ACME Solar Share Price Target From 2025 to 2030

Acme Solar Holdings is a leading renewable energy company in India that is involved in the generation of solar power. The firm designs, builds, owns, and operates big solar power projects across India. Acme is renowned by virtue of its technology in solar power and sustainability, thus emerging as one of the renewable energy market leaders in India.

Leadership & Market Position

- CEO: Manoj Upadhyay (Founder & Chairman)

- Industry: Renewable Energy (Solar Power Generation)

- Market Capitalization: ₹11,823 Cr

- Competitors: Adani Green Energy, Tata Power Renewable, ReNew Power, Azure Power

Acme Solar Holdings is recognized for its groundbreaking solution to solar energy, which includes high-efficiency photovoltaic panels and hybrid solar power systems.

2. Financial Health: How Strong Is It?

Revenue & Profit Trends

Acme Solar’s installed solar capacity has increased consecutively for the last five years, revenue growth keeping pace with the increase in power generation. Despite the fact that the company is facing problems with its net profitability in the form of a negative ROE of -5.37%.

Debt vs. Equity

- The Debt to Equity ratio is 5.46, where the company is heavily in debt.

- Improve debt management so that in the long term, the firm is financially strong.

Earnings Per Share (EPS)

- EPS (TTM): ₹10.93

- Despite EPS being positive, there has to be an improvement continuously to please long-term investors.

Cash Flow & Financial Reports

- Balance Sheet: The company is carrying humongous assets in terms of solar power projects but carries too much debt.

- Income Statement: Topline is improving, but net profits have not stabilized yet.

- Cash Flow Statement: Operating cash flow is positive but way too much financial outlay due to the repayment of loans.

3. Stock Performance: How Does It Behave?

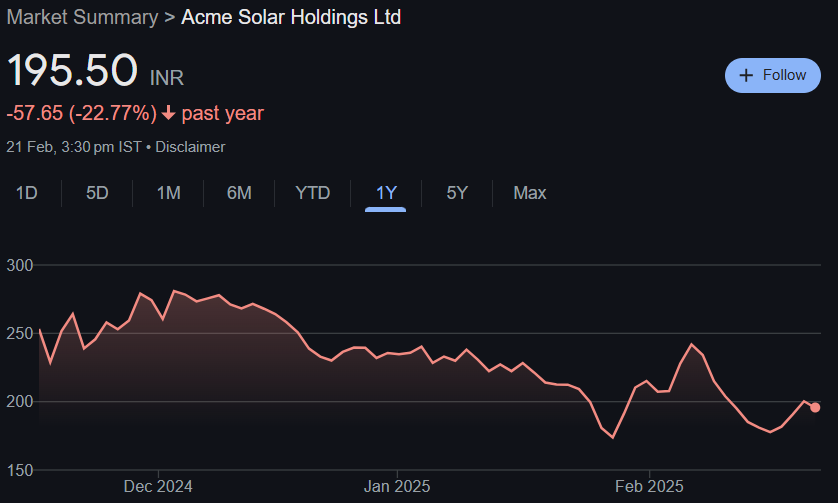

Recent Stock Price Details

- Open Price: ₹195.99

- 52-Week High: ₹292.40

- 52-Week Low: ₹167.75

- P/E Ratio (TTM): 17.88 (Industry P/E: 26.64)

- P/B Ratio: 2.72

The stock of the company has been volatile with a steep fall of -22.77% in the last one year. The volatility reflects market sentiment, financial issues, and overall economic trends.

Technical Indicators

- RSI (14): 45.3 (Neutral Zone)

- MACD: -8.3 (Bearish)

- ADX: 18.0 (Weak Trend)

- Momentum Score: 16.4 (Technically Weak)

All these signs point towards the fact that Acme Solar stock is currently under pressure, yet long-term investors can still anticipate something if financials are disciplined.

4. Dividends & Returns: What Do Investors Get?

- Dividend Yield: 0% (No dividend payment by Acme Solar now).

- Stock Buybacks: No recent buyback reported.

