Cipla Share Price Target From 2025 to 2030

Cipla Limited is an Indian multinational global pharmaceutical company based in Mumbai. The company engages in the production and distribution of generic drugs, active pharmaceutical ingredients (APIs), and biotech drugs. Therapeutic drugs by Cipla are present in a very wide range of therapeutics such as respiratory, cardiovascular, diabetes, oncology, and infection diseases. Cipla is represented in more than 80 countries across the world.

Leadership Team

It is headed by Umang Vohra, Managing Director & CEO. It is steered by a seasoned leadership team with an agenda of growth, innovation, and sustainability.

Market Capitalization & Industry Position

- Market Cap: ₹1.19 Lakh Crore

- Employees: Over 25,000

- Industry Players & Competitors: It is pitted against industry players such as Sun Pharma, Dr. Reddy’s Laboratories, and Lupin. It is among the leading pharma players in India, especially in the chronic disease and respiratory segment.

2. Financial Health: How Healthy is It?

Revenue & Profit Growth (Last 5 Years)

- Cipla has been continuously reporting top-line growth, owing to its growing product basket and international presence. Its five-year top-line CAGR is approximately 9-12%.

Debt vs. Equity

- Debt-to-equity ratio: 0.02, reflecting an ultra-stable capital base with zero dependence on debt.

- Book Value per Share: ₹351.18, reflecting a good intrinsic value.

Earnings Per Share (EPS) & Cash Flow

- EPS (TTM): ₹61.78

- P/E Ratio (TTM): 23.88, comparatively lower than the industry, thus Cipla is a good investment stock.

- Cash Flow: Favorable cash flows for operations and long-term expansion.

Key Reports:

- Balance Sheet: Robust asset base with acceptable liquidity.

- Income Statement: Growth in revenues with stable operating margins.

- Cash Flow Statement: Growth with favorable free cash flow.

3. Stock Performance: How Does It Behave?

Stock Trends

- 52-Week High: ₹1,702.05

- 52-Week Low: ₹1,317.25

- Current Price: ₹1,472.00 (+1.29% in last one year)

- Upper Circuit: ₹1,823.30

- Lower Circuit: ₹1,328.20

Technical Indicators

- RSI (14): 53.6 (Neutral)

- MACD: Bullish Signal (MACD above center & signal line)

- ADX: 10.8 (Stock has neutral trend)

- MFI: 56.0 (Stock neither overbought nor oversold)

- ATR: 35.1 (Volatility in middle zone)

4. Dividends & Returns: What Do Investors Get?

- Dividend Yield: 0.88% (Periodic but small payments)

- Stock Buybacks: No notable buybacks reported in recent past.

