TCS Share Price Target From 2025 to 2030

Tata Consultancy Services (TCS) is a worldwide leading IT services, consulting, and business solutions firm. It offers services in over 46 countries in sectors such as software development, cloud computing, artificial intelligence, cyber security, and business process outsourcing.

Who Owns the Company?

- TCS is owned by the Tata Group, the largest conglomerate in India. K. Krithivasan is the CEO and Managing Director of TCS since 2023. The group has an experienced management cadre with genuine thought process towards digitalization and innovation.

Size of the Organization:

- Market Capitalization: INR 13.33 Lakh Crore

- Employees: Over 600,000 as of 2023

- Revenue (2023): $27.9 billion

- Spread across the World: North America, Europe, Asia, others

Competitive Position

TCS is facing stiff competition from IT majors like Accenture, Infosys, Wipro, and Cognizant. TCS also has strong brand value, stable growth, and customer stickiness.

2. Financial Health: How Strong Is It?

Revenue & Profit Growth

TCS has been registering steady growth in revenues and profits for the past five years. The IT sector continues to register growth on the back of higher demand for digital transformation and cloud computing solutions.

- Revenue Growth (CAGR 2018-2023): 10.5%

- Net Profit Growth (CAGR 2018-2023): 9.2%

Debt vs. Equity

- TCS has a very minimal debt-to-equity ratio of 0.09, indicating an aggressive balance sheet with zero significant leverage.

Earnings Per Share (EPS)

- EPS (TTM): 134.78 INR

- The EPS has been on a steady rise, and that is indicating strength in the financials as well as earning power.

Strength in Cash Flows

- TCS has a strong cash flow position with which it can invest in new investment, acquisition, and payment to shareholders in the form of dividends.

3. Stock Performance: How Does It Behave?

Recent Market Figures

- Open Price: INR 3,743.15

- High: INR 3,763.20

- Low: INR 3,679.70

- 52-Week High: INR 4,592.25

- 52-Week Low: INR 3,591.50

- P/E Ratio: 27.32

- Dividend Yield: 1.58%

Technical Analysis

- RSI (Relative Strength Index): 27.4 (Oversold, hence may recover)

- MACD: -88.0 (Down trend, i.e., Bearish)

- ADX: 32.3 (Trend strength: Moderate)

- MFI: 20.7 (Overbought, hence a reversal back can be seen)

The company has been disappointing investors in recent times but is a promise to re-recover as technicals have signaled overbought positions.

4. Dividends & Returns: What Do Investors Get?

Dividend Policy

TCS has been a consistent payment of dividend. Its dividend yield is 1.93%, which is marvelous for long-term share holders who are expecting to receive steady returns.

Stock Buybacks

The management repurchases the shares on a constant basis, showcasing the management optimism regarding future growth.

5. Growth Potential: What’s Next?

Future Growth Drivers

- Artificial Intelligence & Cloud Services: Expansion in solutions on artificial intelligence and cloud services.

- Digital Transformation: Unexpected spike in multinationals’ embracing of digital services.

- Geographical Expansion: Top-line growth in Europe, North America, and emerging nations.

- Strategic Acquisitions: Possible M&A for broadening the service basket.

TCS Share Price Target From 2025 to 2030

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹4600 |

| 2026 | ₹5600 |

| 2027 | ₹6600 |

| 2028 | ₹7600 |

| 2029 | ₹8600 |

| 2030 | ₹9600 |

6. External Factors: What Can Influence the Stock?

Main Economic & Industry Trends

- Interest Rates & Inflation: Increasing rates can affect IT expenditure.

- Global IT Spending: To grow, skewed towards TCS.

- Regulatory Policies: Business is governed by data security policies.

- Geopolitical Issues: US, UK, and EU policies can affect offshore out-sourcing.

