UPL Share Price Target From 2025 to 2030

UPL Limited is an agrochemical multinational that trades in sustainable farm solutions. The company trades in post-harvest solutions, seeds, and crop protection solutions with a focus on technology-driven farm products. UPL operates in more than 130 countries with a large distribution network serving farmers globally.

Leadership & Market Position For UPL Share Price

It is headed by Jai Shroff, its CEO. Under the stewardship of its capable leadership, UPL today is one among the big boys of agrochemicals jumping directly into blockbusters like Bayer, Syngenta, and Corteva Agriscience. UPL ranks among the agrochemicals industry’s leading players in the top five league with a market capitalization of ₹49,400 crore.

Competitive Position For UPL Share Price

UPL has a dominant leadership in the emerging markets and has a diversified portfolio of generic and branded agrochemicals. The company’s sustainability and innovation strategy provides it with a competitive advantage in the agri-market.

2. Financial Health: How Strong Is It?

Revenue & Profit Growth

In the last five years, UPL has been showing top-line growth irrespective of industry headwinds in the shape of commodity prices volatility and political tension. The key financial figures are as follows:

- Revenue Growth: 8-10% CAGR last five years

- EBITDA Margin: Approximately 19-22%

- Profitability: Rising profits with emphasis on cost control

Debt vs. Equity

- The debt equity ratio of UPL is 1.23, which is sustainable considering its stable top-line platform.

- The debt of the company has been decreasing year by year, creating financial solidity.

Earnings Per Share (EPS)

- EPS have fluctuated depending on external factors but is an important profitability indicator. The company has also made strategic choices to drive bottom line through product innovation and cost management.

Cash Flow Position

- UPL has registered good operating cash flows with ample liquidity to be used in subsequent expansion and acquisition plans.

Most Important Financial Ratios to Watch For UPL Share Price

- Balance Sheet: Reflects consistent assets and managed liabilities.

- Income Statement: Profit margins and top-line growth reflect consistent expansion.

- Cash Flow Statement: Reflects effective cash management.

3. Stock Performance: How Does It Behave?

- Current Price: ₹622.90

- 52-Week High: ₹649.45

- 52-Week Low: ₹429.52

- Last Year Growth: 30.51% increase

Most Significant Technical Indicators

- Moving Averages: UPL is close to its 50-day and 200-day moving averages, indicating stability.

- RSI (Relative Strength Index): 60.2 (neutral zone, not oversold or overbought)

- MACD (Moving Average Convergence Divergence): 22.7 (upward trend but below signal line)

- ADX (Average Directional Index): 33.4 (moderate trend strength)

- Market Momentum: Neutral to bullish, improved investor sentiment.

4. Dividends & Returns: What Do Investors Get?

- Dividend Yield: 0.16%

- Last Dividend Pay-Out: ₹0.55 per share

- Stock Buybacks: Been growth and expansion-oriented rather than aggressive buybacks.

- Comparison to Peers: Strong long-term return potential but conservative dividend yield.

5. Growth Potential: What’s Next?

Expansion & Innovation

- New Products: Heavily invested in green agrochemical solutions.

- Global Expansion: Consolidating its hold in Latin America, Africa, and Asia.

- Acquisitions: Potential mergers to expand its market presence.

- R&D Investment: Emphasis on biotech solutions for next-generation agriculture.

6. External Factors: What Can Move the Stock?

Economic & Industry Trends

- Inflation & Interest Rates: May impact raw material price.

- Regulatory Changes: Green regulations for the agrochemical industry.

