ABB India Share Price Target From 2025 to 2030

ABB India Share Price Target From 2025 to 2030: ABB India Ltd. is a global-class industry with business in industrial automation, robotics, electrification, and motion services. ABB India is the Indian subsidiary of the global electrical equipment market leader and digital solution market leader – the ABB Group. ABB India solutions are for power, transport, and manufacturing enterprises and are therefore an impetus for Indian industry growth.

Leadership and Market Presence

The company is well managed, and its Managing Director is Sanjeev Sharma. ABB India’s market capitalization is INR 1.12 lakh crore and is among the largest in the industry. The company has more than one manufacturing unit and a vast network in India with emphasis on digitalization and automation.

Competitive Position

ABB, India is competing with the industry giants Siemens India, Schneider Electric, and Bharat Heavy Electricals Ltd. (BHEL). Being a pioneer with its focus areas of digitalization, sustainability, and innovation, ABB, India is pioneering in the industrial automation business as well as smart electrification solutions.

Financial Health: How Strong Is It?

Revenue & Profit Growth

ABB India over the last five years has been registering growth in revenues and profits consistently. ABB has employed digital technology to continue the growth of cost discipline and market share.

- Revenue: Has been improving consistently on the strength of demand for industrial automation.

- Net Profit: Growth momentum on the strength of operating efficiency.

Debt vs. Equity

- ABB India is debt-free, which is a very comforting factor. The company has sufficient funds in the form of internal accruals and also has a good balance sheet.

Earnings Per Share (EPS) & Cash Flow

- EPS (TTM): 88.32, showing good earnings per share.

- Free Cash Flow: Sufficient cash surplus for future growth needs as well as dividend pay-out.

Key Financial Numbers

- P/E Ratio (TTM): 59.89 (Industry P/E: 15.84)

- Return on Capital (ROC): 28.45%

- Book Value: INR 333.89

- Dividend Yield: 0.83%

Stock Performance: How Does It Perform?

Performance in Last Year

- 52-Week High: INR 9,149.95

- 52-Week Low: INR 5,019.75

- Current Market Price: INR 5,292.00

- Volatility: Recent downtrends with moderate volatility.

Technical Points

- MACD (12, 26, 9): -254.5 (Negative sign)

- RSI (14): 38.5 (On the verge of oversold zone)

- ADX: 38.2 (Indicates medium-strength trend)

- ROC (21): -11.6 (Positive sign for downtrend)

- ATR: 233.2 (High level of volatility)

Dividends & Returns: What Do Shareholders Get?

- ABB India’s dividend record is good, but the yield itself is not high at 0.83%. Gains will be reinvested to a great extent for expansion. Capital gain fund investors and not dividend yield investors will appreciate ABB India.

Growth Potential: What’s Next?

Future Developments

- Increasing Automation & Robotics Business: Increasing demand for manufacturing and energy segment automation solutions.

- Investment in Green Energy Solutions: ABB India is heavily investing in green technology to meet India’s green growth plan.

- Digital Transformation & AI Integration: Developing AI-driven automation solutions to drive industrial efficiency.

- Global Expansion & Strategic Partnerships: ABB India aims to expand globally via mergers and partnerships.

External Factors: What Can Influence the Stock?

Economic Trends & Industry Factors

- Government Policies: Beneficial to the “Make in India” initiative and higher infrastructure spending.

- Interest Rates & Inflation: A rise in the interest rate may affect capital-exhausting projects.

- Competition & Market Disruptions: Competition through technology, if any, can impact the market share of ABB India.

