RCF Share Price Target From 2025 to 2030

RCF Share Price Target From 2025 to 2030: Rashtriya Chemicals and Fertilizers Ltd. (RCF) is a massive public sector enterprise in producing and marketing industrial chemicals and fertilizers in India. RCF is a division under the Government of India’s Ministry of Chemicals and Fertilizers.

Products & Services:

- Fertilizers: Urea, complex fertilizers, biofertilizers

- Industrial Chemicals: Ammonia, Methanol, Nitric Acid, Sulfuric Acid

- Agrochemicals and Micronutrients

Leadership Team

- The company is guided by a professional management team and the Government of India. The management team is driven by operation efficiency, next-generation modernization, and green farming solutions.

Market Capitalization & Size:

- Market Cap: ₹6,601 Crore

- Employees: Over 4,000

- Competitive Position: Competes with National Fertilizers Ltd., Chambal Fertilizers, and Gujarat State Fertilizers & Chemicals Ltd.

2. Financial Health: How Strong Is It?

Revenue & Profit Growth (Last 5 Years)

- RCF has recorded steady revenue growth, but profitability also has been uneven with raw material price volatility and government subsidies.

Debt vs. Equity:

- Debt-to-Equity Ratio: 0.60 (Comfortable)

- Company debt situation is comfortable, well within a good range for capital-starved business segments.

Earnings Per Share (EPS):

- EPS (TTM): 4.81

- EPS trend has been good, recording good earnings performance always.

Cash Flow:

- Operating cash flow of RCF has remained healthy and strong, which is supporting business growth and sustainability prospects.

3. Stock Performance: How Does It React?

Performance for Last Year:

- 52-Week High: ₹245.00

- 52-Week Low: ₹110.80

- Current Price: ₹119.00

- Yearly Change: -13.20 (-9.98%)

Technical Indicators:

- RSI (14): 31.7 (Stock is near oversold levels)

- MACD: -8.9 (Bearish signal)

- ADX: 31.8 (Strength of trend is moderate)

- ROC (21): -24.4 (Negative momentum)

- P/E Ratio: 24.79 (Fairly higher compared to industry average of 19.60)

- P/B Ratio: 1.43 (Fair valuation)

Volatility

- RCF has experienced high volatility, with ongoing price fluctuations on the basis of government policy announcements, global commodity prices, and demand-supply scenario.

4. Dividends & Returns: What Investors Get?

- Dividend Yield: 1.04% (Normal dividends)

- Dividend History: RCF has a good dividend history of paying dividends, which is valued by income investors.

- Stock Buybacks: No recent buybacks, indicating focus on capital investment and growth.

5. Growth Potential: What’s in the Pipeline?

Future Developments:

- Capacity Expansion: Fertilizer production expansion to meet growing agricultural demands.

- Government Support: Riding Indian government support towards local production of fertilizers.

- Sustainability Initiatives: Invest in green power and green fertilizers.

Projected Share Price Targets:

| YEAR | SHARE PRICE TARGET (INR) |

| 2025 | 250 |

| 2026 | 400 |

| 2027 | 550 |

| 2028 | 700 |

| 2029 | 850 |

| 2030 | 1000 |

6. External Drivers: What Can Drive the Stock?

Economic Trends:

- Inflation and interest rate changes on cost of production.

- Raw material buying led by global commodity prices.

Industry Trends:

- Government subsidies and price control of fertilizers.

- Organic and sustainable fertilizer adoption.

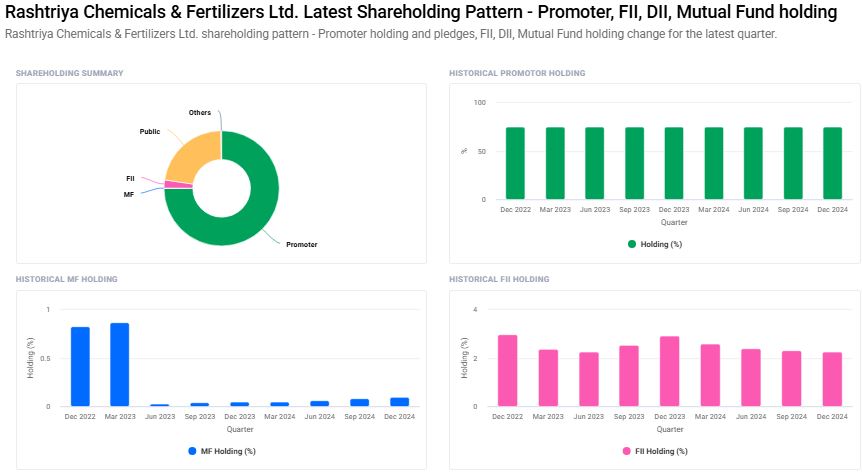

Institutional Holdings:

- Promoters: 75.00%

- Retail & Others: 22.45%

- Foreign Institutions: 2.26%

- Domestic Institutions: 0.19%

- Mutual Funds: 0.10%

7. Risk Factors: What Can Go Wrong?

- Market Risk: The volatility in the share prices due to overall trends in the market.

- Business Risk: The rivalry from the private sector players and imports from abroad.

- Financial Risk: The volatility in the subsidy regimes impacting the forecastability of the revenues.

- Political Risk: Policy shocks on fertilizer prices and availability.

FAQs for RCF Share Price

1. Is Rashtriya Chemicals and Fertilizers Ltd. a good long-term investment?

Yes, RCF is well supported by the government, has a stable dividend, and growth prospects. But it also carries the risks of market volatility and policy regulation.

2. What will be the RCF share price in 2025?

Based on the market sentiment and finance, the year 2025 target price will be ₹250.

3. Why is RCF stock fluctuating?

RCF stock is affected by commodity price movement, government policy, and global economic trends.

4. Does RCF pay dividends?

Yes, RCF has a consistent dividend yield of 1.04% and is an ideal long-term value investment stock.

5. What are the most critical risks involved in investing in RCF?

Significant threats are private sector competition, change in government subsidy policy, and rise in the raw material price.

6. What is RCF’s share price long-term goal?

Long-term goal of the share price as of 2030 is ₹1000, which has an increasing trend.

7. How effectively does RCF compete against competitors?

RCF is competing with National Fertilizers and Chambal Fertilizers. It has massive government backing but is competing with private sector giants who have gigantic expansion projects.

8. Do I buy RCF shares today?

RCF shares are undervalued currently after the market corrections. Provided you have a long-term view, it can be an investment opportunity.

RCF is well-positioned firm in Indian fertilizer industry with the government’s support and stable demand. Long-term outlook is positive despite unavoidable short-term fluctuations, particularly with expansion plans in the offing and supportive policies. Always evaluate risks prior to investment.