SBI Card Share Price Target From 2025 to 2030

SBI Card Share Price Target From 2025 to 2030: SBI Cards and Payment Services Ltd. (SBI Card) is a leading credit card issuer in India. SBI Card is a subsidiary of State Bank of India (SBI) and provides different credit card products to retail and corporate clients. The business of the company is diversified and includes lifestyle, travel, shopping, and corporate cards.

Key Facts:

- Business: Financial Services (Credit Card and Digital Payments)

- Market Capitalization: ₹79,910 Crore

- Competitors: HDFC Bank, ICICI Bank, Axis Bank, Bajaj Finserv

SBI Card has a great market position due to its brand name with SBI, the largest bank of India, and also the humongous customer base. It has the banking franchise of SBI through which it has a humongous customer base as well.

2. Financial Health: How Strong Is It?

Revenue & Profit Trends

SBI Card has shown steady revenue growth in the past five years. It is backed by rising credit card and digital payment usage in India.

- Earnings Per Share (EPS) (TTM): ₹21.49

- Revenue Growth: Steady growth with strong growth in transaction value.

- Net Profit Margin: High margin on account of high interest revenues and late payment charges.

Debt vs. Equity

- Debt-to-Equity Ratio: 3.30 (Moderate leveraging but in check because of high cash flow.)

Cash Flow

- Healthy cash flows from interest receivables and credit card revenues.

- Adequate money for running the business and business growth.

3. Stock Performance: How Does It Behave?

- Current Stock Price: ₹839.95

- 52-Week High: ₹872.00

- 52-Week Low: ₹647.95

- P/E Ratio: 39.10 (Industry above average, reflecting high investor confidence.)

Technical Indicators:

- RSI (14): 60.1 (Neutral to marginally bullish trend.)

- MACD (12,26,9): 23.3 (Bullish momentum but not near the signal line.)

- ADX: 23.9 (Reflects stable trend.)

- MFI: 57.8 (Moderate money flow in the stock.)

- ROC (21): 10.8 (Positive momentum.)

SBI Card is overall on an upswinging trend with moderate volatility.

4. Dividends & Returns: What Do Investors Get?

- Dividend Yield: 0.60%

- Most Recent Dividend Paid: ₹0.30%

- Stock Buybacks: No recent large buybacks.

Comparatively with peers, the dividend yield of SBI Card is low but with strong growth prospects.

5. Growth Potential: What’s Next?

Future Plans:

- Higher penetration of Tier 2 and Tier 3 cities.

- Upscaling of digital payment solution and fintech partnership.

- New credit card launch with best brand collaborations.

Innovation & Strategy:

Risk decision with AI to connect with customers more effectively.

- Extensions of BNPL and EMI products.

- Most effective marketing strategies to connect with customers.

Mergers & Acquisitions:

- Potential fintech company collaborations.

- Collaborations with online shopping platforms.

6. External Factors: What Can Move the Stock?

- Economic Trends: Inflation and interest rate influence spending.

- Regulatory Changes: Government regulation of credit card charges and fees.

- Market Competition: New entrants and innovative fintech.

- Institutional Investors: Sudden buying or selling of shares influences stock price.