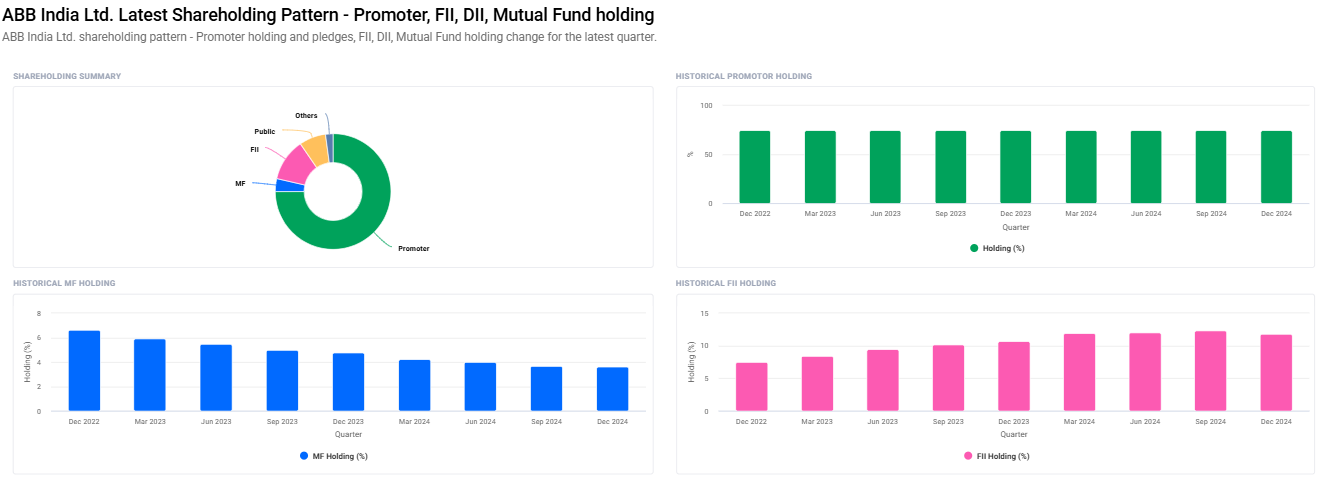

Institutional Investment Trends

- Promoters Holding: 75.00%

- Foreign Institutional Investors (FII): 11.85% (Declined from 12.28%)

- Retail & Others: 7.46%

- Mutual Funds: 3.62% (Weak decline from 3.69%)

7. Risk Factors: What Can Go Wrong?

- Market Risk: Bearish sentiments overall in the share market can hurt share prices.

- Business Risk: Error in decision making or failure to implement plans.

- Financial Risk: Even ABB India’s strong balance sheet, loss of profitability will be seen in the share price.

- Global Uncertainty: Geopolitical risk, protectionism, and economic slowdown can suppress business growth.

ABB India Share Price Target (2025-2030)

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹9200 |

| 2026 | ₹13200 |

| 2027 | ₹17200 |

| 2028 | ₹21200 |

| 2029 | ₹25200 |

| 2030 | ₹30000 |

FAQ For ABB India Share Price

1. Is ABB India a good long-term investment bet?

Yes, ABB India is a good quality long-term punt due to its technology leadership, better finances, and industrial digitalization and green power growth opportunity.

2. Why is the P/E of ABB India higher than industry?

The company will be worthy of a premium multiple on account of its technology leadership, improved margins, and better growth opportunity in automation and electrification.

3. Does ABB India pay dividend?

Yes, but the dividend yield is very low (0.83%), since the company puts a lot of profit into growth and expansion.

4. What are the primary investment risks of ABB India?

The primary risks to remember are market volatility, global competition, economic slowdown, and government policy change.

5. How is ABB India different from Siemens India?

Both are automation leaders but ABB India is placing more emphasis on digitalization and electrification whereas Siemens is placing more emphasis on infrastructure solutions and mobility.

6. ABB India share target price would be in the year 2025.

Experts are expecting ABB India share up to INR 9,200 in the year 2025 based on trend continuation.

7. Will ABB India share hit INR 30,000 by the year 2030?

Looking at its growth trend currently, expected growth, industry growth, it can reach INR 30,000 by 2030 if nothing negative is not done to it in the market.

Final Thoughts

ABB India is a rock-solid industrial giant with higher odds to grow. Being an automation, electrification, and digitalization led business, it’s a completely lovely long-term investment opportunity which just can’t be overlooked. Investors need to account for the economic and market scenario while investing in both of them.