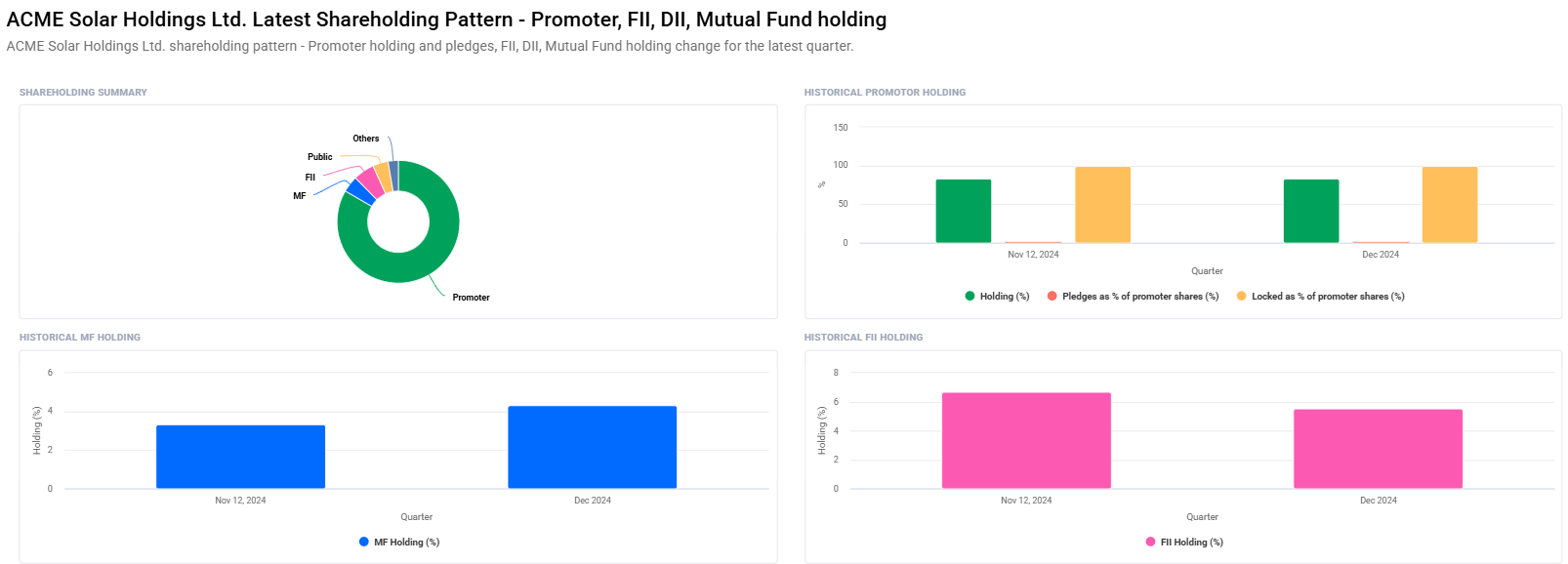

- Institutional Holdings: Increasing institutional holding, with holdings rising from 33.89% to 34.89%.

5. Growth Potential: What’s Next?

Expansion & Market Strategy

- Acme Solar is expanding its solar power capacity aggressively in India.

- Penetration strategy for high-demand international solar energy markets.

- Possible partnerships with government bodies and private entities for renewable energy projects.

Innovation & Future Plans

- Investment in advanced solar panel technology for improved efficiency.

- Creating hybrid solar-storage system.

- Mergers and acquisitions to grow market share.

6. External Factors: What Can Influence the Stock?

- Government Policies: Tax credits on renewable energy enhance profitability.

- Global Energy Prices: Revenue depends on energy price and availability on demand.

- Economic Trends: Variation in interest rates determines cost of capital.

- Competition: Higher competition from other solar energy firms might limit market share growth.

7. Risk Factors: What Can Go Wrong

- Market Risk: Fluctuation of stock prices.

- Business Risk: Weight of high debt affecting financial condition.

- Financial Risk: Adverse ROE and dependence on debt financing.

- Regulatory Risks: Government regulations regarding renewables subsidies.

8. Share Price Target from 2025 to 2030

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹300 |

| 2026 | ₹420 |

| 2027 | ₹540 |

| 2028 | ₹660 |

| 2029 | ₹780 |

| 2030 | ₹900 |

The ACME Solar Share Price will increase, subject to improved financial performance, judicious management of debt, and continued demand for renewable energy.

FAQs For ACME Solar Share Price

1. Is Acme Solar a good long-term investment?

Acme Solar has reasonable growth prospects in the renewable energy space, but investors need to be careful about its debt and finances.

2. Why is Acme Solar’s stock volatile?

The company is impacted by government policy towards renewable energy, investor outlook, and financials.

3. Does Acme Solar pay dividends?

No, the company is not currently paying dividends but focusing on expansion and managing debt.

4. What will cause Acme Solar’s share price to appreciate?

Increased solar capacity, enhanced financial well-being, and widespread adoption of renewable energy.

5. Do I invest in Acme Solar now?

Investors need to look at industry trends, debt, and financial health prior to investing. The company is risky because of its financial composition but has long-term growth prospects.

Acme Solar Holdings is a fascinating investment opportunity in the clean energy sector. Its leverage, capital adequacy, and volatility, however, must be most critically evaluated before any investor can choose to invest. To investors willing to make an informed risk, long-term growth prospect appears lucrative.