Bank Of Maharashtra Share Price Target From 2025 to 2030

Bank Of Maharashtra Share Price Target From 2025 to 2030: Bank of Maharashtra (BoM) is a highly ranked Indian public sector bank with a dominant franchise in retail banking and strong presence in the state of Maharashtra and elsewhere. The bank, which was established in 1935, has expanded its wings all over the country offering various financial products and services including corporate and retail banking, lending, and e-banking facilities.

Leadership and Market Position

- CEO & MD: Bank is led by seasoned management with an emphasis on digitalization and loan book expansion.

- Market Capitalisation: ₹36.83K Cr

- Competitive Position: Competes against public sector and private sector banks like SBI, PNB, and ICICI Bank.

2. Financial Health: How Healthy Is Bank of Maharashtra?

Revenue & Profit Growth

- Bank of Maharashtra has been experiencing steady bottom line and top line growth. Its bottom line has gone up over the last five years due to better asset quality and growth in loans leading to better profit.

Debt vs. Equity

- Bank’s Debt-to-Equity Ratio of 0.00 is healthy, which indicates a sound capital structure with low reliance on external borrowings.

Earnings Per Share (EPS)

- Current EPS: ₹17.55 (TTM)

- Rising EPS indicates rising profitability and operating efficiency.

Cash Flow & Assets

- Book Value: ₹127.94 per share, indicating robust asset backing.

- Return on Capital (ROC): 13.35%, showing efficient utilization of capital.

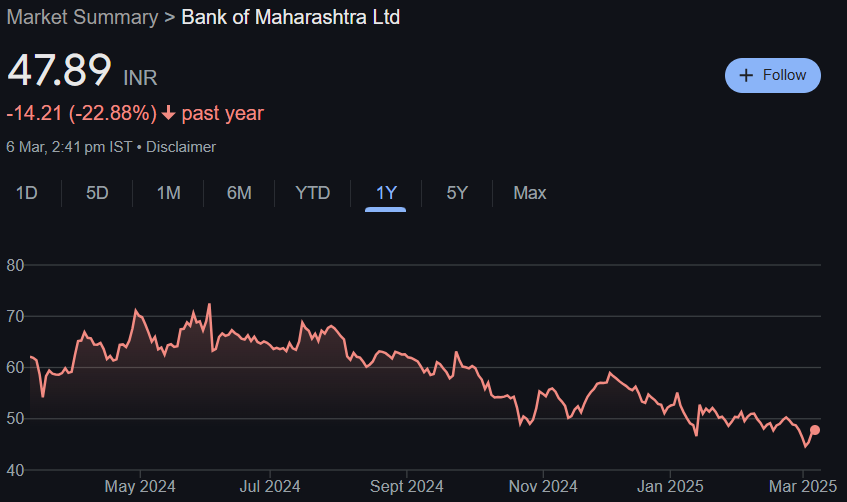

3. Stock Performance Analysis

Price Trends

- Current Share Price: ₹47.80

- 52-Week High: ₹73.50

- 52-Week Low: ₹43.67

The stock has been volatile over the last twelve months, declining by 22.91%. But good fundamentals and expansion plans indicate an anticipated turnaround in a couple of years.

Market Depth & Trading Trends

- Buy Order Quantity: 33.91%

- Sell Order Quantity: 66.09%

- Total Traded Value: ₹37.88 Cr

- P/E Ratio: 6.57 (lower than industry P/E of 12.52, which shows undervalued stock)

