MOIL Share Price Target From 2025 to 2030

MOIL Share Price Target From 2025 to 2030: MOIL Limited (Manganese Ore India Limited) is the largest producer of manganese ore in India. It is owned and operated by the Ministry of Steel and is a key part of India’s steel production value chain. It possesses large mining complexes and enjoys monopoly in India’s domestic market for manganese.

Key Points:

- Industry: Mining and Metals

- Products: Manganese ore, used primarily for making steel

- CEO & Leadership: Owned and operated by an experienced management under the control of government

- Market Capitalisation: INR 6,820 Cr (as of the latest available data)

- Competitive Strength: To be amongst the top suppliers of manganese ore in India, pitted against foreign and domestic mining entities

2. Financial Position: How Strong Is It?

MOIL has been stable in finances over the years. Below is a summary of its financial position:

Revenue & Profit Growth

- In the past five years, MOIL has continued to record revenue through ore production and exports.

- Its P/E of 19.13 is on par with industry colleagues, indicating moderate valuations.

- EPS (Earnings Per Share) of 17.55 indicates good earnings.

Debt vs. Equity

- Debt-to-equity ratio: 0.00, indicating that MOIL has no debt, a clear plus for capital-intensive industries.

- Book Value: INR 127.94 per share, providing investors with a good benchmark on valuation.

Cash Flow

- The company has good cash flows, putting it in a good position to finance operations and dividend.

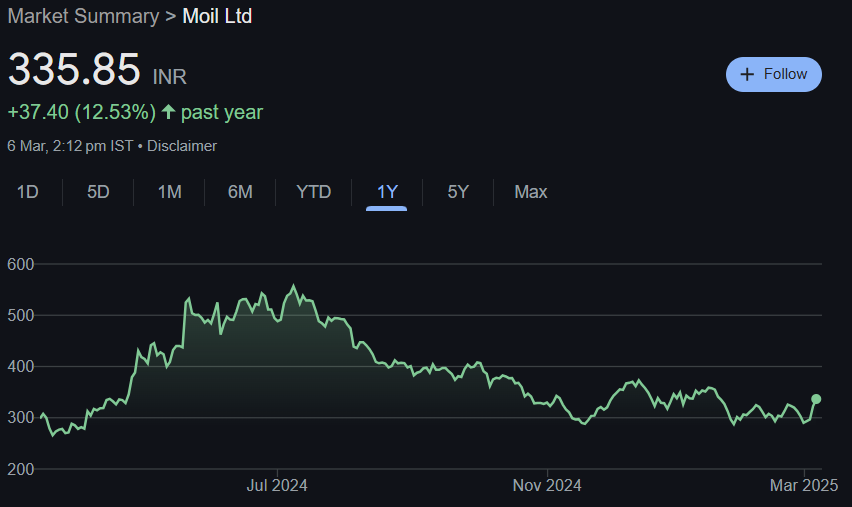

3. Stock Performance: How Does It Behave?

The MOIL stock performance has been fluctuating but unstable.

Key Price Levels:

- 52-week High: INR 588.00

- 52-week Low: INR 260.05

- Current Price: INR 335.90

- Upper Circuit: INR 387.35

- Lower Circuit: INR 258.25

Market Sentiment

The stock’s momentum score is 38.5, i.e., neutral technical bias.

- RSI (14): 54.9, i.e., not overbought or oversold.

- MFI (74.1): Indicative of potential overbought levels, i.e., pullback can occur.

- MACD: Now in the lower half, i.e., bearish short-term trend.

4. Dividends & Returns: What Do Investors Get?

- Dividend Yield: 1.58% (mean yield according to industry standards)

- Payout Stability: The firm pays out the dividends regularly and hence is a choice firm of long-term investors.

