Apollo Micro Systems Share Price Target From 2025 to 2030

Apollo Micro Systems Share Price Target From 2025 to 2030: Apollo Micro Systems Ltd. is a technology company engaged in designing, developing, and manufacturing electronic solutions for defense, aerospace, and homeland security industries. Apollo Micro Systems provides customized solutions ranging from mission-critical systems to weapon integration systems, avionics, and space-based applications. Apollo Micro Systems is the industry leader in India’s defense market and caters to organizations like DRDO, ISRO, and Indian Armed Forces.

Leadership & Market Position

The firm is guided by a powerful leadership team that is headed by Managing Director and CEO Baddam Karunakar Reddy, who has over three decades of experience in the industry. He has pushed Apollo Micro Systems to expand its business scope and position itself in the defense electronics space. The company has a market capitalization of approximately ₹3,834 crore as it picks up steam in the market.

2. Financial Strength: How Robust Is It?

Revenue & Profit Patterns

Apollo Micro Systems has shown consistent revenue and revenue growth over the past five years driven by rising defense spending by the Indian government and rising global demands for innovative electronic technology. The company has shown consistent revenue and net profit growth despite being in a very competitive business.

Debt vs. Equity

Apollo Micro Systems’ Debt-to-Equity ratio of 0.37 is indicative of moderate borrowings dependence. While the same indicates the company to have healthy debt, the same ought to indicate stability.

Earnings Per Share (EPS)

- Current EPS (TTM): 181

- The EPS has been rising steadily, which is an indicator of first-class profitability.

Cash Flow Position

The firm has been able to create stable cash flow to fund its operations and future expansion. Instability in government defense contracts, however, has a potential impact on the stability of short-term cash flow.

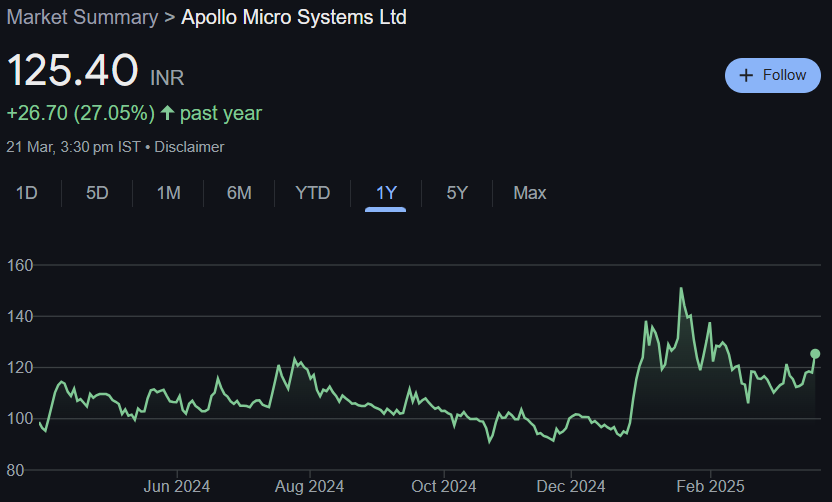

3. Stock Performance: What Does It Do?

Recent Stock Price Trends

- 52-week high: ₹157.00

- 52-week low: ₹87.99

- Current price: ₹125.40 (as of last available data)

- P/E ratio: 66.57 (above industry average, indicating premium valuation)

- Market Volatility: Moderate, price volatility because of demand from the defense industry and government policies.

Technical Indicators

- RSI (14): 59.5 (Neutral Zone)

- MACD: -0.1 (Bearish Signal)

- ADX: 14.4 (Weak Trend Strength)

- ROC (21): 18.0 (Bullish Momentum)

- MFI: 70.8 (Overbought Zone, Possible Pullback)

