Bharat Dynamics Share Price Target From 2025 to 2030

Bharat Dynamics Limited (BDL) is India’s pioneering defense public sector undertaking (PSU). The company’s core business is to produce guided missiles, underwater weapon systems, launchers, countermeasure dispensing systems, and other defense hardware. BDL is one of the key enablers of improving India’s defense by providing advanced weapon systems to Indian Armed Forces.

Who Owns the Company?

The company is led by a strong management of years of experience in the defense sector. The CMD and chairman are responsible for operations, keeping in view technological development and collaboration with the government and private institutions.

How Large Is the Company?

- Market Capitalization: ₹39,390 Crore

- Employees: Approximately 3,000+

- Competitive Position: BDL is the market leader in India for missile manufacturing, competing with other defense PSUs and some private sector firms.

2. Financial Wellness: How Firm Is It?

Revenue & Profit Trends

Bharat Dynamics has exhibited constant revenue growth during the past five years. Enhanced demand for defense hardware, orders from the government, and novel technologies have fueled the finances of the company to grow aggressively.

- Revenue Growth: Consistent with growing government orders for defense.

- Profit Margins: Robust because of cheap production and value orders.

Debt vs. Equity

- Debt-to-Equity Ratio: 0.00 (Debt-free company)

- Book Value: ₹101.81 per share

Bharat Dynamics has a healthy balance sheet with zero debt, hence making it a financially low-risk stock.

Earnings Per Share (EPS) & Price-to-Earnings (P/E) Ratio

- EPS (TTM): ₹15.43

- P/E Ratio: 71.38 (vs. industry average of 37.27)

The relative higher P/E ratio of BD indicates that the company is expected by the market to increase remarkably in the near future but, on the other hand, that the company’s share would be too costly at current prices.

Cash Flow & Dividends For Bharat Dynamics Share Price

- Dividend Yield: 0.48%

- Cash Flow: Strong due to frequent government orders

3. Stock Performance: How Does It Perform?

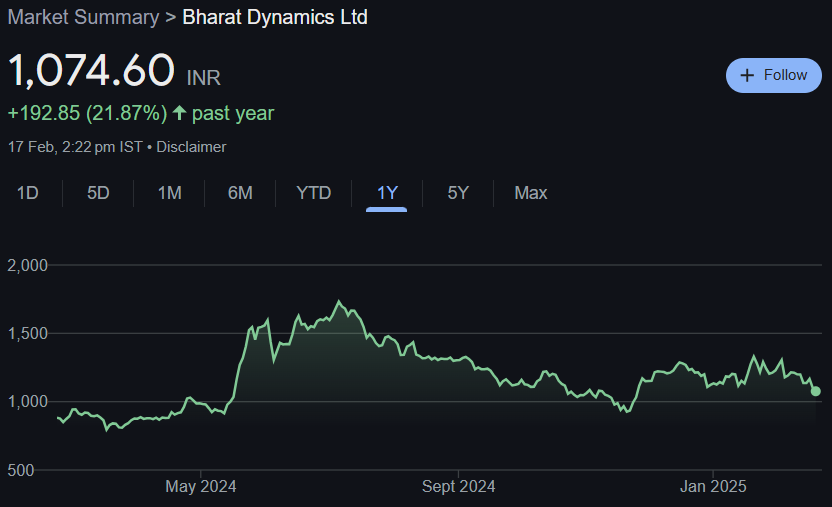

Price Trends & Volatility

- 52-Week High: ₹1,794.70

- 52-Week Low: ₹776.05

- Current Price: ₹1,074.65 (latest available figures)

The stock has been extremely volatile, with price action on defense agreements, government policy, and mood.

Technical Indicators

- Momentum Score: 32.3 (Technically weak)

- MACD: -16.3 (Bearish trend)

- RSI: 39.5 (Entering oversold range)

- ADX: 18.7 (Weak trend strength)

These technical indicators are an indication of the fact that in the short term, the stock is being sold. Fundamentals are good in the long term.

