Trent Share Price Target From 2025 to 2030

Trent Share Price Target From 2025 to 2030: Trent Ltd. is India’s top retail groups and a Tata Group subsidiary. The group runs different retail ventures in different formats, i.e., Westside, Zudio, and Star Bazaar, with high consumer acceptability in fashion, lifestyle, and grocery businesses. While Westside carries upper-fashion apparel, Zudio offers value-for-money fashion. The supermarket and grocery operations are run by Star Bazaar.

Leadership Team

The leadership team led by Noel Tata, which has successfully steered the company to date, also takes a strategic direction in driving the company towards its future success. With highly experienced managers running the business, Trent has been functioning at its best to expand its store base in India.

Market Position

Having a market capitalization of approximately INR 1.76 lakh crore, Trent Ltd. is retail giant. Its rivalries are from Reliance Retail, Aditya Birla Fashion, and Shoppers Stop. Its extensive sponsorship of Tata Group gives it a better edge over other competitors in the retailing business in India.

2. Financial Health: How Strong Is It?

Revenue & Profit Growth

- In the past five years, Trent Ltd. has witnessed steady growth in revenues on the back of growing consumer spending and retail growth. The share price of the company has increased by 28.60% in the past one year, indicating high investor optimism.

Debt vs. Equity

- Debt-to-Equity ratio of Trent Ltd. at 0.39 indicates an equally weighted capital structure. Trent is not borrowing-oriented and thus well-funded and risk-free to meet interest payment.

Earnings Per Share (EPS)

- EPS (Trailing Twelve Months – TTM) value of 54.37 indicates a stable level of profitability. Trent Ltd.’s improved ability to generate high returns is always inviting long-term investors towards the company.

Cash Flow Analysis

- Trent Ltd.’s Return on Capital (ROC) is 29.14%, an excellent indicator of how effectively the company is utilizing its capital. Its dividend yield is 0.08%, indicating a cautious dividend policy with retention of earnings for growth.

3. Share Performance: How Does It Perform?

Price Trends and Volatility

- 52-Week High: INR 8,345.00

- 52-Week Low: INR 3,750.25

- Current Price Range: INR 4,936.30 – INR 5,129.25

The stock of the company has been fluctuating in the last one year but has an overall upward trend due to robust finances and expansion plans.

Technical Indicators

- MACD: -290.4 (Bearish signal)

- RSI (14): 35.5 (Neutral to slightly oversold)

- ADX: 33.2 (Reflects a stable trend)

- MFI: 18.0 (Oversold, rebound signal)

Analyst Recommendations

- Buy: 58%

- Hold: 17%

- Sell: 28%

Most of the analysts believe that Trent Ltd. is an investment option.

4. Dividends & Returns: What Do Investors Get?

The firm has been paying dividends regularly, but the yield remains low at 0.08%. This is consistent with the fact that the firm prefers to reinvest its returns in the form of growth and expansion and not in the form of big dividend payouts.

5. Growth Potential: What’s the Next Move?

Growth Strategies

- The company is expanding Zudio stores rapidly in tier-2 and tier-3 cities for mass fashion retailing.

- Westside continues to be the market leader for premium retail and expanding base.

- The company is growing online business too to compete with online fashion retailer likes of Myntra, Ajio etc.

Trent Share Price Target From 2025 to 2030

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹8500 |

| 2026 | ₹13000 |

| 2027 | ₹17500 |

| 2028 | ₹22000 |

| 2029 | ₹26500 |

| 2030 | ₹31000 |

6. External Factors: What Can Affect the Share?

Economic Trends

- Inflation rate, interest rate, and growth rate of GDP are expected to influence consumer consumption and performance of retail firms. Financial strength of Trent Ltd. is essential to its success.

Industry Regulations

- Government policies toward FDI in retail and taxations will shape the expansion plan of Trent, particularly in supermarkets and e-commerce.

