Excelerate Energy’s Shocking Growth: Why Investors Are Taking Notice!

Excelerate Energy (NYSE: EE), a key player in the liquefied natural gas (LNG) market, has been making waves with strong financial results and ambitious expansion plans. As the company sets its sights on global growth, analysts and institutional investors are weighing in—some with optimism, others with caution.

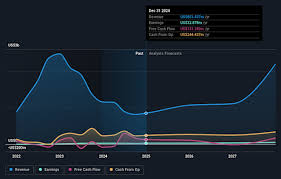

Excelerate’s Financial Boom

The company reported record-breaking financial performance in 2024, with total operating revenue climbing to $274.6 million, a 14.3% increase compared to the previous year. This impressive growth highlights Excelerate’s ability to capitalize on the rising demand for LNG solutions.

Looking ahead to 2025, the company has projected:

- Adjusted EBITDA between $340 million and $360 million

- Maintenance capital expenditures between $60 million and $70 million

- Growth capital commitments ranging from $65 million to $75 million

With these numbers, Excelerate is positioning itself as a major force in the LNG sector, aiming to expand its footprint in strategic global markets.

Massive Expansion Plans Underway

Excelerate Energy is not slowing down. The company is eyeing 12 major regasification projects, mainly across Asia Pacific and the Americas, where LNG demand is soaring. One of the standout projects includes the Payra project in Bangladesh, signaling the company’s commitment to emerging markets hungry for energy solutions.

To support these ambitious projects, Excelerate plans to expand its fleet of floating storage and regasification units (FSRUs), ensuring a steady supply of LNG to key regions.

Analysts Split on Excelerate’s Future

The investment community remains divided on Excelerate Energy’s outlook. Some analysts are bullish, while others are taking a more cautious approach:

- Barclays recently raised its price target from $31.00 to $32.00, maintaining an “overweight” rating, signaling confidence in its growth strategy.

- Morgan Stanley took the opposite stance, downgrading Excelerate’s stock to “underweight” and setting a lower price target of $29.00.

- The overall analyst consensus leans toward a “Hold” rating, with an average target price of $31.00—suggesting a wait-and-see approach for many investors.

Institutional Investors Are Making Big Moves

Despite mixed analyst sentiment, institutional investors are betting big on Excelerate.

- TimesSquare Capital Management LLC recently acquired a new stake worth $13.85 million, showing strong confidence in the company’s future.

- D.E. Shaw & Co. Inc. increased its holdings by 16.2%, bringing its total investment to $13.17 million.

These moves suggest that major financial players see potential in Excelerate’s long-term strategy, even as some analysts remain cautious.

Final Thoughts: What’s Next for Excelerate?

With record earnings, bold expansion plans, and increasing interest from institutional investors, Excelerate Energy is a company to watch. While analysts are split, the company’s strategy of targeting high-demand regions and growing its LNG infrastructure could pay off significantly in the years to come.

For investors, the big question is: Will Excelerate Energy continue its upward trajectory, or are challenges ahead? With the energy market evolving rapidly, this stock remains one of the most intriguing plays in the LNG sector.