4. Dividends & Returns: What Do Investors Get?

- Dividend Yield: 0.48% (Low but stable)

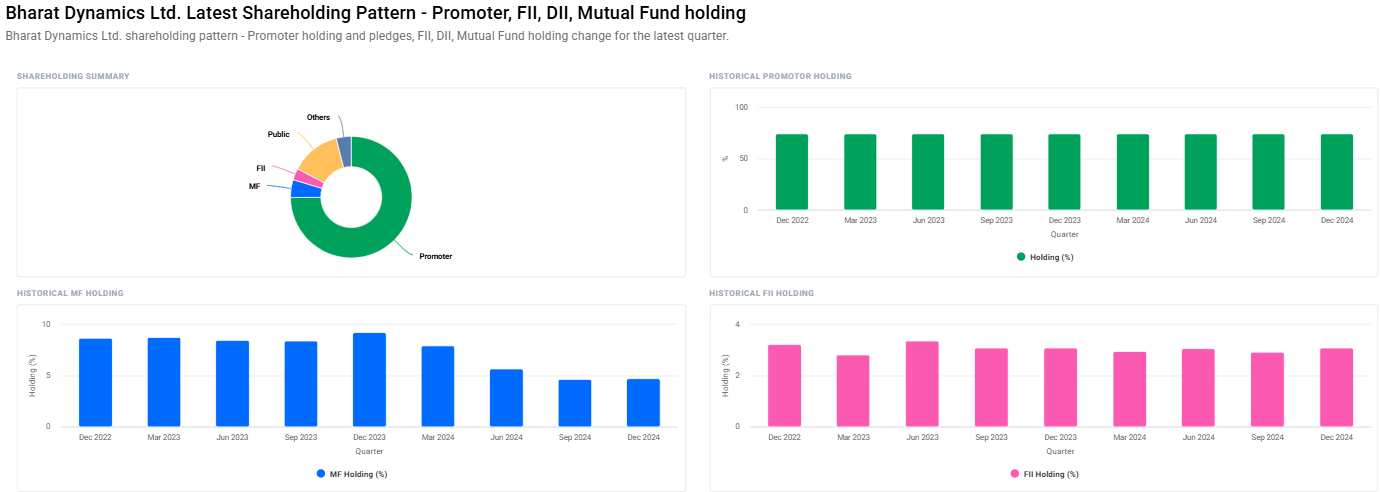

- Promoter Holding: 74.93% (High government trust)

- Institutional Holding: 11.79% (Rise in institutional investor demand)

The company provides stable but low dividends, and high government trust instilling confidence among long-term investors.

5. Growth Potential: What’s Next?

Future Projects & Innovations

Bharat Dynamics is engaged in new technology and new defense orders, including:

- Increased missile production facilities

- Synchronization with global defense companies

- Development of next-generation weapon systems

Strategy for Expansion

- Domestic Market: Growing defense spending by the Indian government

- International Market: Export opportunity to friendly countries

Growing defense budget by India could be a blessing for BDL in the form of new orders and associations.

6. External Factors: What Can Drive the Stock?

Economic Trends

- Favorable government policies favoring indigenous defense production

- Global geopolitical tensions driving defense stock demand

- Inflation and interest rate fluctuations influencing market mood

Industry Trends

- Defense procurement growth under “Atmanirbhar Bharat” scheme

- Private sector defence production participation on the upswing

- Government Institutional Investments & Policies

- Indian government’s biggest defence deals

- Increase in foreign institutional investors and mutual fund holdings

7. What Can Go Wrong? Risk Factors

Market Risks

- Stock price volatility with respect to external geopolitical developments

- Decline in the market affecting investor sentiment

Business Risks

- Dependence on government orders

- Private defence industry competition

Political & Global Risks

- Defence spending-altering policy

- Trade controls holding back export

Bharat Dynamics Share Price Target (2025-2030)

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹1800 |

| 2026 | ₹2800 |

| 2027 | ₹3800 |

| 2028 | ₹4800 |

| 2029 | ₹5800 |

| 2030 | ₹6800 |

Stronger future outlook by 2030 projections with government orders increasing, technological advancements, and foreign defense orders.

Frequently Asked Questions (FAQs) For Bharat Dynamics Share Price

1. Is Bharat Dynamics a good long-term investment?

Yes, Bharat Dynamics is sufficiently financed, is backed by the government, and has high growth potential in the defense segment.

2. What drives Bharat Dynamics share price?

Key drivers are defense orders, government policy, geopolitics, and global economic conditions.

3. Does Bharat Dynamics pay dividends?

Yes, but with a relatively low 0.48% dividend yield. But consistent payment is an indicator that it is financially healthy.

4. Is the stock overvalued today?

The stock is short-term overvalued at a P/E of 71.38 (over the industry’s) but is excellent long-term.

5. What are the risks associated with an investment in Bharat Dynamics?

The risks include market volatility, dependency on government orders, and policy changes impacting the defense sector.

Bharat Dynamics Ltd. is a steady player in the basket of Indian defence firms with increasing defence budgets coupled with government preference for local manufacturing. The stock may have the short-term bear phases impact now but has a robust long-term trend pattern. Investors can look forward to buying the stock in the future by considering outside factors and industry trends before choosing the investment.