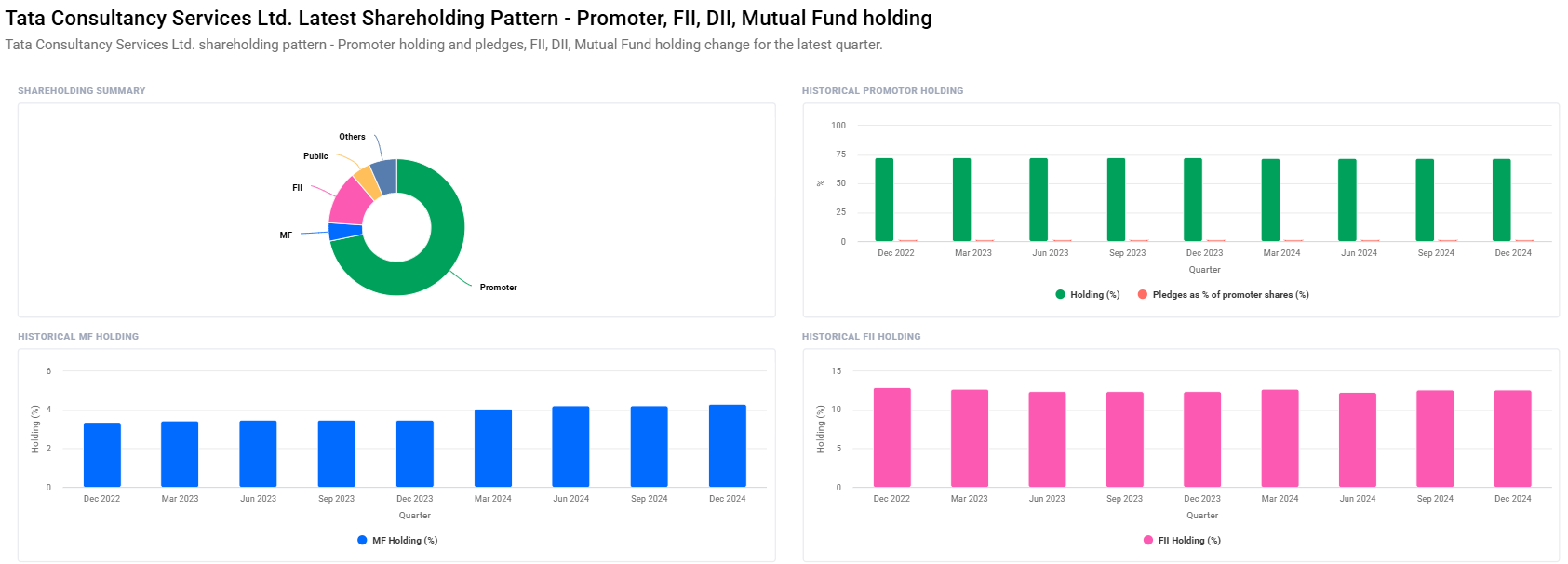

Institutional Investors

- Promoters Hold: 71.77%

- Foreign Institutions: 12.68%

- Mutual Funds: 4.32% (Uptrend)

7. Risk Factors: What Can Go Wrong?

Business & Financial Risks

- Market Competition: Global IT company pressure is there.

- Currency Fluctuations: Dollar fluctuation to rupee affects top line.

- Tech Disruptions: Need to be in sync with AI, automation, and blockchain.

- Regulatory Challenges: New data security regulations can affect operations.

FAQs For TCS Share Price

1. Is TCS a good long-term investment stock?

Yes, TCS has good financials, stable growth rate, and cautious dividend payout, hence good long-term investment.

2. How much will be the TCS share price in 2025?

They would be in the range of INR 4,600 in 2025.

3. Why is TCS share price so weak right now?

Its present technical trends are oversold, though can recover in the second half.

4. Future acquisition deals made by TCS are there in the pipeline scheduled?

No any company big deal announcement yet, though would definitely make strategic acquisitions for further consolidation of its services.

5. TCS share price in 2030?

TCS is likely to reach INR 9,600 by 2030 with healthy market demand and consistent growth.

TCS is an IT sector darling with good fundamentals, consistent growth, and favorable long-term prospects. The investors have to keep the market trends, economic environment, and global uncertainty in mind while framing the investment strategies.