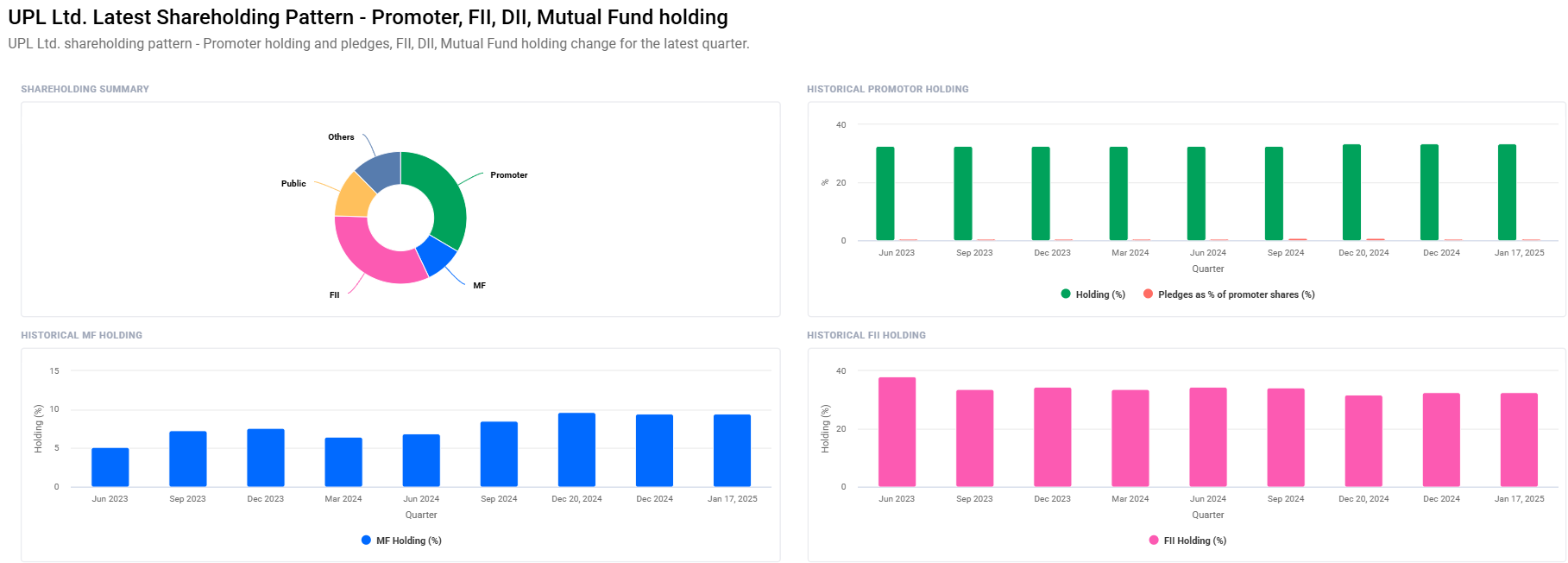

Institutional Holdings:

- Foreign Institutions: 35.46%

- Promoters: 33.50%

- Retail & Others: 12.14%

7. Risk Factors: What Goes Wrong?

- Market Risks: Downfall of economic growth in demand.

- Regulatory Risks: Change in regulation of pesticides.

- Debt Management: Impact on financials due to overborrowing.

- Competition: Tight competition with international agrochemical majors.

UPL Share Price Target (2025-2030)

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹650 |

| 2026 | ₹850 |

| 2027 | ₹1050 |

| 2028 | ₹1250 |

| 2029 | ₹1450 |

| 2030 | ₹1650 |

FAQs For UPL Share Price

1. Should UPL Ltd. be a good stock to invest in?

UPL Ltd. is a good agrochemical company with consistent growth. If you are forced to invest long term in sustainable agriculture, UPL is a very good investment.

2. What are the chances of future growth for UPL?

UPL is well placed worldwide and because it focuses on sustainable farming and R&D, it has huge chances to grow within the next ten years.

3. What are the risks of an investment in UPL stocks?

The greatest risks are regulatory problems, market volatility, and global agrochemical firm competition.

4. Will the risk price of UPL become ₹1,650 in 2030?

Considering trends in the industry and growth in finances so far, UPL can grow to ₹1,650 by 2030 on the back of consistent revenue growth along with R&D.

5. Does UPL provide dividends?

Yes, UPL also provides dividends, although the dividend yield is very low compared to some other companies.

6. Historically, how has UPL performed?

Historically, UPL share price has risen by 30.51%, which is a sign of good performance and shareholder confidence.

7. How is UPL positioned relative to its industry peers?

UPL is compared to multinationals agrochemical behemoths Syngenta and Bayer. Having a lower market cap, the company’s emphasis on innovation and international presence maintain it at par with its large peers.

UPL is a performance-driven agrochemical player that has enough resources and room to grow. Sustained-value investors who believe in investing in sustainable agriculture do have a deserving investment option at UPL. Its investors are required to be attentive to regulation in the industry and industry prospects before investment.