Waaree Energies Share Price Target From 2025 to 2030

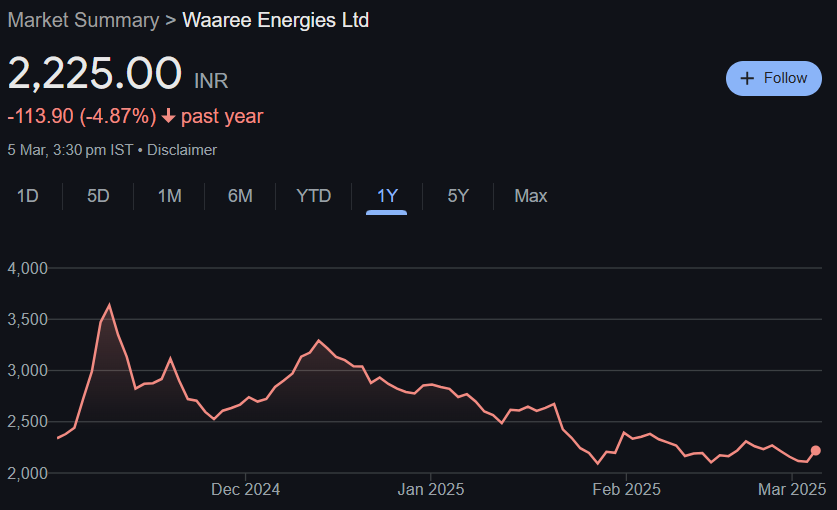

Waaree Energies Share Price Target From 2025 to 2030: Waaree Energies Limited, a leader in the renewable energy market, has experienced its utmost prosperity and development during the past two years. The company’s shares opened on 30 January, 2025, at ₹2,115.20, hit an intra-day high of ₹2,247.00, and closed at ₹2,109.45. The market cap was ₹64,090 crore with high and low at ₹3,743.00 and ₹2,026.00, respectively, over 52 weeks.

Company Essentials: Who They Are?

Products, Services, and Industry

- Waaree Energies is involved in the manufacturing of solar photovoltaic (PV) modules and complete solar solutions with integrated services, such as project development up to engineering, procurement, and construction (EPC) services. Being a part of the renewable energy group, the company is always involved in meeting the increasing global demand for clean energy sources. The products provided by the company include high-efficiency solar modules for both domestic and international markets.

Leadership Team

It is led by CEO Amit Paithankar, who has steered Waaree Energies through volatile market reality and spread its wings internationally. He has piloted the company through tidal waves and made the most of shifting dynamics in the field of renewable energy.

Having a market capitalization of ₹64,090 crore as of January 2025, Waaree Energies has become a prominent player in the renewable energy segment. The company has increased its manufacturing capacity to 13.3 gigawatts (GW) in India, well positioned than ever before to address the increasing demand for solar products within India and globally.

Competitive Position

- Waaree Energies has healthy competitive standing in the renewable energy business, i.e., solar module production. Its healthy order book position of 20 GW as on September 2024 reflects healthy demand for its services and products. Capacity expansion through investment in a strategic way and operating leverage have enabled Waaree to maintain its market share in spite of increased competition.

Financial Health: How Strong Is It?

Revenue and Profit Growth

Waaree Energies has seen humongous bottom and top line growth in the previous five years. The company’s top line was up 69% at ₹11,398 crore from FY2023 levels of ₹6,750 crore. PBT increased at an astonishing 156% to ₹1,734 crore in FY2024 compared to ₹677 crore in the previous fiscal. This is proof of the firm’s solid business models and its ability to catch the wave of the rising renewable energy market. Debt vs. Equity

Waaree Energies adopts a conservative gearing policy with a debt-equity ratio of 0.20. Conservative gearing indicates the availability of a healthy balance sheet with adequate financial buffer, with scope available to the company to utilize borrowed funds for capitalizing on growth opportunities without over-reliance on loans.

Earnings Per Share (EPS)

- Waaree’s EPS has been rising consistently, thus cementing its profitability as well as value creation for its shareholders. Its FY2024 EPS was ₹62.76, which is sharply higher than FY2023’s ₹24.49. The consistent rise in EPS reflects Waaree’s ability to generate shareholder wealth through consistent earnings growth.