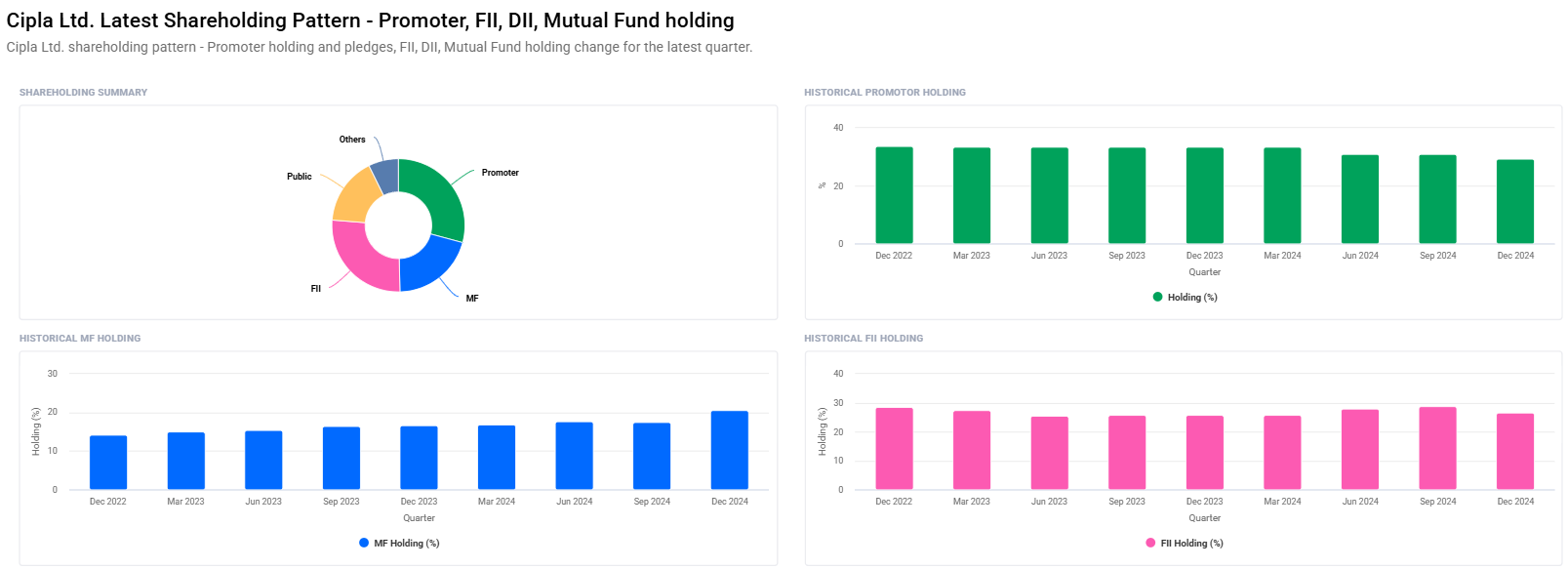

- Institutional Holdings: 54.37% (Very high institutional investor confidence)

5. Growth Potential: What’s Next?

Future Growth Strategies

- New Drug Launches: Expansion of specialty and chronic pipeline of medicines.

- International Growth: Creating roots in regulated markets such as the US, Europe, and South Africa.

- Acquisitions & Partnerships: Integration of potential acquisitions and mergers to drive capabilities.

- Technology & Innovation: Ongoing work in digital health and AI-pharmaceuticals discovery.

6. External Drivers: What Can Push the Stock?

Key Market Drivers

- Economic Trends: Healthcare spending policy, inflation, and risk of global recession.

- Industry Trends: Price wars, patent losses, and government approvals.

- Government Policies: Pharma action and regulatory guidance on price regulation of the drug.

- Institutional Investor Sentiment: Institutional buying or selling.

7. Risk Factors: What Can Go Wrong?

- Market Risk: General stock market volatility impacting Cipla share price.

- Business Risk: Patent loss and regulatory problems.

- Financial Risk: Unexpected falls in revenue or margins.

- Geopolitical Risk: Import/export restrictions, trade embargoes, or political instability.

8. Cipla Share Price Target between 2025 to 2030

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹1700 |

| 2026 | ₹2100 |

| 2027 | ₹2500 |

| 2028 | ₹2900 |

| 2029 | ₹3300 |

| 2030 | ₹3700 |

Key Drivers for Growth

- Sustainability of pharma product demand.

- New therapeutic segment forays.

- Expansion in global markets and acquisitions.

- Leapfrog technologies in drug manufacturing.

9. FAQs For Cipla Share Price

1. Is Cipla a good long-term investment?

Cipla is debt-free and financially sound and has growth opportunities. It is a good bet for a pharma stock-hunting long-term investment.

2. Does Cipla provide a dividend?

Yes, Cipla pays a 0.88% dividend yield but the number is not big.

3. What is the riskiest threat to Cipla’s stock?

Regulatory, competition, and loss of patent could impact Cipla’s growth.

4. How does Cipla stand compared to other pharma stocks?

Cipla stands similar to Sun Pharma, Dr. Reddy’s, and Lupin. It’s lower on a P/E scale than the industry average and thus it’s an undervalued investment.

5. Will Cipla Share Price reach ₹3,700 in 2030?

Yes, given growth opportunities and expansion plans, Cipla can reach ₹3,700 in 2030 if the company continues its performance.

Cipla is a good pharma stock with good finances and good growth opportunities. Investment hunters need to still remain updated on market trends, domestic policies, and global economic developments before investing.