cash flow generation ensures that it can sustain its operations and fund future expansion plans without taking on excessive debt.

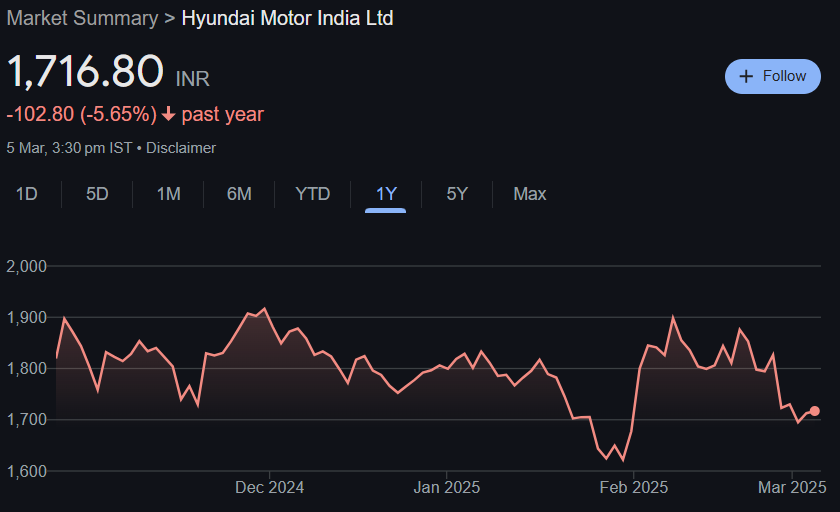

3. Stock Performance: What Does It Do?

Hyundai Motor stock performance has been going up and down in the past 52 weeks, reflecting market sentiment, supply chain challenges, and macroeconomic factors.

- 52-Week High: ₹1,970.00

- 52-Week Low: ₹1,610.65

- Current Price: ₹1,716.80

- Price Trend: Slightly bearish on account of recent market corrections

Technical Indicators

- Momentum Score: 18.8 (Technically weak stock at the moment)

- MACD (12,26,9): -12.4 (Bearish indication)

- RSI (14-day): 42.0 (Neutral, not oversold yet)

- MFI (Money Flow Index): 16.8 (indicates an oversold position, bounce expected pending)

Hyundai is paying a 7.74% dividend and was income investor’s blue chip in the bargain. The company also did share buybacks to maximize shareholder value.

5. Space to Grow: What’s Next?

Hyundai is investing heavily in two of its biggest future growth drivers:

- Electric Vehicles (EVs): Growing Ioniq brand and bets on battery tech

- Autonomous Driving: Consolidating autonomous capabilities through partnership with the world’s top tech leaders

- Hydrogen Fuel Cell: Full-scale push for hydrogen fuel cars

- Global Expansion: New geographies expansion and US and India production growth

By their application, Hyundai is subject to an increased proportion of the new car market.