Cash Flow

- While no cash flow number is even suggested, the strong top-line growth and profitability do give some indication towards a healthy cash flow position. With this financial condition, Waaree Energies can sustain its operations, invest in capacity, and seek new business opportunities.

Waaree Energies Share Price Target From 2025 to 2030

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹3800 |

| 2026 | ₹5600 |

| 2027 | ₹7400 |

| 2028 | ₹9200 |

| 2029 | ₹11000 |

| 2030 | ₹12800 |

Stock Performance: How Does It Behave?

Price Trend

- Waaree Energies’ share was volatile over the past one year. It also recorded a 52-week high of ₹3,743.00 and a 52-week low of ₹2,026.00. It closed at ₹2,109.45 on 30th January 2025 and showed that there was a process of consolidation that was at its peak then. This is a reflection of the dynamic action always taking place in the renewable space and investment sentiment because of policy and market forces worldwide.

Volatility

- The company has exhibited mean volatility, as described by global energy policy, national mood in the market, and news regarding the company. Volatility is to be equaled by the investors in investment such that their tolerance for risk doesn’t change and is equal to the fluctuation in the share.

Valuation Metrics

- As of Jan 2025, valuation multiples like P/E ratio are not available as the company is relatively new to the public arena and due to its volatile earnings. Industry P/E ratio is 62.05, and it can be used as a reference point while deciding on Waaree’s valuation compared to the industry. Investors would be wise to take note of these figures when the company settles down and more data points are developed.

Technical Indicators

- Moving Averages: The moving averages of the stock show a consolidation period, as the prices are consolidating after the highs. Investors should be careful and observe such trends so that they can mark entry or exit points.

- Relative Strength Index (RSI): 37.7, i.e., the stock will be going towards the oversold level. If an RSI is below 30, then the stock is oversold and will correct.

- Moving Average Convergence Divergence (MACD): MACD below the middle line, bearish signal. Watch out for any crossover signals that could signal a change in momentum.

Dividends & Returns: What Do Investors Get?

Dividend Policy

- Waaree Energies has not announced a dividend yet, as of today, January 2025, rather than keeping profit on reinvestment to finance its growth and expansion. It pursues its company strategy to expand its holding in rapidly growing renewable energy business.

Stock Buybacks

- No new proposals of share buybacks are available with figures. Spent on financing its growth strategy is a priority now.

Comparison with Industry Players

Waaree Energies is competing with other solar panel makers and other renewable energy sector players in India and across the world. Market leaders include Adani Green Energy, Tata Power Solar, Vikram Solar, and ReNew Power.

- Market Position: Waaree Energies is among the top solar module makers in India with strong bookings and growing capacity to produce.

- Revenue Growth: Waaree has seen healthier revenue growth compared to peers with improved solar adoption and wider global markets.

- Profitability: 156% FY2024 PBT growth is sufficient to give the confidence of finance strength compared to peers.

- Debt Management: Waaree’s prudent debt-to-equity ratio of 0.20 puts it in the league of more stable finance than some peers, who have taken on excessive debt.

Future Outlook: Where Is It Headed?

Growth Prospects

Waaree Energies has healthy long-term growth prospects as

- Solar Capacity Expansion: Waaree increased its manufacturing capacity to 13.3 GW to meet increasing domestic and international demand.

- Robust Order Book: With an order book of 20 GW, Waaree will generate top-line growth over the next few years.

- Government Policies & Incentives: Waaree will benefit from Indian government policies to adopt solar, production-linked incentives (PLI), and net-zero emissions.

- International Expansion: Expansion of exports to the US, Europe, and Africa provides diversification and insurance of revenues.

Threats Potential

Waaree is well-placed, but with some challenges too:

- Uncertain Raw Material Prices: Wafer, glass, and polysilicon prices determine profitability.

- Hostile Competition: Domestic and foreign competitors like Adani, Tata, and Chinese manufacturers are threats.

- Regulatory Threats: Tariffs, import quotas, or government policy shifts threaten operations.

- Stock volatility: Market and industry shocks are responsible for short-term volatility.

Conclusion: Is Waaree Energies a Good Investment?

Waaree Energies is an investment choice that can be considered by those who are interested in alternative power and long-term growth. Waaree’s financials, robust top-line growth, robust order book, and government incentives place it at the leadership position among solar players. Investors should consider the stock volatility, market risk, and competition before investing, however.