CDSL Share Price Target From 2025 to 2030

CDSL Share Price Target From 2025 to 2030: Central Depository Services (India) Ltd. (CDSL) is amongst the leading operators of India’s financial market infrastructure. CDSL provides depository services which provide support for electronic trading and ownership of securities. CDSL came into existence in 1999 and is a central depository of India’s two, along with NSDL. Stock brokers, banks, and financial institutions are the main customers of CDSL who use its facilities to dematerialize, settle, and keep their securities records.

Key Leadership & Market Position

- CEO: Nehal Vora

- Market Capitalization: ₹23.91K Cr

- Industry: Financial Services (Depositories & Trading Infrastructure)

- Competitors: NSDL, CAMS, KFin Technologies

CDSL has gained traction due to its low cost of setup and widespread coverage, particularly among retail investors as well as brokerage houses. The regulators’ unstinted backing in the form of SEBI ensures hiccup-less operation.

2. Financial Health: How Strong Is It?

Revenue & Profit Growth

CDSL has posted consistent revenue and net profit growth in the past five years, fueled by increased participation in the stock market and increased demand for electronic processing of securities.

- P/E Ratio: 43.04 (indicates that the stock is slightly above industry peers)

- EPS (TTM): ₹28.58

- Book Value: ₹73.18

- Return on Capital Employed (ROCE): 34.85% (indicates efficient use of capital)

Debt vs. Equity

- CDSL is financially sound since it has minimal or no debt. Its minimal borrowing is a sign of a healthy balance sheet and the ability to weather market declines.

Cash Flow & Dividends

- Dividend Yield: 0.99%

- Stable Dividend Pay-Out: The company pays a consistent pay-out of dividends, rewarding regular investors.

- Reserves of Cash: Healthy cash generation ensures long-term growth and advancing technology.

3. Stock Performance: How Does It Behave?

Current Trends in the Stock

- 52-week high: ₹1,989.80

- 52-week low: ₹811.00

- Current Price: ₹1,144.00

CDSL shares have survived despite market volatility, driven by growth in India’s retail investor base. Recent technicals, however, have signaled short-term bearishness:

- MACD: -82.5 (below centerline, bearish momentum)

- RSI: 28.8 (oversold range, potential bounce)

- ADX: 45.7 (indicates strong trend strength)

4. CDSL Share Price Target 2025-2030

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹2000 |

| 2026 | ₹3200 |

| 2027 | ₹4400 |

| 2028 | ₹5600 |

| 2029 | ₹6800 |

| 2030 | ₹8000 |

The growth outlook is predicated on increased market penetration, increased retail participation, and dematerialization of shares in India.

5. Growth Potential: What’s Next?

Expansion Plans

- Demat Account Increase: Higher numbers of retail investors trading on the stock exchange will translate to higher transaction volumes for CDSL.

- Technological Upgrades: Investment in blockchain and AI-enabled technologies to enhance security and efficiency.

- Strategic Tie-Ups: Tie-ups with banks and fintech organizations to expand services.

- International Expansion: Scope for new emerging economies entry for depository services.

6. External Factors: What Can Influence the Stock?

Economic Trends

- Rise in Interest Rates: Can decrease stock market participation, affecting the top line of CDSL.

- Surge in Stock Market: A bull trend in the equity market will result in more demand for depository services.

Interest of Institutional Investors

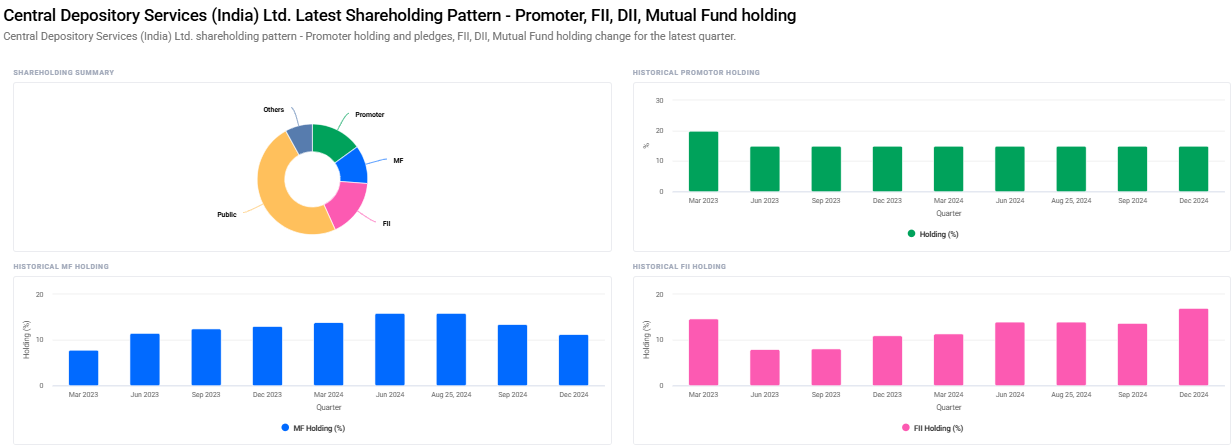

- FII/FPI holding increased from 13.70% to 17.01%

- Mutual Fund holding decreased from 13.36% to 11.21%

- Promoter holding is stable at 15%

- Institutional investor accumulation in CDSL is a positive sign of long-term growth.

7. Risk Factors: What Can Go Wrong?

Market Risks

- Downsides in the stock markets can limit transaction volumes.

- Competitor movements (NSDL, CAMS) could influence CDSL market share.

Regulatory Risks

- SEBI regulations can imply higher cost of compliance.

- Government policies regarding digital securities can impact business operations.

Technological Risks

- Cybersecurity threats in the financial sector.

- Challenge of integrating with new fintech products.

FAQs For CDSL Share Price

1. Is CDSL a good long-term investment?

Yes, CDSL enjoys a healthy market position, steady revenue growth, and benefits from increasing digitalization of securities. Investors must take into account market trends and risks before investing.

2. Why is the stock price of CDSL under pressure at present?

Technical levels indicate a short-term bearish trend but on a fundamental front, the company is healthy. Short-term corrections provide good points of entry for long-term players.

3. How does CDSL stand versus NSDL?

Both are Indian central depositories but have a relatively bigger retail client base for CDSL and institutional clients at NSDL. The cost leadership business model provides CDSL a competitive advantage.

4. Why and what are the factors that would drive CDSL’s share value to ₹8000 by the year 2030?

- Improved participation of retail investors.

- Exploring fintech-led solutions.

- Sound top-line and bottom-line performance.

- Alliances and technical prowess.

5. Are there serious threats faced by CDSL?

Yes, there are risks, namely change in regulations, economic downturn, and cyber attack. But financial health of it has the effect of nullifying them.

CDSL is a strong long-term investment opportunity with its stable finances, market leadership, and potential for expansion. Short-term volatility aside, the company’s intrinsic strength calls for a sustained, five-year trend of rising share price. Investors must stay updated with company news and market trends to invest in it.