6. External Forces: What Drives the Stock?

- Economic Forces: Interest rates, inflation, foreign demand for cars

- Government Policymaking: Tax credits, emissions regulations, EV incentives

- Industry Forces: Hybrid and electric vehicle shift, supply chain disruption

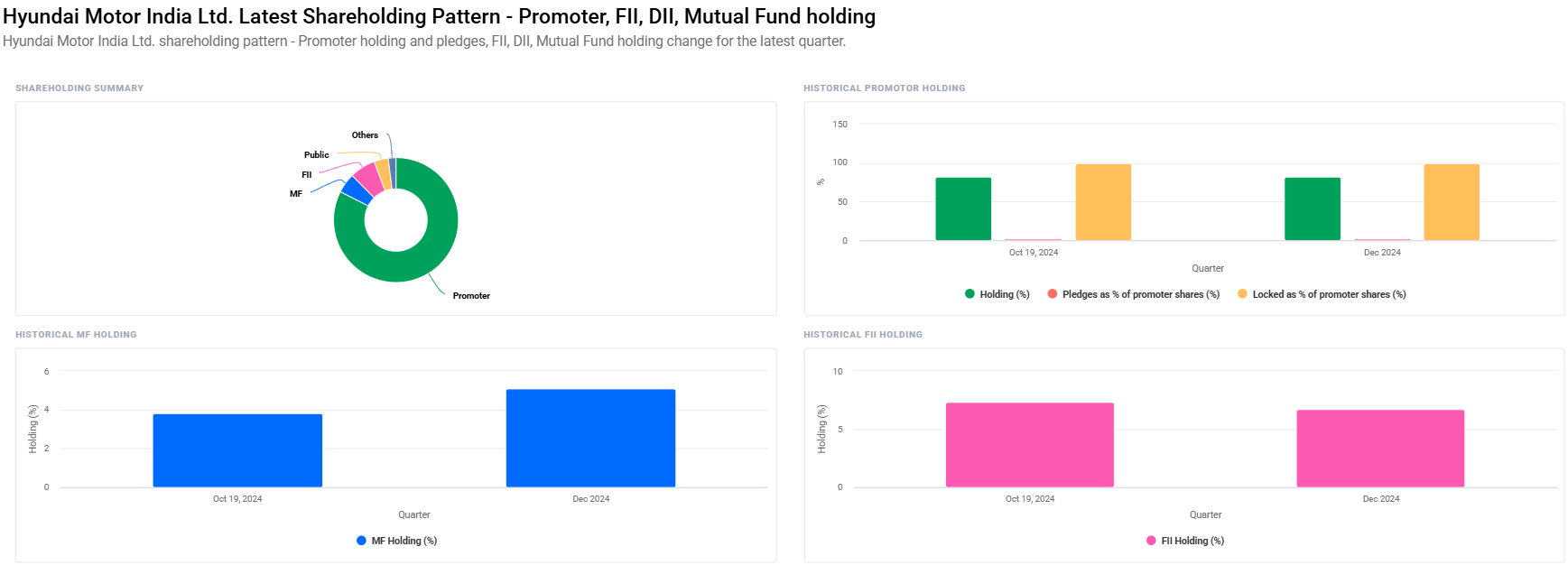

- Investment Activity by Institutional Investors: Foreign investment, mutual fund ownership

7. Risk Considerations: What Could Go Wrong?

- Risk Related to Markets: Economic declines in car demand

- Business Risk: Lag in product launches or inability to innovate

- Financial Risk: Increase in debt burden or decline in profitability

- Regulatory Risk: Import/export duty or shift in emission regulation

Hyundai Motor Share Price Target in 2025-2030

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹2000 |

| 2026 | ₹2300 |

| 2027 | ₹2600 |

| 2028 | ₹2900 |

| 2029 | ₹3200 |

| 2030 | ₹3500 |

FAQs For Hyundai Motor Share Price

1. Is Hyundai Motor a good long-term investment stock?

Yes, Hyundai is strong in its finances, is holding very little debt, and it’s very clear on expansion in EV and autonomous, large. So it’s a great wager for the long term.

2. How is the stock price of Hyundai determined?

World car demand, supply chain, govt. policy, and technology shifts determine stock price.

3. How is Hyundai different from the likes of Tesla and Toyota?

Tesla is taking the EV lead, but Hyundai is right behind it. Toyota is always the stable competition, but Hyundai’s hydrogen fuel cell initiative keeps it ahead.

4. If I invest today, what return can I look forward to?

With price target projections, the company share can grow in hundreds, and 200%+ returns in 2030 are a surety.

5. Is Hyundai a dividend-paying stock?

Yes, Hyundai has a wonderful 7.74% dividend payment and is an excellent income stock.

6. What are the greatest investment risks for Hyundai stock?

The biggest dangers are economic downturn, bills drafting policy, and rising competition in the EV space.

Hyundai Motor is a good investment with good finance, mid-innovation, and growth plans on a global scale. The investors need to balance the opportunities and drawbacks of growth and bring the decision to an end. Diversify your investment portfolio at all times and stay connected to the prevailing market trend in a bid to make the right investment choice.