BYD ORD Share Price Target From 2025 to 2030

BYD ORD Share Price Target From 2025 to 2030: BYD Company Limited (Build Your Dreams) is a Chinese multinational conglomerate engaged in electric vehicle (EV) production, batteries, and renewable energy. BYD was established in 1995 and is now one of the world’s largest EV makers, rivaling the likes of Tesla. BYD has diversified businesses in automobile manufacturing, battery technology, rail transit, and electronics.

Who is the CEO of the company?

Wang Chuanfu is the Chairman and CEO of the company. BYD, under Wang Chuanfu’s vision, is committed to holding a greater global market share in EVs and establishing itself as an industry leader in clean energy solutions.

How large is the company?

- Market Capitalization: 1.14LCr (1.107T HKD)

- Employees: More than 290,000 employees globally

- Global Presence: China, Europe, North America, and other key international markets

Competitive Position

BYD is vying head-to-head with Tesla, NIO, XPeng, and established auto players stepping into the EV space like Volkswagen and Toyota. Its strongest edge is vertical integration, local production of batteries, and good support from the Chinese government.

2. Financial Health: How Strong Is It?

Revenue & Profit Trends (Last 5 Years)

BYD has also kept posting good revenue growth with higher EV sales and better battery technology. Its own margins have also been better as it scales up production.

Debt vs. Equity

- BYD has a good debt-to-equity ratio, and thus it is not overly dependent on debt while growing its business.

Earnings Per Share (EPS)

- EPS (TTM): 12.49 HKD

- A growing EPS indicates that the company is making more and more profits for its shareholders.

Cash Flow

- BYD cash flow is robust, driven by government subsidies on electric vehicles and robust demand for electric vehicles in the world.

Key Reports to Watch

- Balance Sheet: To analyze assets and liabilities

- Income Statement: To monitor revenue and expenses

- Cash Flow Statement: To analyze liquidity

3. Stock Performance: How Does It Act?

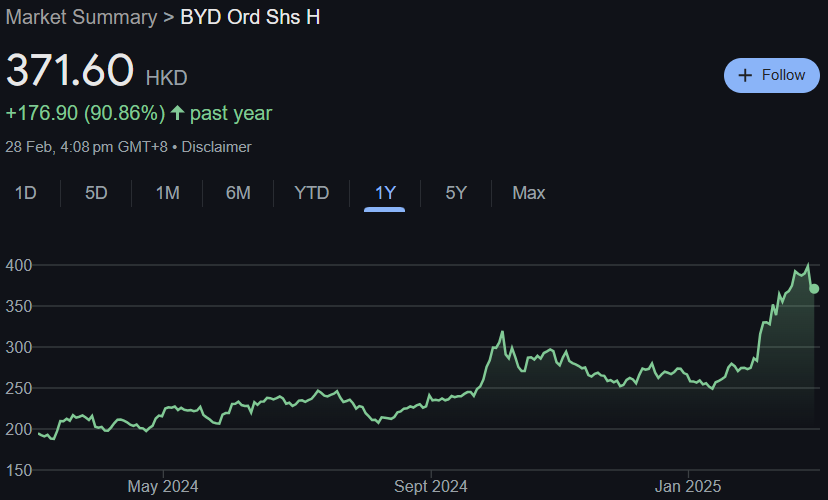

- 1-Year Performance: +90.86% appreciation

- 52-Week Range: 186.60 – 408.80 HKD

- Current Price: 371.60 HKD

- P/E Ratio: 29.79 (Reflecting high investor sentiment)

Technical Indicators

- Moving Averages: Showing a strong trend in the uptrend direction during the last one year

- RSI & MACD: Show good market momentum

- Support & Resistance Levels: Support at 360 HKD and resistance at 408 HKD

4. Dividends & Returns: What Shareholders Get?

- Dividend Yield: 0.92%

- Forward Dividend & Yield: 3.41 HKD (0.92%)

- Ex-Dividend Date: June 11, 2024

BYD’s dividend is relatively low because the company keeps profit for development.

5. Growth Potential: What’s the Next?

Expansion Strategies

- Doubling down on battery and electric output capacity

- Expansion into the North American and European markets

- Government subsidies for clean energy solution

Future Innovations

- Improved Blade Battery technology (simpler, longer-lasting EV batteries)

- Next generation of electric vehicles to compete with Tesla and NIO

- Expansion into AI-powered autonomous driving technology

Possible Mergers & Acquisitions

- BYD plans to establish additional strategic partnerships to develop its EV technology and global presence.

6. External Factors: What Can Affect the Stock?

Economic & Industry Trends

- World demand for EV propels BYD growth

- Interest rate and inflation shift will impact stock valuation

- Government policy initiatives for clean energy are consistent with BYD’s market position

Institutional Investors

- Big institutional investors are adding BYD to their holdings as a show of confidence in BYD’s growth.

7. Risk Factors: What Can Go Wrong?

Market Risks

- Broad market forces on stock price direction

- Policy change in big markets influencing adoption of EV

Business & Financial Risks

- Intense rivalry from Tesla, NIO, and legacy automakers venturing into the EV space

- Chance supply chain disruptions influencing production

Geopolitical Risks

- US-China trade relations impacting BYD’s growth on a global level

- Stringent environmental regulations that may affect production costs

BYD ORD Share Price Target (2025-2030)

| YEAR | SHARE PRICE TARGET (HKD) |

| 2025 | 420 |

| 2026 | 640 |

| 2027 | 860 |

| 2028 | 1080 |

| 2029 | 1300 |

| 2030 | 1520 |

FAQs For BYD ORD Share Price

1. Is BYD a suitable long-term growth investment?

Yes, BYD dominance of the EV and battery business, government incentive, and tech improvements make for a good long-term investment.

2. Why is the share price for BYD advancing?

- Increasing portion of the EV market

- Incredible developments in battery technology

- International market development

3. How is BYD different from Tesla?

As Tesla competes in high-margin markets, BYD competes on price and massive volumes. BYD bests Tesla when it comes to vertical integration and battery production.

4. Does BYD distribute a dividend?

Yes, but its dividend yield (0.92%) is minimal because profits are being reinvested to fund growth.

5. What are the risks that need to be taken into consideration by investors before investing in BYD stock?

- Market volatility

- Fluctuations in regulations

- Growing competition in the EV industry

6. How does BYD’s Blade Battery technology shape its future?

The Blade Battery enhances safety, durability, and cost-cutting, rendering BYD’s EVs competitive.

Final Thoughts

BYD is a fast-growing EV and battery leader. It has delivered high returns in the last year and will keep growing, reaching 1520 HKD by 2030. Investors must watch for economic news, industry news, and geo-political risk in order to make improved investment decisions.