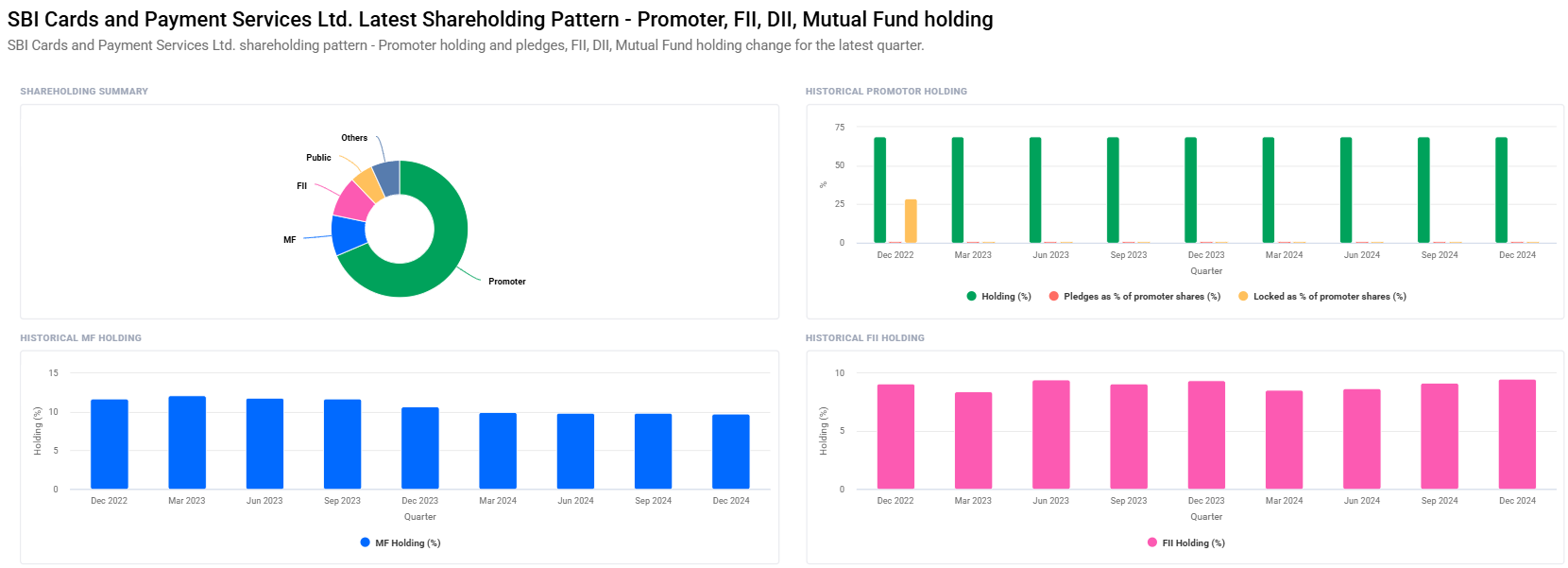

Institutional Holdings:

- Promoters: 68.60% (Stable holding)

- Mutual Funds: 9.71% (Decline in last quarter.)

- Foreign Institutions: 9.51% (Increasing trend)

- Retail Investors: 5.41%

7. Risk Factors: What Can Go Wrong?

- Market Risk: Global economic slowdown reduces consumer spending.

- Business Risk: Credit card interest and late payment charge dependence.

- Financial Risk: Increase in bad debts and loan default.

- Regulatory Risk: RBI regulations to credit card business.

- Technological Disruption: Increase in fintech competition.

8. SBI Card Share Price Targets (2025-2030)

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹900 |

| 2026 | ₹1150 |

| 2027 | ₹1400 |

| 2028 | ₹1650 |

| 2029 | ₹1900 |

| 2030 | ₹2150 |

The share price targets indicate high growth prospects, led by growing customer base and acceptance of digital payments.

FAQs For SBI Card Share Price

1. Is SBI Card a good long-term growth investment?

Yes, SBI Card has a strong market presence, consistent revenue growth, and growing digital payment adoption, making it a good long-term investment.

2. How does SBI Card compare with HDFC and ICICI Bank credit cards?

SBI Card has a strong market share but lags behind HDFC in premium segments. However, it leads in partnerships and accessibility through SBI’s banking network.

3. What are the key risks of investing in SBI Card?

- Market variations and sovereign risk are major threats.

- Regulatory changes, increase in competition, and economic weakness affecting the usage of credit cards are key risks.

4. Does SBI Card give typical dividends?

Yes, but low dividend yield as compared to banking stocks. More focus is put on reinvestment of profit in order to catalyze the growth.

5. Will SBI Card benefit from India’s growing digital payment culture?

Yes, growth in the acceptance of credit cards and electronic payment will drive long-term SBI Card growth.

SBI Card is blessed with India’s expanding digital economy and credit marketplace. Although the stock is moderately volatile, the long-term prospects are positive. Financial performance, regulatory advice, and industry dynamics must be followed by investors in order to make sound investment decisions.