Vodafone Idea Share Price Target From 2025 to 2030

Vodafone Idea Limited (Vi) is a prominent Indian telecom company formed following the merger of Vodafone India and Idea Cellular. The company provides mobile network services, broadband, and digital solutions in India. Vodafone Idea remains a market player to reckon with despite fierce competition from Reliance Jio and Bharti Airtel.

- CEO: Akshaya Moondra

- Market Capitalization: ₹57,471 Cr

- Industry: Telecommunications

- Competitors: Reliance Jio, Bharti Airtel, BSNL

Financial Health: How Healthy Is It?

Vodafone Idea has seen financial struggle in recent past years, due to too much debt and intense price wars in India’s telecommunications sector. Below are a few important financial facts:

- Revenue & Profit Growth: The company recorded losses in earlier years, its Earnings Per Share (EPS) at -3.91.

- Debt to Equity Ratio: -2.62, reflecting high leverage.

- Book Value: -13.09, reflecting liabilities in excess of assets.

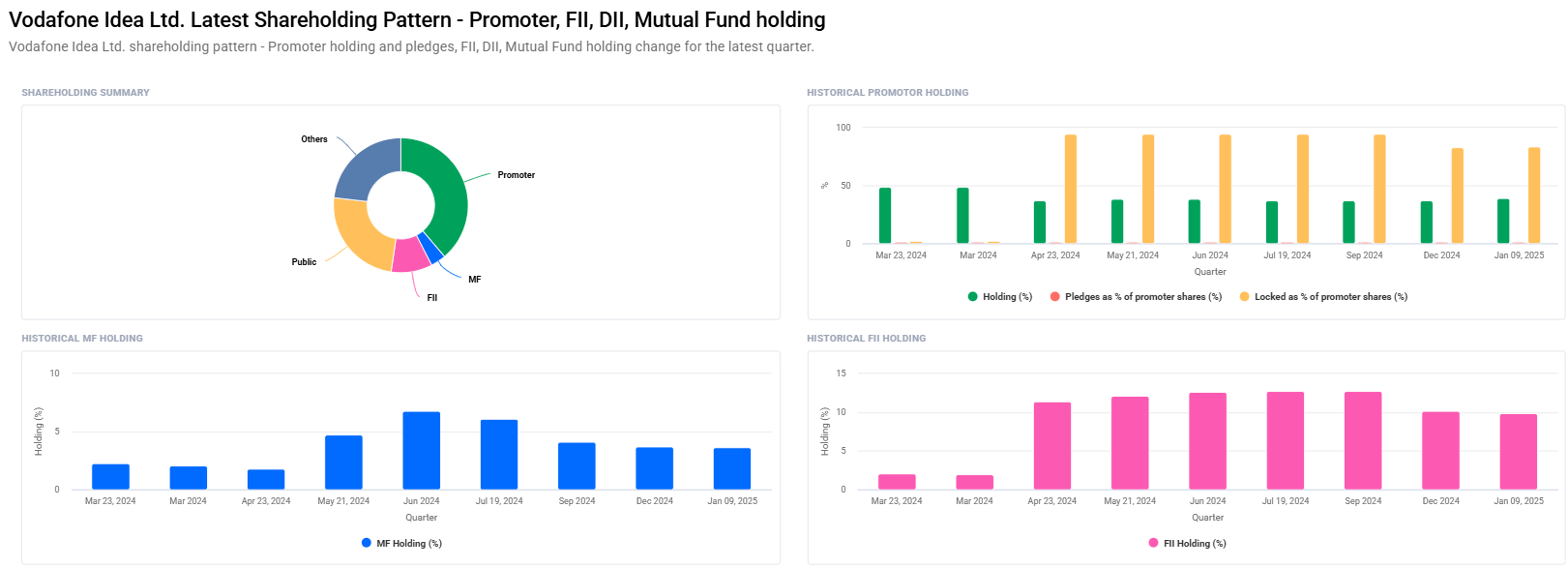

- Institutional Holdings: Institutional and foreign investors have been offloading holdings, indicating weak confidence.

- Cash Flow: Insufficient to service heavy debt repayment, which has been compelling capital infusion and external funding.

Key financial reports:

- Balance Sheet: Indicating high liabilities in the form of spectrum payments and debt.

- Income Statement: Negative margins due to price competitiveness.

- Cash Flow Statement: Struggling to record positive free cash flow.

Stock Performance: How Does It Behave?

- Current Stock Price: ₹7.94

- 52-Week High: ₹19.18

- 52-Week Low: ₹6.61

- Volatility: High owing to regulatory changes, fund-raising efforts, and price pressure due to competition.

- P/E Ratio: Negative as the company is not profitable till date.

- P/B Ratio: Negative, indicating financial stress.

Technical Indicators

- RSI (Relative Strength Index): 40.4 (Neutral)

- MACD (Moving Average Convergence Divergence): Negative, indicating a bearish trend.

- MFI (Money Flow Index): 48.8 (Neutral)

- ADX (Average Directional Index): 18.4, indicating a weak trend.

- ROC (Rate of Change): -49.9 in 125 days, which is low momentum.

Growth Potential: What’s Next?

Despite the financial troubles, there are some growth drivers for Vodafone Idea:

- Fundraising: The company has been attempting to raise money so that it can invest in 5G launches and network expansion.

- Government Support: Waiver of adjusted gross revenue (AGR) dues and relief packages.

- Tariff Increases: Recent trends indicate telecom operators are able to raise tariffs in an attempt to become more profitable.

- Strategic Alliances: The firm can form alliances with foreign investors or technology providers to upgrade infrastructure.

- Expansion Plan: Expansion of fiber network and broadband services.

External Factors Affecting the Stock

- Telecom Industry Trends: Data consumption and digitalization.

- Government Policies: Spectrum auction, license fees, and policy.

- Economic Factors: Inflation rate, interest rates, and overall stock market trends.

- Institutional Investors: Return of big investors can create profitable investor confidence.

Risks and Challenges

- High Debt: Its biggest worry is its ₹2 trillion debt, which makes profitability challenging.

- Competitive Pressure: Both Airtel and Jio possess stronger financial strength and customer base.

- Low Customer Retention: Frequent tariff hikes might drive away customers.

- Regulatory Risks: AGR dues and spectrum auctions are risks.

Vodafone Idea Share Price Target from 2025 to 2030

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹20 |

| 2026 | ₹34 |

| 2027 | ₹48 |

| 2028 | ₹62 |

| 2029 | ₹76 |

| 2030 | ₹90 |

These are based on the assumption of Vodafone Idea securing funds, reducing tariffs, and debt decline. But risk-taking opportunities are high.

FAQs For Vodafone Idea Share Price

1. Is Vodafone Idea a long-term investment?

It’s a riskier one due to financial concerns, but in case of successful restructuring and financing, it is promising.

2. Will Vodafone Idea turnaround within the next two years?

It is contingent upon funding, tariff hikes, and competition from Airtel and Jio.

3. Why is Vodafone Idea’s stock so volatile?

Volatility due to high debt, plans to raise money, government actions, and industry rivalry.

4. What are the drivers of growth for Vodafone Idea?

Successful 5G launch, strategic partnerships, tariff hikes, and better financial health.

5. Do I invest in Vodafone Idea today?

Only if you are willing to assume high risk. Wait for better indications of a turnaround.

Vodafone Idea remains a high-risk, high-reward stock. The investor would have to wait for financial revival, debt restructuring, and industry dynamics before entering.