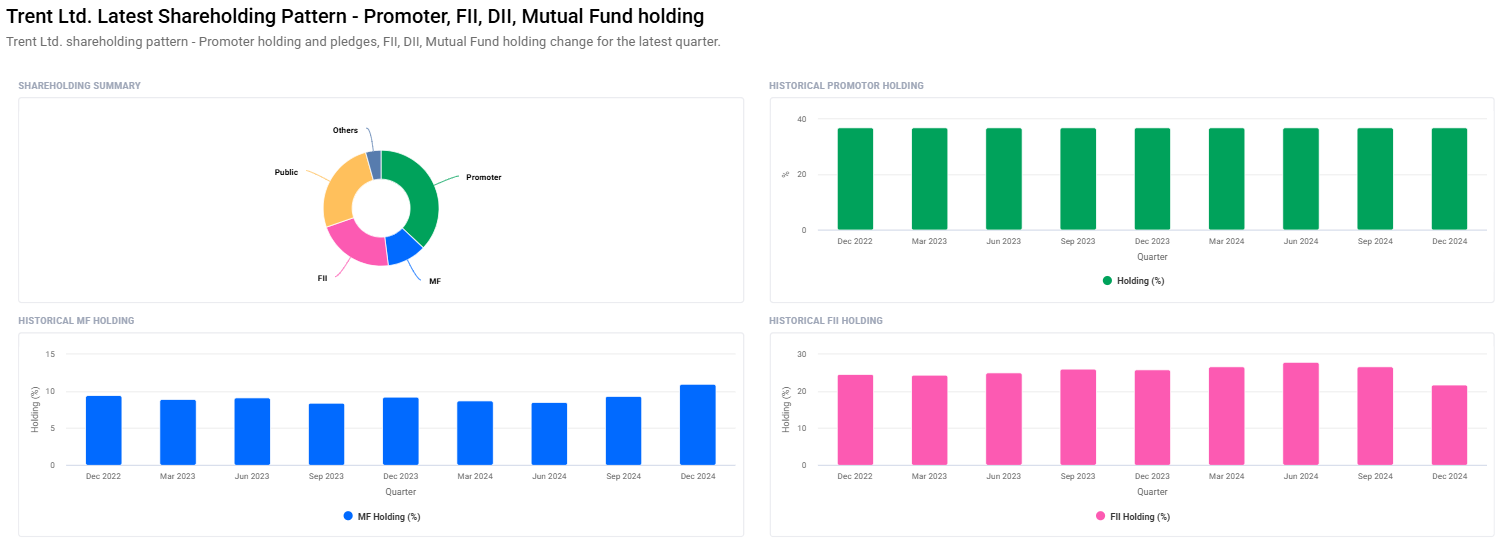

Activity of Institutional Investors

- Promoter Holding: 70.08%

- Mutual Funds: 9.33% to 11.00%

- Foreign Institutions: 26.62% to 21.68%

7. Risk Factors: What Can Go Wrong?

Market Risks

- Weakening economies may discourage consumer expenditure, thus affecting sales adversely.

- Volatility in the stock market may influence share prices in the short run.

Business Risks

- Increased competition from Reliance Retail and Aditya Birla Fashion may compress margins.

- Supply chain problems may impact retail operations.

Financial Risks

- A high P/E ratio of 93.29 indicates that the stock is expensive. The investors have to keep valuations in mind while investing for the long term.

Geopolitical Risks

- Government policies reforms in issues to with taxes or overseas investments influence retail expansion strategies.

Final Thoughts

Trent Ltd. is still a strong player in the Indian retailing sector because of the conservative financial and operating practices of the Tata Group. With growing revenues, expansion strategies, and positive market attitudes, the company will experience robust growth in its share price in the next decade.

FAQs For Trent Share Price

1. What would be Trent Ltd.’s target share price in 2025?

The target value for 2025 would be INR 8,500, given the current growth trends and market trends.

2. Is Trent Ltd. a good long-term investment?

Yes, with its healthy financials, growth strategy, and market leadership, Trent Ltd. is a good long-term investment.

3. What are the factors that can influence Trent Ltd.’s share price in the future?

Share performance of Trent can be influenced by economic, competition, government policy, and institutional investor moods.

4. Does Trent Ltd. provide dividends?

Yes, Trent Ltd. does provide dividends but at very low levels of 0.08% as the company likes to invest on the growth side.

5. How well is Trent Ltd. doing compared to its competitors?

Trent Ltd. is facing competition from Reliance Retail, Aditya Birla Fashion, and Shoppers Stop. With Tata backing and with aggressive growth, it is placed well in the retailing space.

6. What is the long-term share price target of Trent Ltd.?

The long-term goal of 2030 has been projected to be INR 31,000 by extrapolation of growth and planning for growth.