KFintech Technologies Share Price Target From 2025 to 2030

KFintech Technologies Share Price Target From 2025 to 2030: KFIN Technologies Limited is a major financial technology solutions provider in India. The company is well known for providing registry and transfer agency services, mutual fund services, corporate registry, and e-financial solutions. The company is a major player in the financial industry since it offers end-to-end transaction management services, assists asset managers, and provides hassle-free operations in the capital market.

Leadership and Market Presence

KFIN Technologies is operated by a highly experienced management team with strong financial and technological capabilities. It has a market capitalization of 15,163 Cr and is a top fintech player. It competes with players like CAMS (Computer Age Management Services), Karvy, and other financial service companies.

Financial Health: How Strong Is It?

Analyzing the financial well-being of the company is required to forecast its future stock performance. Among the most important financial numbers are listed below:

Revenue and Profitability

- KFIN Technologies has posted consistently increasing revenue over the last five years.

- The EPS of the company is 18.73, indicating that the company is profitable.

- ROE is 24.57%, healthy in comparison to industry players.

Debt vs. Equity

- The Debt-to-Equity ratio is 0.04, which shows a financially healthy company with minimal debt.

- Low gearing provides KFIN Technologies with financial discipline and a healthy balance sheet.

Cash Flow Analysis

- Satisfactory working capital cash flow permits expansion and investments in the future.

- Healthy finances guarantee long-term viability.

Stock Performance: What Has It Been Trading Like?

Recent Stock Market Data

- Current Stock Price: ₹890.75

- 52-Week High: ₹1,641.35

- 52-Week Low: ₹548.70

- P/E Ratio: 47.08 (Industry average: 47.38)

- Market Capitalisation: ₹15,163 Cr

- Dividend Yield: 0.65%

Technical Indicators

- Relative Strength Index (RSI): 38.4 (Neither overbought nor oversold)

- MACD: -74.5 (Bearish trend)

- Moving Average Divergence: Negative, indicating downward direction

- Average Directional Index (ADX): 29.8 (Indicating moderate trend strength)

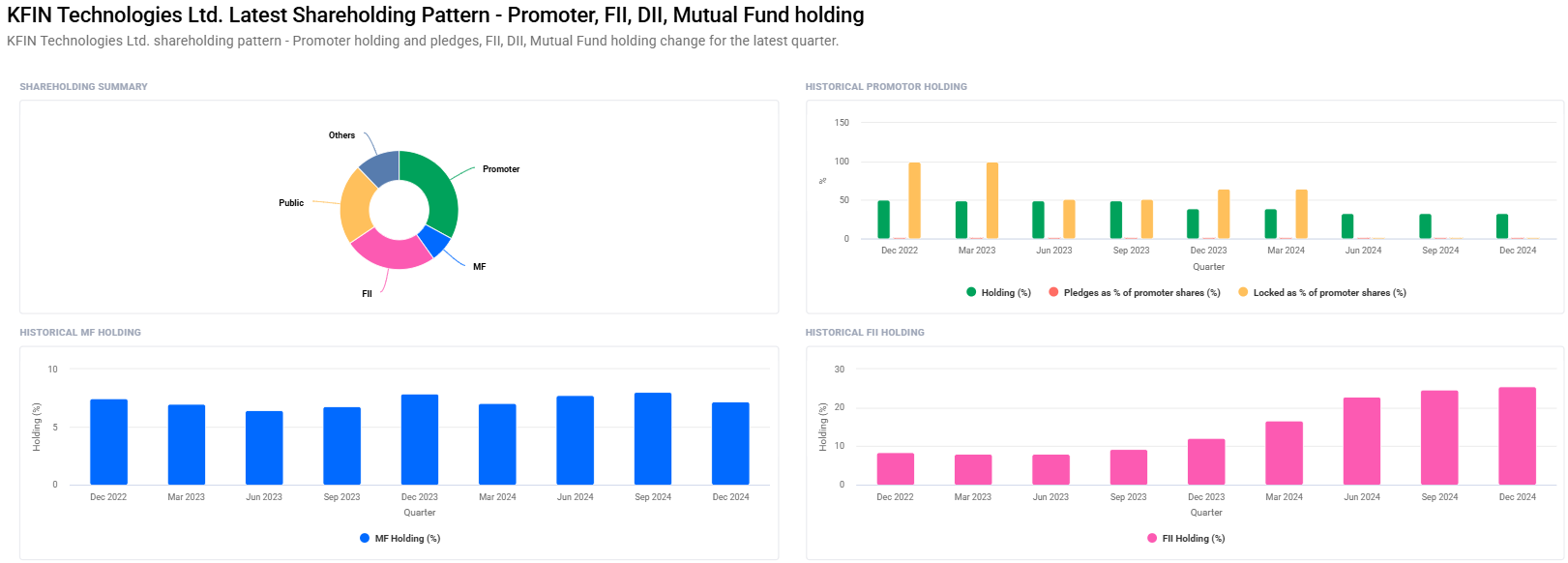

Shareholding Pattern

- Promoters: 32.96% (Slight dip from last quarter)

- Foreign Institutions: 25.40% (Up from 24.61%)

- Retail Investors: 22.21%

- Mutual Funds: 7.22% (Down from 8.04%)

This is pointing towards an increase in the foreign investor proportion, reflecting confidence in KFIN Technologies.

Growth Prospects: What Awaits KFIN Technologies?

Expansion and innovation plans

- It is emphasizing digital financial services, expanding its footprint in fintech solutions.

- It is expanding overseas, exploring new geographies for revenue diversification.

- Strategic collaborations with asset management companies can spur growth.

Mergers & Acquisitions

- Future possibilities to inorganic expansion in the way of acquisition of fintech companies can strengthen the service bouquet of KFIN and bolster its market dominance.

Government Policies and Economic Factors

- Government encouragement towards digital financial services is a silver lining.

- Indian economic growth and growing trend of investment in India will boost the market share of KFIN.

KFIN Technologies Share Price Target 2025-2030

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹1700 |

| 2026 | ₹2700 |

| 2027 | ₹3700 |

| 2028 | ₹4700 |

| 2029 | ₹5700 |

| 2030 | ₹6700 |

Risks & Challenges

Market Risks

- Volatility: Share price can go up or down depending on overall market movements.

- Competition: Competing firms like CAMS can be a challenge.

Business Risks

- Regulatory Changes: Any regulatory shift in the financial industry will affect profitability.

- Technological Disruptions: Fintech’s rapid innovations require constant innovation.

FAQs For KFintech Technologies Share Price

1. Is KFIN Technologies a good long-term investment?

Yes, with healthy finances, minimal debt, and rising foreign institutional investment, KFIN Technologies is a good long-term bet.

2. Does KFIN Technologies offer a dividend?

Yes, the firm offers a 0.65% dividend yield, offering stable returns to investors.

3. What drives the share price of KFIN Technologies?

The share price of the company is driven by

- Market trend in the fintech space

- Regulatory responses affecting financial businesses

- Activity of institutional investors (FIIs and mutual funds)

- Growth strategy and top line performance of the company

4. Is now the time to invest in KFIN Technologies?

Investment these days is all about risk-taking. The fundamentals have been good on the part of the company, but technically we are going through a bearish to neutral trend. Perhaps it is best to wait and observe the stock for good entry points.

KFIN Technologies is a solid company with a firmly established position among financial services firms. With consistent revenue growth, negligible debt-to-equity, and growing foreign institutional investment, the stock is safe to invest in for long-term growth. According to price targets, the stock of the company can rise up to ₹6,700 by 2030, and hence it can be an investment that is a multi-bagger.