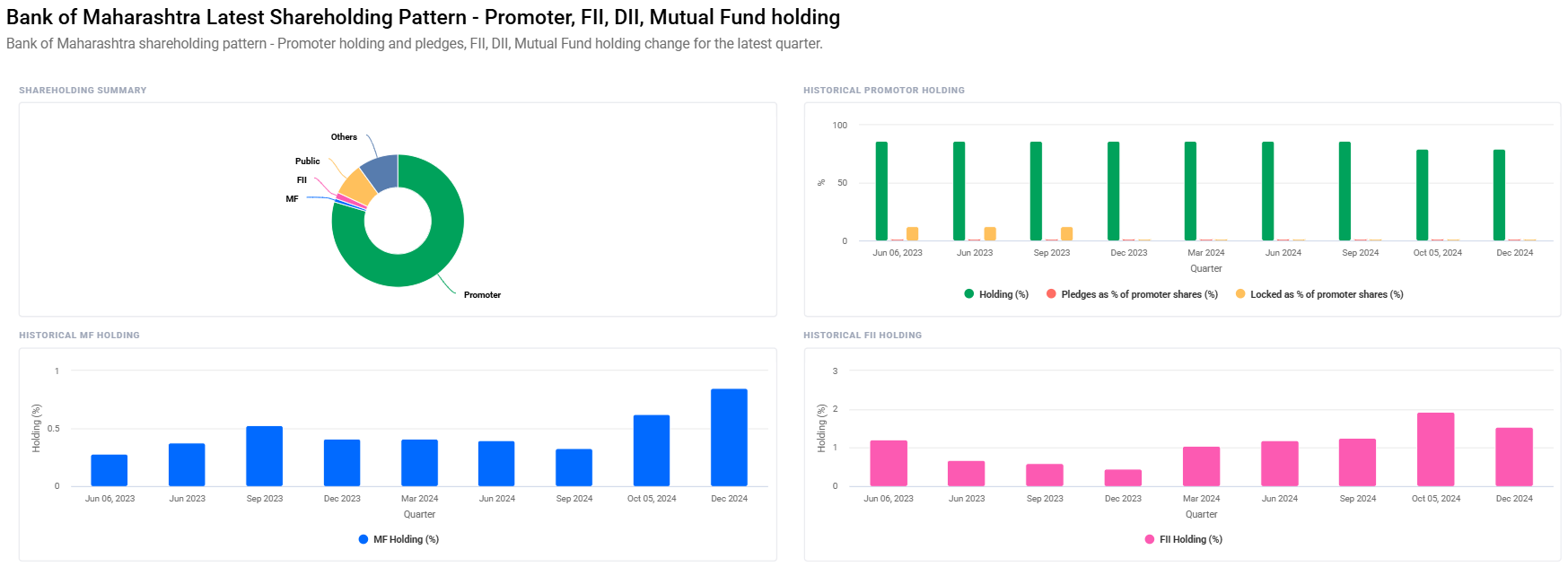

4. Dividend & Investor Returns

- Dividend Yield: 2.92%

- Promoter Holding: 64.68%

- Foreign Institutional Investors (FII) Holding: 3.12% (increasing trend shows confidence of foreign investors)

- Mutual Fund Holding: From 0.33% to 0.85%

5. Growth Potential & Future Prospects

Expansion Strategies

- Increased digital banking initiatives to enhance customer experience.

- Growing loan book in retail, MSME, and agricultural segments.

- The government policies as banking reforms will also weigh in their favour.

Future Mergers & Acquisitions

- Nothing has been said, yet public sector banks are never absent from headlines mooting merger and consolidation plans.

6. Share Price Targets Between 2025 & 2030

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹80 |

| 2026 | ₹110 |

| 2027 | ₹140 |

| 2028 | ₹170 |

| 2029 | ₹200 |

| 2030 | ₹230 |

7. Technical Indicators & Market Mood

- MACD (Moving Average Convergence Divergence): Also in negative (-3.9), thus short-term bearish.

- RSI (Relative Strength Index): 54.9, and thus indicating neutral momentum.

- Money Flow Index (MFI): 74.1, and thus the stock slightly overbought.

- ADX (Average Directional Index): 24.3, indicating moderate strength in direction of price movements.

8. External Drivers of Stock Performance

- Economic Conditions: Economic policy, interest rates, and inflation directly affect banking stocks.

- Government Regulations: Changes in policy regarding public sector bank will have significant impact.

- Institutional Investments: Increase in FII and mutual fund investment indicates high investor confidence.

9. Risks & Challenges

- Market Risk: Increase in share prices would be affected by volatility in the stock market.

- Regulatory Risks: RBI policy or banking regulation reform would be difficult to implement.

- Competition: HDFC, ICICI, and Axis Bank are competitive players as well.

Frequently Asked Questions (FAQs)

1. Is Bank of Maharashtra suitable for long-term investment?

Yes, based on good financial health, good earnings growth rate, and strong focus on e-banking, the stock is suitable for long-term investment.

2. What could be Bank of Maharashtra share price trend for 2025?

With the current trend, a target of ₹80 can be assumed for 2025.

3. Why fell the share 22.91% in previous year?

The decline can be attributed world economy volatility, profit booking of investors, and market volatility.

4. Which are the drivers of growth of the bank?

- MSME and retail loan expansion.

- Digital banking penetration.

- Reforms in PSU banks by government.

5. Does Bank of Maharashtra offer dividend?

Yes, dividend yield is 2.92%, hence it’s a good dividend stock investment for dividend players.

6. What are the risks that need to be kept in mind by investors?

- Interest rate risk.

- Private sector bank competition.

- Public sector bank regulation efforts.

7. Will the share cross ₹230 in 2030?

Actually, if the bank is able to sustain its high growth rate, consolidate its profitability, and benefit from digital banking trends, the target of ₹230 in 2030 does seem firmly within reach.

Bank of Maharashtra has sound fundamentals, increasing investor confidence, and expansion plans with a growth focus. Share price can fluctuate on a short-term market front, but long-term investors can expect to get stable returns at a share price of ₹230 by 2030. However, an investor should keep track of economic trends, government announcements, and industry developments to make an informed investment decision.