Amazon Just Made $20 Billion in Profit – But Is It Enough?

Amazon’s stock is currently trading at $211.11, down slightly by 0.55% from its last close. Today, it’s been bouncing between $211.07 and $214.42, which isn’t too dramatic, but over the past year, the stock has been on quite a ride—hitting a high of $242.52 and dropping as low as $151.61. If you’ve been following Amazon’s stock, you know this kind of movement is pretty normal, but it definitely keeps investors on their toes.

Big Investors Are Sticking With Amazon

A huge chunk of Amazon’s stock—about 72%—is owned by major financial institutions. This means that some of the biggest investors in the world have faith in Amazon’s long-term success. Recently, U.S. Capital Wealth Advisors boosted its investment in the company by 12.6%, now holding 186,393 shares. CX Institutional also increased its stake by 7.8%—which is a solid vote of confidence.

But even big investors take hits sometimes. Last week, institutions lost about 7% on their Amazon holdings, showing that no one is immune to market fluctuations. Still, the fact that they’re sticking around suggests they believe Amazon’s future is strong.

Amazon’s Profits Are Soaring—But the Future Isn’t Perfect

Amazon wrapped up 2024 with some impressive numbers. The company pulled in $187.79 billion in revenue in the fourth quarter—10% higher than last year. Even more exciting, its net income skyrocketed 88% to $20 billion, proving Amazon’s ability to keep making money.

That said, the company’s forecast for early 2025 is a little underwhelming. Amazon expects to bring in $151 billion to $155.5 billion in Q1, which is slightly less than what analysts were hoping for.

Amazon’s $100 Billion Bet on AI

Amazon is making a massive investment in artificial intelligence. The company plans to spend over $100 billion this year, mostly on AI and cloud computing. This puts Amazon in direct competition with tech giants like Microsoft and Google, which are also pouring billions into AI.

Because of this, analysts at BMO Capital Markets have raised their price target for Amazon’s stock to $280, saying they see big growth coming from Amazon Web Services (AWS). UBS analysts are also optimistic, keeping their “buy” rating on the stock.

What Analysts Think About Amazon’s Stock

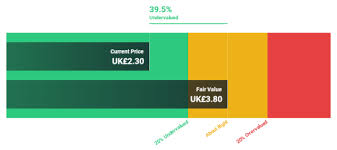

Right now, most experts believe Amazon’s stock has room to grow. The average 12-month price target is $262.61, which is about 25% higher than where the stock is today. Most analysts still rate it as a “Strong Buy”, meaning they expect Amazon to keep climbing in the long run.

What It All Means

Amazon is still a dominant force in e-commerce and cloud computing, and now it’s making a huge bet on AI. Even though the stock goes through ups and downs, major investors and analysts seem confident in Amazon’s future. The next few months will be crucial in seeing whether the company’s big investments pay off.