Applied Digital Stock Price Predictions From 2025 to 2030

Applied Digital Corporation (NASDAQ: APLD) is a global industry top player in providing high-performance computing (HPC) solutions to AI, blockchain, and cloud computing industries. The company is specialists in constructing massive-scale digital infrastructure, providing data centers for high-power computing needs.

Market Position and Leadership

- CEO: Wes Cummins

- Market Capitalization: $2.011 billion

- 52-Week Range: $2.36 – $12.48

- Employee Strength: Mid-sized company with focus on digital technology experts

Industry and Competition

Applied Digital competes against industry leaders in cloud infrastructure and AI-computing rivals, including:

- NVIDIA (NVDA)

- Advanced Micro Devices (AMD)

- Hewlett Packard Enterprise (HPE)

- Marathon Digital Holdings (MARA) – in the blockchain industry

As demand in crypto-mining and AI data centers continues to rise, APLD will grow long-term in high-performance computing.

2. Financial Position: How Stable Is Applied Digital?

To estimate Applied Digital’s financial well-being, we look at the most important numbers: revenue, debt, earnings per share (EPS), and cash flow.

Revenue & Profit Trends

- Applied Digital has seen robust revenue growth in recent years as demand for its data centers has risen. The company is still in its investment-stage phase, though, and thus has posted negative earnings per share (-1.90 TTM EPS).

Debt vs. Equity Analysis

- The company has enormous investment in infrastructure but needs to take care of maintaining a proper debt-to-equity ratio so that it is not compromising on finance.

Cash flow comes handy to sustain the business and grow in the future.

Financial Reports to Monitor:

- Balance Sheet: Verifies assets, liabilities, and debts.

- Income Statement: Verifies growth in revenue and margins.

- Cash Flow Statement: Verifies if APLD is liquid enough to sustain business.

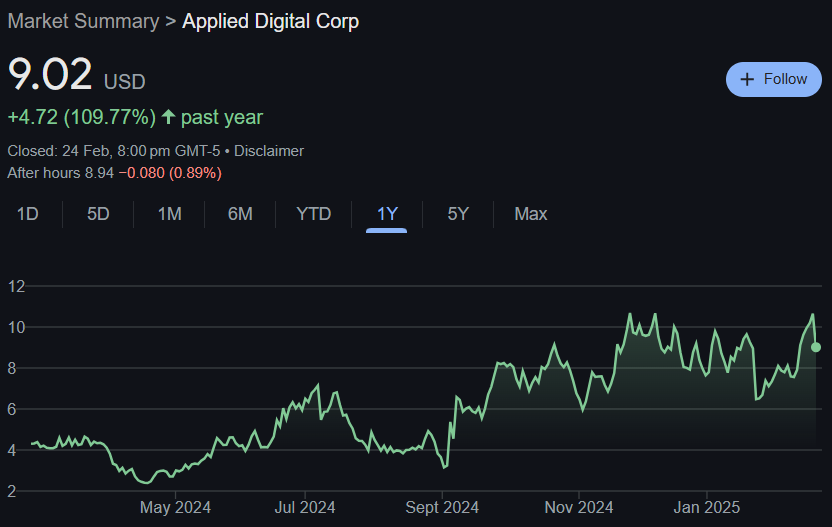

3. Stock Performance: Trends and Technical Analysis

Applied Digital has remained in good momentum, supported by solid technical indicators with bullish potential.

Stock Price Patterns – Recent

- Previous Close: $10.65

- Day’s Range: $8.60 – $10.49

- 1-Year Growth: +109.77%

Key Technical Indicators

- Momentum Score: 72.4, Technically strong (Above 70 = Bullish)

- MACD (12,26,9): 0.4, Bullish (MACD above center & signal line)

- ADX: 16.9, Trending but not strongly directional

- RSI (14): 52.6, Neutral (Neither overbought nor oversold)

- MFI (Money Flow Index): 73.7, Overbought (Possible pullback ahead)

- ATR (Average True Range): 1.02, Volatility is moderate

These metrics suggest Applied Digital’s stock is currently firm but potentially ripe for a slight pullback from an overbought position.

4. Dividend & Returns: What Investors Receive

- Dividend Yield: N/A (Company has yet to pay any dividends)

- Stock Buybacks: None recently in the news

- Return on Investment: APLD outperformed the market year to date (+109.77%)

Applied Digital is intent on plowing profits into expansion, rather than paying dividends. This is typical of fast-growing technology firms.

5. Growth Potential: Future Outlook

The future growth strategy for Applied Digital is to increase AI computing capacity and further partnerships with cloud hosts and crypto-mining companies.

Drivers of Future Growth:

- AI & Machine Learning Boom: Increasing demand for AI processing power makes Applied Digital more appealing.

- Crypto Recovery: As cryptocurrency prices rebound, mining hardware demand will increase.

- Strategic Partnerships: Possible collaboration with large tech companies to drive cloud computing initiatives.

- New Data Centers: Geographic diversification would be a big contributor to top lines.

6. External Drivers of Stock Performance

- Economic Trends: Increased interest rates and inflation could impact technology stock prices.

- Industry Regulations: Cryptomining and AI computing are governed by the government, and this can affect Applied Digital’s business model.

- Institutional Investors: High institutional investment will generate price momentum.

7. Risk Factors: What Can Go Wrong?

- Market Risk: The stock is volatile, and Applied Digital is no exception.

- Financial Risk: The company has not yet become a break-even concern, thus continuous losses would make it funding issues.

- Regulatory Risks: Increased regulation of crypto mining and energy consumption could affect the company.

- Competitive Pressure: Amazon AWS and Google Cloud giants could decrease Applied Digital’s market share.

Applied Digital Stock Price Forecasts (2025-2030)

From prior records, financial performance, and industry growth trends, the following is Applied Digital’s forecasted stock price for the next five years:

| YEAR | STOCK PRICE PREDICTIONS ($) |

| 2025 | $13 |

| 2026 | $23 |

| 2027 | $33 |

| 2028 | $43 |

| 2029 | $53 |

| 2030 | $63 |

All these projections have been made keeping in view an aggressive growth trend and keeping in mind that the company will continue to grow the AI computing, crypto mining, and cloud storage businesses.

Frequently Asked Questions About Applied Digital Stock

1. Will Applied Digital’s s price keep on rising?

Applied Digital has positive growth prospects, but its future price movement will largely depend upon the overall economic climate and market conditions.

2. Is Applied Digital a good long-term investment opportunity?

Yes, assuming the company is able to implement its growth strategy and surf the wave of AI computing demand. Investors should, however, remain risk-conscious in the near term.

3. Why is the stock price of Applied Digital so volatile?

The shares are affected by the trend in cryptocurrency and AI markets, and this results in the incessant up and down in price.

4. Does Applied Digital pay dividends?

No, they are invested in growth and infrastructure development.

5. What are the greatest risks of investing in Applied Digital?

Unprofitability of the company, regulatory issues, and competitive risk by giant tech companies is a huge risk.

Conclusion: Is Investing in Applied Digital Worth It?

Applied Digital is a high-risk, high-reward stock. Its strength in momentum, AI computing expansion, and crypto infrastructure expansion make it a fantastic stock for long-term return-seeking investors.

While this is a wonderful stock for the right shareholder, because of the volatility and unpredictability of the technology sector, investors must diversify their holdings and keep an eye on Applied Digital’s well-being.