Mahindra Share Price Target From 2025 to 2030

Mahindra Share Price Target From 2025 to 2030: Mahindra & Mahindra (M&M) is a major Indian automobile and farm equipment-producing company. It is a group company of Mahindra Group that operates various business segments in auto, agriculture, IT, finance, and aviation.

Important Facts:

- CEO: Anish Shah (last update)

- Market Capitalization: ₹3.10 lakh crore (approx.)

- Business: Auto, Farm Equipment, IT, Finance, and Aerospace

- Competitors: Tata Motors, Maruti Suzuki, Ashok Leyland

- Listing in Stock Exchanges: NSE & BSE

Financial Health

- Revenue & Profit Trend (Last 5 Years): Mahindra & Mahindra has been experiencing steady revenue and profit growth on the strength of strong domestic and international demand for tractors and SUVs.

Debt to Equity

- Debt-to-equity ratio is 1.68, demonstrating judicious policy of leverage.

Earnings Per Share (EPS)

- EPS (TTM): 99.82

- Yearly EPS growth indicates long-term improvement.

Cash Flow & Fundamentals

- P/E Ratio: 27.38 (Industry P/E 20.81)

- Return on Capital (ROC): 16.83%

- Book Value: ₹2,595

- Dividend Yield: 0.75%

These fundamentals place Mahindra & Mahindra in a position of being financially stable with satisfactory profitability accompanied by traceable debt.

Stock Performance & Technical Analysis

Mahindra & Mahindra stock has been in an uptrend, going up 36.46% in the last one year. Short-term volatility, however, seems to be indicated through technical indicators.

Key Technical Indicators:

- Momentum Score: 42.5 (Neutral)

- RSI (14): 32.4 (Heading towards oversold levels)

- MACD: -89.5 (Bearish)

- MFI: 21.9 (Oversold, recovery expected)

- 52-Week High: ₹3,270.95

- 52-Week Low: ₹1,788.80

As M&M shares are in the oversold position, analysts are anticipating a likely rebound in the short run.

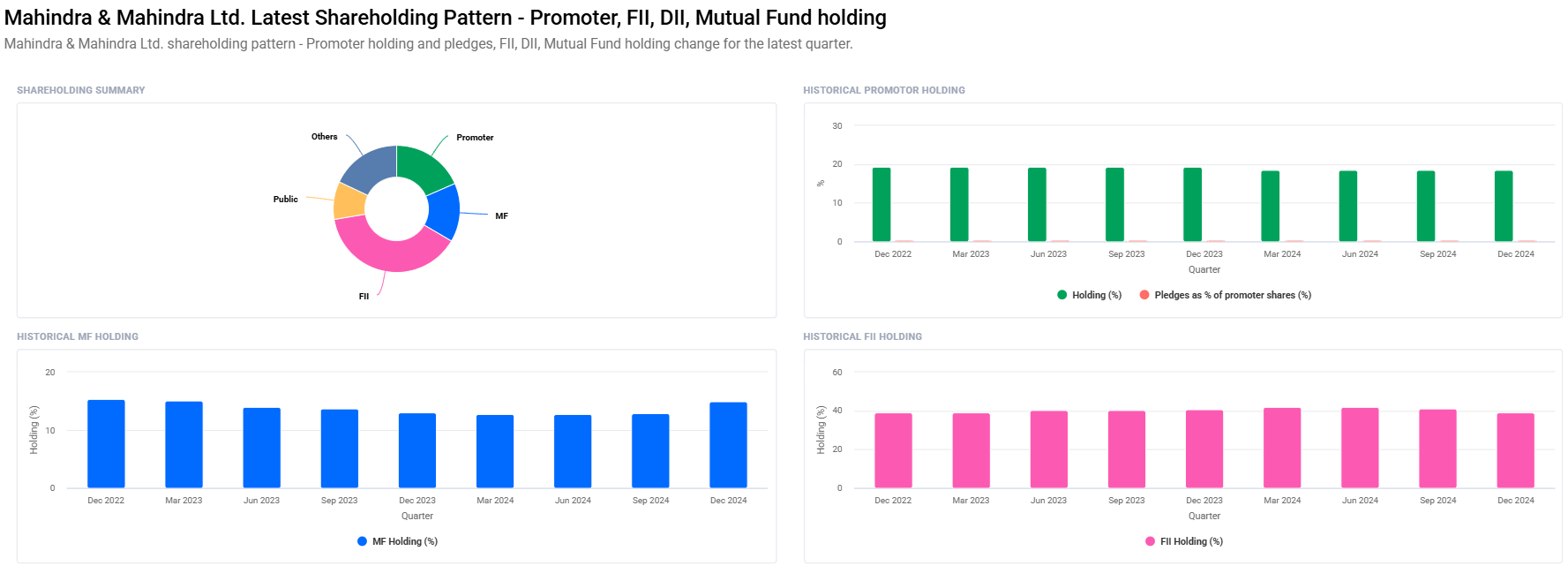

Institutional & Retail Investors

- Foreign Institutional Investors (FII): 38.91%

- Promoters: 18.48%

- Mutual Funds: 14.98%

- Retail Investors & Others: 13.38%

Shareholding Changes

- Promoters have decreased holdings by a minimal amount from 18.54% to 18.48%.

- FIIs have decreased holdings from 41.18% to 38.91%.

- Mutual Funds have increased stakes from 12.92% to 14.98%.

This update suggests long-term future horizon of Mahindra & Mahindra is on the institutional investor radar.

Mahindra & Mahindra Share Price Target (2025-2030)

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹3500 |

| 2026 | ₹5000 |

| 2027 | ₹6500 |

| 2028 | ₹8000 |

| 2029 | ₹9500 |

| 2030 | ₹11000 |

The above target is projecting keeping in view revenue growth, profitability, and sector expectation.

Growth Potential & Future Outlook

- EV Segment Growth: Mahindra is rapidly expanding its Electric Vehicle (EV) segment with new launches in the pipeline.

- SUV & Tractor Demand Strength: Leadership roles in SUV and tractor segments have upbeat top-line opportunities.

- Global Expansion: Overseas market penetration growth, i.e., Europe and Africa.

- R&D & Innovation: Continued Growth in technology spending, i.e., electric and autonomous mobility.

- Strategic Partnerships: Strategic partnerships with global players such as Volkswagen in electric mobility.

Risk Factors

- Market Risk: Global economic downturn can cause harm to demand.

- Regulatory Risks: Reforms in government policy and emissions rules.

- Raw Material Costs: Variations in steel and semiconductor prices.

- Competition: Very strong competition from Tata Motors and Maruti Suzuki and global players.

Frequently Asked Questions (FAQs)

1. What would be the share price of Mahindra & Mahindra in 2025?

Share price target for 2025 would be ₹3,500.

2. Would the Mahindra & Mahindra shares reach ₹11,000 in 2030?

With growth it has and growth in EV segment and with its good balance sheet, M&M can reach ₹11,000 by 2030.

3. Is Mahindra & Mahindra a long-term value investment?

Yes, M&M is a leader in the industry with great fundamentals, growth drivers for the long term, and a value bet for the long term.

4. What are the potential risks of investment in Mahindra & Mahindra?

Market volatility, regulatory reforms, stiff competition, and volatility of raw material prices are the principal risks.

5. Does Mahindra & Mahindra offer dividends?

Yes, the dividend yield is 0.75% and safe for dividend investors to opt for.

Mahindra & Mahindra will also grow in the next two years with good fundamentals, growth in EV, and growing global penetration. Growth seekers can also opt for M&M, with the rider of growth potential and risk factors.