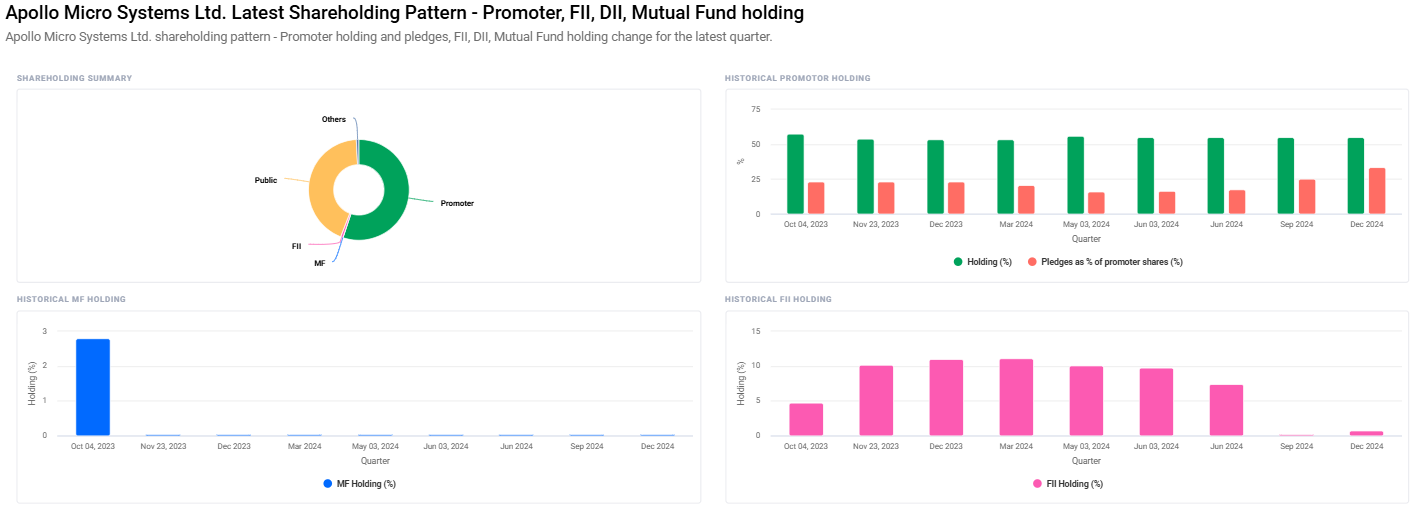

4. Dividends & Returns: What Do Investors Get?

- Dividend Yield: 0.04% (Extremely Low)

- Stock Buybacks: No recent buyback plans

- Promoter Holding: 55.12% (Stable but 33.17% shares are pledged, a risk factor)

Apollo Micro Systems invests its profits more into business growth instead of giving astronomical dividends.

5. Growth Prospects: What’s in Focus?

- New Orders: Apollo Micro Systems is garnering new defense and aerospace orders, driving revenues in the future.

- Expansion Internationally: Prospects of joint ventures with world defense giants.

- Innovation: Investing money in state-of-the-art AI and IoT-driven defense technologies.

- Government Support: Indian government’s defense indigenization drive will support Apollo Micro Systems.

6. External Factors: What Can Move the Stock?

- Economic Trends: Increase in inflation and interest rates may affect defense spending.

- Industry Trends: Increasing defense budgets and modernization are the positive drivers.

- Government Policies: Favorable policies such as ‘Make in India’ can facilitate the growth of Apollo Micro Systems.

- Institutional Investments: FII/FPI investment has increased from 0.19% to 0.74%, reflecting growing confidence of investors.

7. Risk Factors: What Can Go Wrong?

- Market Risk: Volatility in stock price due to exogenous economic shocks.

- Business Risk: Government contracts reliant; delay in orders can impact revenues.

- Financial Risk: Overpriced (P/E ratio of 66.57) and can be corrected.

- Geopolitical Risk: Defense segment subject to national security policy.

8. Apollo Micro Systems Share Price Target (2025-2030)

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹170 |

| 2026 | ₹240 |

| 2027 | ₹310 |

| 2028 | ₹380 |

| 2029 | ₹450 |

| 2030 | ₹520 |

These are dependent upon the growth trajectory of the company, industry growth, and financial health.

FAQs For Apollo Micro Systems Share Price

1. Is Apollo Micro Systems a good long-term investment?

Apollo Micro Systems does have good growth prospects, especially in the defence segment. But risks such as share volatilities and reliance on the government’s orders for investors to watch out for.

2. Why is the P/E ratio of Apollo Micro Systems so high?

Since the P/E ratio of 66.57 is so high, the investors expect future high growth. But with that comes the implication that the stock can be overvalued in the short run.

3. What are the key drivers of the stock price of Apollo Micro Systems?

The key drivers are defense budgetary expenditure, government orders, technology innovation, and global geopolitical trends impacting defense expenditure.

4. Does Apollo Micro Systems pay dividend?

Yes, but the dividend yield is very low (0.04%). The company likes growth through reinvestment.

5. What are the investment risks of Apollo Micro Systems?

Material risks are dependence on government orders, overvaluation, market volatility, and share pledge by promoters (33.17% of promoter shares).

6. How has foreign institutional investment (FII) evolved?

FII/FPI holding has increased from 0.19% to 0.74%, showing growing investor confidence in Apollo Micro Systems.

Apollo Micro Systems is a stock to be watched in the defense sector, given India’s growing defense budget and goSolo ambitions. Apollo Micro Systems is a financially strong company with future growth potential, but investors need to exercise caution regarding stock volatility, valuation concerns, and dependency on government orders. Looking ahead in the long term by exercising proper risk assessment, investors can invest.