PNB Share Price Target From 2025 to 2030

PNB Share Price Target From 2025 to 2030: Punjab National Bank (PNB) is one of India’s pioneering public sector banks offering diversified banking products and services including retail banking, corporate banking, international banking, and treasury operations. Established in 1895 with its headquarters in New Delhi, PNB has been the trendsetter to revolutionize India’s banking industry.

As of 2024, PNB is thriving and overcoming the problems of the recent past due to excessive NPAs. In spite of the problems of the banking industry due to excess digitalization, credit demand growth, and government-sponsored programs, the future of PNB is positive. The article gives a recap of the financial well-being, share price, level of expansion, and share price prediction between 2025 and 2030 of PNB.

PNB Share Price Target for 2025 to 2030

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹150 |

| 2026 | ₹200 |

| 2027 | ₹250 |

| 2028 | ₹300 |

| 2029 | ₹350 |

| 2030 | ₹400 |

Company Overview

What Does Punjab National Bank Do?

Punjab National Bank offers a wide range of banking and financial products and services, including:

- Retail Banking – Current and savings accounts, personal loans, home loans, and credit cards.

- Corporate Banking – Working capital loans, business loans, and trade finance.

- Treasury Operations – Government securities, derivatives, and forex.

- Digital Banking – Fintech alliances, mobile banking, and internet banking.

Market Presence and Leadership

- CEO & MD: Until 2024, Atul Kumar Goel.

- Market Capitalization: ₹1.07 lakh crore.

- Branches and ATMs: Over 10,000 branches and 13,000+ ATMs in India.

Financial Performance and Health

A sound financial base is the only-most crucial variable influencing share performance. Let us see PNB’s key financial figures:

Revenue and Profitability

PNB has seen revenue and profitability increase in the last few years:

- Net Interest Income (NII) (FY2023-24): ₹1,06,901.62 crore (from ₹85,144.11 crore in FY2022-23).

- Net Profit (FY2023-24): ₹6,751 crore, 12% YoY.

- Return on Capital (ROC): 13.70%.

- Earnings Per Share (EPS): ₹14.65.

Debt-to-Equity Ratio

- PNB has been attempting to clear all its NPAs, but debt-to-equity ratio is number one priority. The ratio stands at 0.88, which is good as per the industry standard.

Dividend Yield

- Dividend yield is 1.53%, and therefore PNB is a good pick for dividend investors.

