Shakti Pumps Share Price Target From 2025 to 2030

Shakti Pumps Share Price Target From 2025 to 2030: Shakti Pumps (India) Ltd. is the leader in stainless steel energy-efficient submersible pump, motor, and solar solution manufacturing. Shakti Pumps has continued to be committed to providing sustainable water pumping solutions for agricultural and industrial applications. With local and global presence, Shakti Pumps has emerged as one of the most robust players in the renewable energy as well as water management industry.

Leadership and Market Position

- CEO: Dinesh Patidar

- Market Capitalization: ₹10,510 Crores

- Industry: Solar Pumps, Renewable Energy

- Competitive Landscape: Kirloskar Brothers, Texmo Industries, and CRI Pumps.

Financial Health: How Strong Is It?

Trend in Revenue & Profit

The past five years have been a good run for Shakti Pumps with consistent revenues due to increased use of solar power and government efforts towards using alternative forms of energy. Revenues for the company have recorded consistent growth based on increased demand for water pumping systems that utilize solar power.

Debt vs. Equity

- Shakti Pumps has a good debt-equity ratio, keeping accounts in check and financing growth projects. The company is excellent at capital management, maintaining a balance between borrowings and reinvesting earnings.

Earnings Per Share (EPS) & Cash Flow

- EPS (TTM): 32.28

- P/E Ratio (TTM): 25.81

- Cash Flow: Positive, indicating the company can fund business and growth in the future.

Key Financial Metrics

- Return on Capital (ROC): 34.90%

- Book Value: ₹78.39 per share

- Dividend Yield: 0.08%

Stock Performance: What Does It Do?

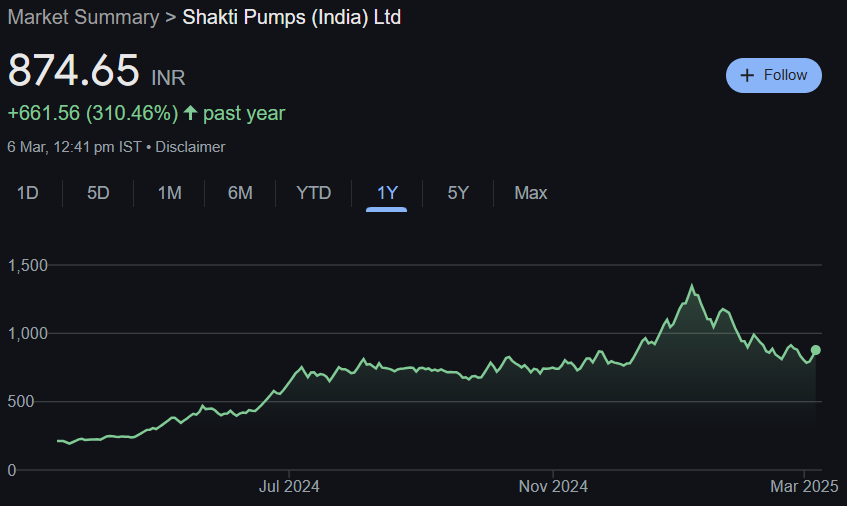

Price Trends & Volatility

- 52-Week High: ₹1,387.00

- 52-Week Low: ₹191.50

- Current Price: ₹874.65

- Past Year Growth: +310.46%

Technical Indicators

- Momentum Score: 48 (Neutral)

- MACD: -48.5 (Bearish Signal)

- RSI (14): 41.7 (Neutral)

- ADX: 28.1 (Moderate Trend Strength)

- ROC (125): 14.5 (Positive Growth)

Dividend & Returns: What Shareholders Receive?

Shakti Pumps’ dividend is moderately but frequently, indicative of the company’s long-term objective of rewarding the stakeholders with returns over value, in contrast to preserving profits and developing later on.

- Dividend Yield: 0.08%

- Stock Buybacks: No major buybacks in recent past.

Growth Potential: What the Future Holds?

Key Growth Drivers

- Government Support: Incentives and subsidies for solar power usage.

- Global Expansion: Growing demand in Middle Eastern and African markets.

- Technological Innovation: Innovative water management technologies.

- Product Diversification: Diversification of renewable energy product offerings.

