IDFC First Bank Share Price Target From 2025 to 2030

IDFC First Bank Share Price Target From 2025 to 2030: IDFC First Bank is the next-generation Indian private sector bank with retail banking and digital banking at its core. It has emerged as a fascinating subject because of its growth model, customer-centric products, and path-breaking banking solutions. With growing institutional investments and its retail banking book growing, investors would be interested to know about its long-term time horizon for share prices. This article provides a thorough review of IDFC First Bank’s finances, share price predictions, and stock performance between 2025 and 2030.

Company Overview

1. Business Operations

IDFC First Bank started business in 2018 by the merger of IDFC Bank and Capital First. The bank has been predominantly involved in:

- Retail Banking (home loans, car loans, MSME loans)

- Corporate Banking (working capital, treasury management)

- Digital Banking Solutions (UPI, mobile banking, credit cards)

2. Leadership Team

- CEO: V. Vaidyanathan, who is known to have led ICICI Bank and Capital First

- Top Executives: Experienced leadership with adequate exposure in banking and financial services

3. Market Position & Size

- Market Cap: ₹42,333 crore (approx.)

- 52-Week High/Low: ₹86.10 / ₹56.36

- P/E Ratio: 21.69 (not significantly overvalued compared to peers)

- Comparison with the industry: Challenging peers with large-sized private sector lenders such as HDFC Bank, ICICI Bank, and Axis Bank

Financial Health Analysis

1. Revenue & Profitability Trends

IDFC First Bank has shown consistent top-line growth during the period. Profitability, however, has been delayed due to provisions for non-performing assets (NPAs) and restructuring charges.

2. Debt vs. Equity Ratio

- Debt-to-Equity Ratio: Normal levels, indicating managed borrowings

- Increased Retail Deposits: Less dependence on high-cost borrowings

3. Earnings Per Share (EPS) & Cash Flow

- EPS (TTM): ₹2.63

- Return on Capital (ROC): 5.10%

- Free Cash Flow: Positive trends, indicating financial solidity

Stock Performance & Market Trends

1. Recent Trends in Stock Price

- Current Market Price: ₹56.61

- Volume: 11,583,617

- 1-Year Performance: -29.07% decline due to extrinsic market situation

2. Technical Indicators

- Momentum Score: 28.6 (Technically weak stock as per Trendlyne analysis)

- MACD (Moving Average Convergence Divergence): -0.7 (Bearish signal)

- RSI (Relative Strength Index): 41.9 (Neither overbought nor oversold stock)

Support & Resistance Levels:

- Upper Circuit: ₹62.51

- Lower Circuit: ₹51.14

Dividend & Institutional Investments

1. Dividend Policy

- Dividend Yield: 0.00% (Plowing profits back into growth presently)

- Future Dividend Potential: Expected as the profits increase

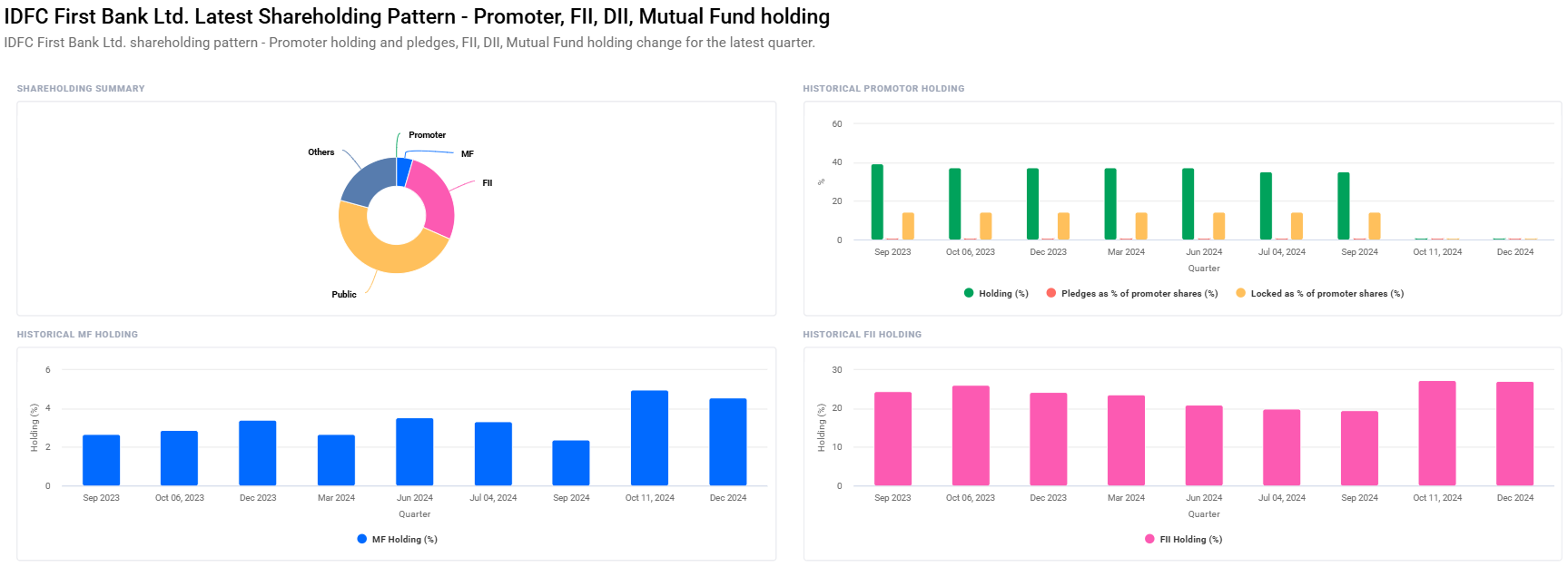

2. Growth in Institutional Holding

- FII/FPI Holding: Increased from 19.57% to 27.12%

- Mutual Funds Holding: Increased from 2.39% to 4.56%

- Total Institutional Holding: Increased from 34.81% to 52.43%

Growth Potential & Future Plans

1. Expansion Plans

- Increasing foothold in tier-2 and tier-3 cities

- Digital banking and fintech alliances emphasis

- Developing MSME and retail loan book

2. Industry & Economic Factors

- Government initiatives towards financial inclusion are in the interest of IDFC First Bank

- Interest rate trends that impact loan demand

- Consistent increase in digital transactions driving top-line growth

IDFC First Bank Share Price Target (2025-2030)

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹90 |

| 2026 | ₹120 |

| 2027 | ₹150 |

| 2028 | ₹180 |

| 2029 | ₹210 |

| 2030 | ₹240 |

Final Thoughts: Is IDFC First Bank a Good Investment?

Short-Term Outlook (2025-2026)

- Investors can expect some volatility due to short-term market trends and policy changes. But rising retail banking focus and institutional backing provide a solid foundation for growth.

Long-Term Prospects (2027-2030)

- With robust growth plans, prudent digital banking plans, and rising institutional investment, IDFC First Bank can be expected to yield good returns in the long term.

FAQs For IDFC First Bank Share Price

1. Will IDFC First Bank shares recover in the future?

Yes, since the bank is consolidating its retail banking operations and is seeing institutional investor flows in increasing measures, it should recover and move up in the future.

2. Does IDFC First Bank pay dividends?

No, presently the bank does not pay dividends as it is a growth and re-investment bank. It might introduce dividends in near future.

3. What are the key investment risk of IDFC First Bank?

The risks are market volatility, rising credit costs, and regulatory actions against the banking sector.

4. What would push IDFC First Bank’s share price up?

Increased digital banking products, retail loan growth,. and Indian economic growth can lead to a stock price increase.