BEML Share Price Target From 2025 to 2030

Bharat Earth Movers Limited (BEML) is a champion public sector Indian company and chiefly engages in manufacturing heavy earth-moving machinery for aerospace, defense, mining, and construction sectors. The company makes equipment for metro rail infrastructure and the Indian Defence Forces, apart from other core sectors.

Who owns the company?

BEML is governed by the Government of India, Ministry of Defence. BEML is guided by a pool of efficient professionals proficient in engineering, operations, and finance. Growth and development strategy is supported by the CMD and Chairman.

Company size:

- Market Capitalization: ₹11,511 Crore

- Employees: More than 6,000 employees

- Industry Position: BEML dominates the Indian heavy engineering industry, rivaling L&T, Tata Hitachi, and Caterpillar in segments.

Competitive Position

- BEML enjoys a robust market presence in the form of government patronage, technologically advanced manufacturing facilities, and experience in defense and infrastructure projects. Its main competitors are:

- Caterpillar: A world industry leader in construction and mining machinery.

- L&T Construction Equipment: A leader in the Indian market.

- Tata Hitachi: A Construction Machinery Player

2. Financial Health: How Strong Is It?

Revenue & Profit Trends

- In the past five years, BEML has experienced steady growth in revenues with increasing defense orders and infrastructure expansion. This has been accompanied by changing profit margins with high operating costs.

Debt vs. Equity

- Debt to Equity Ratio: 0.24 (strongly indicative of low debt burden)

- Return on Equity (ROE): 10.58%

- Book Value: ₹648.16

Earnings Per Share (EPS) & Cash Flow

- EPS (TTM): 62.86

- P/E Ratio: 42.95 (industry average is 34.98, overvalued stock)

- Cash Flow: Positive, where the company can finance its operations and growth.

Key Reports to Watch:

- Balance Sheet: Sound asset base with government backing.

- Income Statement: Steady revenues, albeit volatile profits.

- Cash Flow Statement: Consistent operating cash flow even during economic downturns.

3. Stock Performance: How Does It React?

- 52-Week High: ₹5,488.00

- 52-Week Low: ₹2,671.05

- Current Price: ₹2,749.00

- Market Cap: ₹11,511 Crore

Technical Indicators

- RSI (14): 26.4 (Oversold, with potential to recover)

- MACD: -241.8 (Bearish signal)

- ADX: 27.3 (Trend strength – Moderate)

- MFI: 44.4 (Normal liquidity)

- ROC (125): -26.8 (Weak momentum)

Fundamental long-term strength but technically weak at the moment for BEML stock.

4. Dividends & Returns: What Do Investors Get?

- Dividend Yield: 0.82%

- Payout Consistency: Infrequent but low payout.

- Stock Buybacks: No recent sizeable buyback plans.

5. Growth Potential: What’s Next?

Future Growth Drivers

- Defense Contracts: Driven demand by Indian Defence Forces.

- Infrastructure Development: Boom in metro rail and road development.

- Exports: Growth in overseas demand for BEML products.

- Plans for Privatization: Unlocking of value is feasible through disinvestment.

Expansion Strategy

- Domestic: Development of closer relationships with government ministries.

- Global: Growth in sales to African, Southeast Asian, and Middle Eastern economies.

6. External Factors: What Can Move the Stock?

Economic & Industry Trends

- Inflation & Interest Rates: Could affect project financing.

- Government Policies: Policy for defence industry will be important.

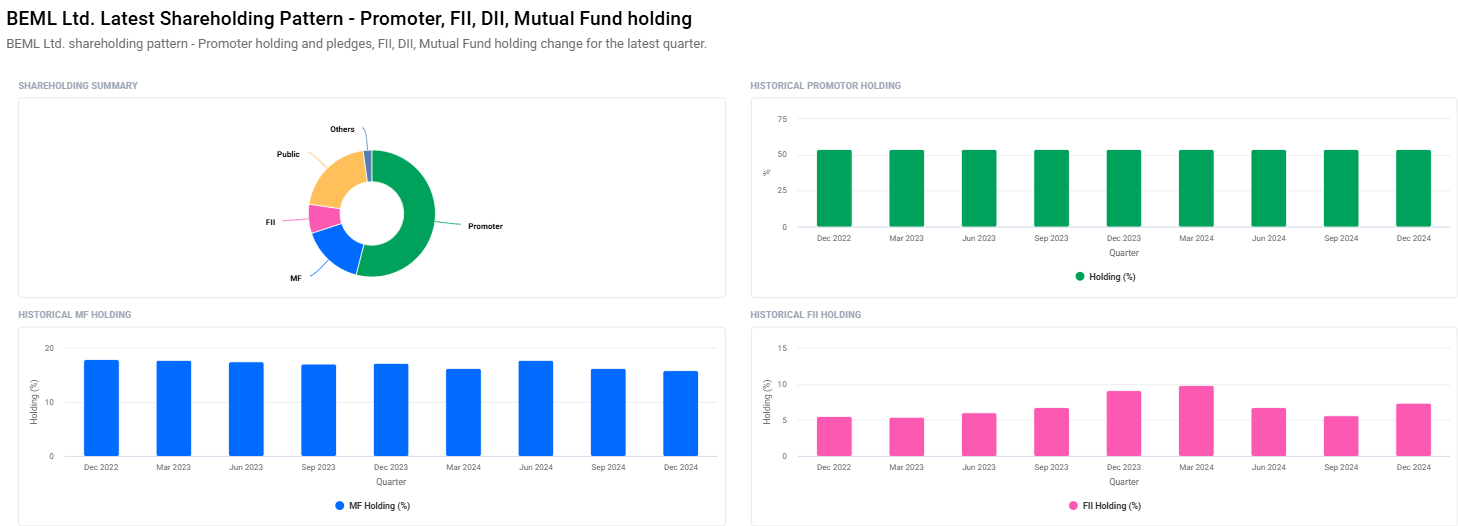

- Institutional Investors: Increased interest in BEML, with FII holding increasing from 5.66% to 7.41%.

7. Risk Factors: What Can Go Wrong?

- Market Volatility: Price volatility due to economic reasons.

- Government Regulations: Shift in defense procurement policy.

- Competition: National and global competition.

8. BEML Share Price Target from 2025 to 2030

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹5500 |

| 2026 | ₹8500 |

| 2027 | ₹11500 |

| 2028 | ₹14500 |

| 2029 | ₹17500 |

| 2030 | ₹20500 |

The numbers are calculated based on projected revenue growth, strategic orders, and industry trends.

FAQs For BEML Share Price

1. Is BEML a long-term good bet?

Yes, BEML enjoys good government support, reasonable cash flows, and growth prospects in defence and infrastructure segments.

2. Why is the share price of BEML volatile?

The share price is volatile because of market volatility, global economic climate, and investor sentiment.

3. Will Indian defence modernization help BEML?

Yes, higher defence spending and domestic manufacturing will be helpful for BEML’s growth.

4. What are risks that investors need to worry about?

Key threats to watch out for include market volatility, regulatory changes, and competition.

5. Do I hold, buy, or sell BEML shares?

Depending on your time period of investment. Short-term traders need to watch technical indicators, while long-term investors can hold for the long haul.

BEML is also a bet to be placed with good growth potential in defence and infrastructure. Technically there are short-term weakness signals, but long-term investors will use its strategic advantage to Indian industry and defence.