Project Anticipated Share Price Targets

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹1400 |

| 2026 | ₹2600 |

| 2027 | ₹3800 |

| 2028 | ₹5000 |

| 2029 | ₹6200 |

| 2030 | ₹7400 |

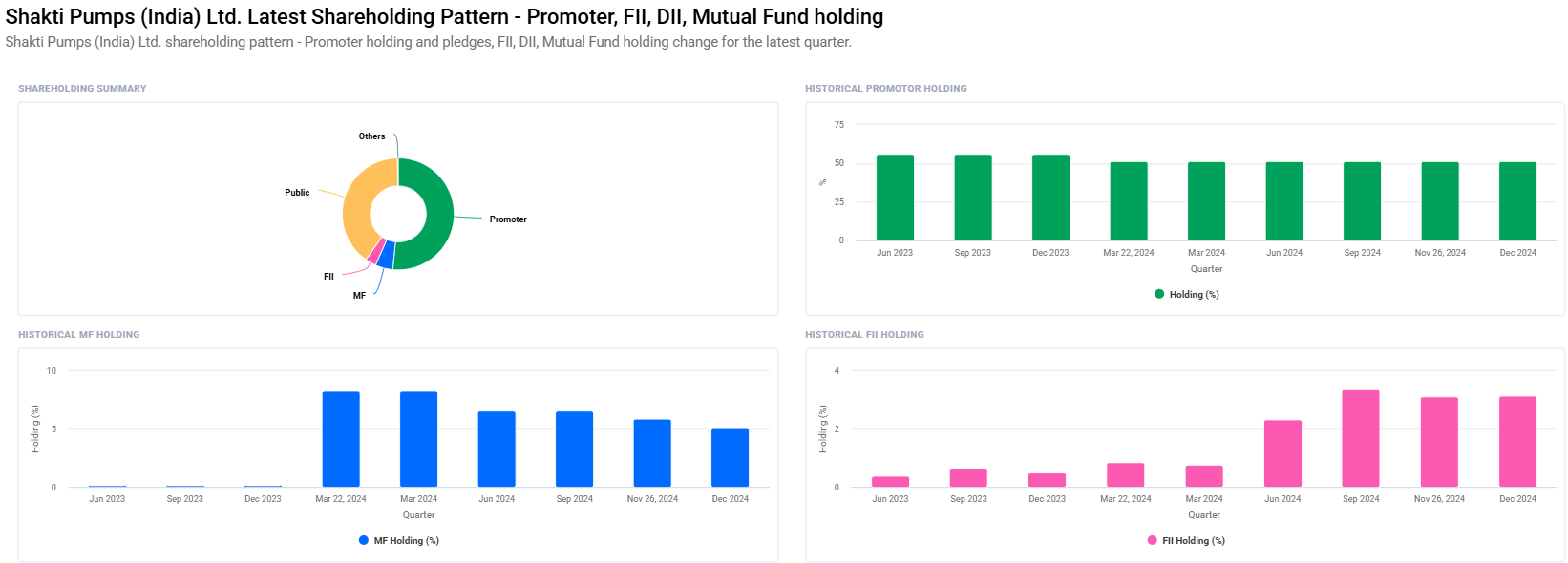

External Drivers of the Stock

- Economic Trends: Interest rates, inflation, and global market conditions.

- Industry Regulations: Government control of the renewable sector.

- Institutional Investors: FII and mutual fund movement.

- Market Sentiment: Technical and fundamental analysis trends.

Risk Factors: What Can Go Wrong?

- Market Risk: Volatility in the stock market.

- Business Risk: Threats to competition and innovation in products.

- Financial Risk: Threat of rise in debt levels.

- Political/Regulatory Risk: Changes in government policy towards subsidies and incentives.

FAQs For Shakti Pumps Share Price

1. Is Shakti Pumps a good long-term investment stock?

Yes, with its sound finances, industry growth opportunities, and renewable energy theme, Shakti Pumps is also a good long-term bet stock.

2. Why the share price has been so high in the last one year?

The stock jumped more than 310% on the back of robust demand for solar power water pumps, government incentives, and robust earning growth.

3. What are Shakti Pumps’ investment risks?

Market risk, regulatory risk, and competition in the renewable energy market.

4. What is the target price of Shakti Pumps in 2025?

It would be approximately ₹1,400 on expected growth.

5. Is Shakti Pumps distributing dividends?

Yes, but a very low dividend yield of 0.08% since the company invests most of the profit in expansion.

Shakti Pumps’ position in the renewable energy sector is a sector with great growth potential. The investor needs to be intelligent enough to look at market trends, revenue, and government policy before investing. On the basis of its good fundamentals and growth trend, Shakti Pumps would be a great stock to have in a long-term portfolio.