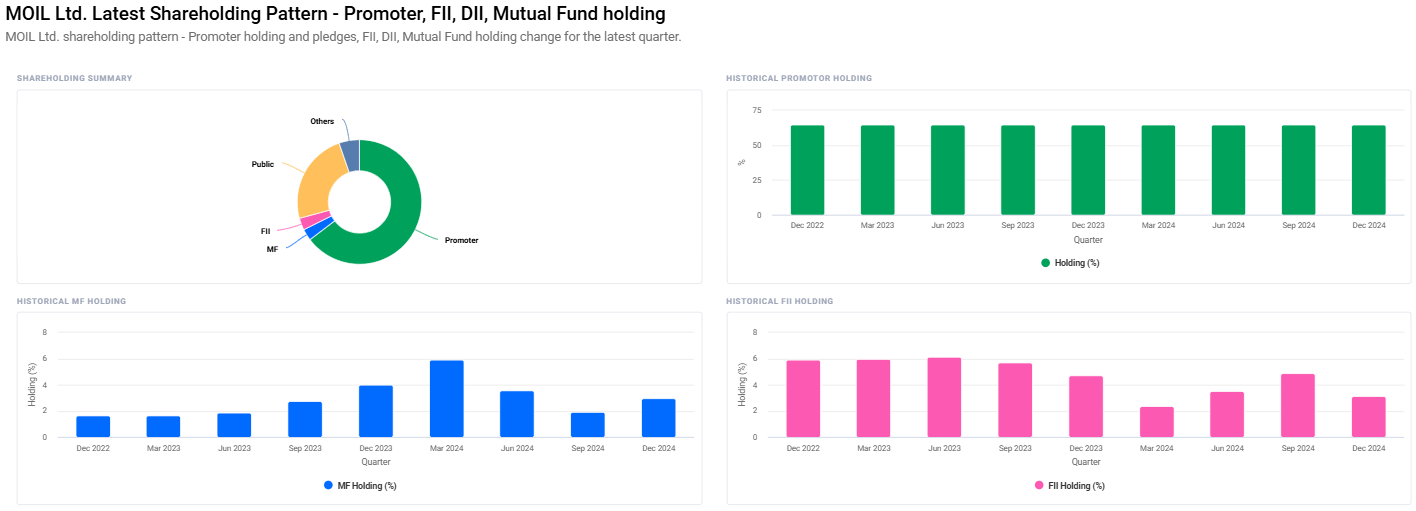

- Institutional Holdings: FIIs holding has declined in the previous three years, though mutual funds augmented holding.

5. Growth Prospects: What’s in the Pipeline?

Plan for Expansion & Future Growth

- Production Expansion: MOIL is going to increase production capacity as well as extend operations into newer mining fields.

- Government Support: Being a PSU, MOIL has policy favor and mining concessions.

- Steel Industry Growth: Rising steel consumption in India will propel manganese ore consumption.

- Technical Upgrades: Investment in state-of-the-art cost-reducing mining equipment can enhance margins.

6. External Factors: What Can Affect the Stock?

- Economic Condition: Global steel demand has direct bearing on MOIL’s top line.

- Regulatory Reforms: Government mining operations and rules on the environment can affect operations.

- Institutional Demand: FII large sudden purchases or sales can influence stock price.

- Commodity Prices: Manganese ore price movement influences profitability.

7. Risk Factors: What Can Go Wrong?

- Risk of Commodity Price: Manganese price volatility can influence earnings.

- Regulatory Risks: Regulatory overhaul of the mining sector could affect business.

- Global Market Conditions: Decline in the steel sector could lower demand.

- Environmental Issues: Harsh regulation of mining operations could influence production.

8. MOIL Share Price Target 2025 – 2030

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹600 |

| 2026 | ₹900 |

| 2027 | ₹1200 |

| 2028 | ₹1500 |

| 2029 | ₹1800 |

| 2030 | ₹2100 |

Targets above have been assumed keeping in view the growth that can be expected by MOIL, industry movement, and the future demand of manganese.

9. FAQs For MOIL Share Price

1. Is MOIL a good long-term investment?

As a matter of fact, MOIL is a debt-free firm with stable cash flows and financially sound. Its long-term growth makes it an attractive investment.

2. What is MOIL’s dividend policy?

MOIL provides stable dividends with a stable yield of 1.58%. Its dividend history is stable.

3. Why is the stock price of MOIL fluctuating?

The price of MOIL stock is determined by the demand for manganese ore, world steel production level, and institutional investor sentiment.

4. What are the risks in investing in MOIL?

Risk due to commodity price change, risk due to law and regulation, and risk due to world economic conditions influence the performance of MOIL.

5. Will infrastructure expansion in India turn out to be a blessing for MOIL?

Yes, as India is developing its infrastructure, the demand for steel and manganese ore will increase, and MOIL will be the gainer.

MOIL is a good PSU stock with a rosy future because it is a debt-free PSU, has good cash flows, and future expansion opportunities in the steel sector. Since the demand for manganese is growing, the stock can rise only substantially in the future and thus create a good long-term investment opportunity.