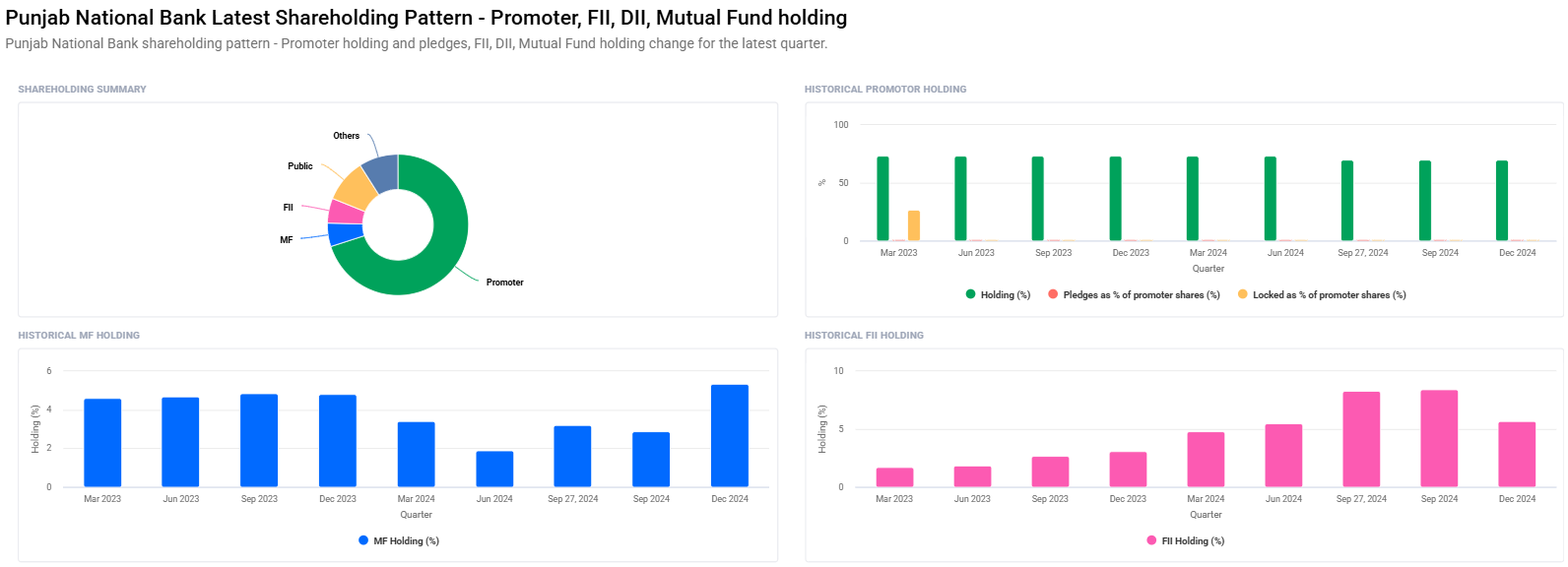

Institutional Holdings & Shareholder Trend

- Promoters: 70.08%

- Retail & Others: 9.91%

- Other Domestic Institutions: 8.95%

- Foreign Institutional Investors (FIIs): 5.70%

- Mutual Funds: 5.36%

Shareholding Changes For PNB Share Price

- Promoter holding is unchanged at 70.08% (as on Dec 2024).

- FIIs have lowered holding between 8.42% and 5.70% QoQ.

- Mutual Funds have raised holding, reflecting confidence in long-term growth.

Technical Analysis – PNB Share price Trend

Key Market Indicators

- 52-Week High: ₹142.90_Strong resistance level

- 52-Week Low: ₹90.16_Strong support level

- Momentum Score: 30.5_Weak technical position

- Relative Strength Index (RSI): 42.9_Neutral

- MACD Signal: -1.6_Bearish

- Money Flow Index (MFI): 32.5_Slightly oversold

Analysis:

- Stock is ranging and turnaround signs are evident.

- RSI indicates neither overbought nor oversold in the stock.

- Bearish as per MACD but trend reversal expected.

Growth Potential & Future Outlook

Bad Loan Recovery Strategy

- PNB has conservatively estimated bad loan recoveries of ₹1.96 billion in FY2025.

- Enhanced gross NPA ratio to 4.09% in Dec 2024 (from 4.48%).

Digital Banking Growth

- Enhanced fintech partnerships.

- Utilization of AI for credit risk grading to support loan sanctioning.

Loans and Deposits Growth

- 13%-14% loan book growth expected in FY2025.

- 12%-13% deposit growth expected.

Government Support & Policy Reforms

- Supported by Government of India with 70.08% holding.

- Enhanced lending culture with positive banking sector policy measures.

Risk Factors to Watch Out For

- Market Risk – Volatility in stock market can affect PNB’s performance.

- Business Risk – Hopes of improving asset quality could lag profitability target.

- Regulatory Risk – RBI new capital adequacy guidelines can impact growth.

- Global Economic Conditions – Risk of recession, inflation, and world banking trends can dictate investors’ mood.

Is PNB Stock a Good Investment?

Short-Term (2025-2026)

- Stock will be volatile but loan books and digital growth will propel growth.

- Expected price range: ₹110 – ₹200.

Mid-Term (2027-2028)

- Improved fundamentals, less NPAs, and higher margins can push prices up.

- Expected price range: ₹155 – ₹300.

Long-Term (2029-2030)

- Being a market leader PSU bank, PNB has enormoous upside potential.

- Expected price range: ₹250 – ₹400.

Frequently Asked Questions (FAQs)

1. What will be 2025 PNB share price target?

PNB’s share price will be ₹110 – ₹150 in the year 2025.

2. Will PNB stock be ₹400 in 2030?

Assuming growth, PNB can go up to ₹400 in 2030, but economics and markets will determine.

3. Is PNB a good long-term investment stock?

Yes, PNB is a good long-term investment stock, if government support, digital banking growth, and asset quality are available.

4. Is there any risk factor while investing in PNB?

The key risks are NPA problems, regulation, and economic slowdowns which will impact the banking sector.

5. Does PNB distribute a dividend?

Yes, PNB gives a 1.53% dividend yield, and it’s a very solid stock to invest in for an income investor.

Final Judgment – Is It Sensible to Invest in PNB?

Punjab National Bank will have a strong return on the back of improved asset quality, digital banking growth, and government support. Short-term volatility cannot be avoided but the long term is okay. Medium-to-long-term investors can invest in PNB for good returns up to 2030.