Coforge Share Price Target From 2025 to 2030

Coforge Share Price Target From 2025 to 2030: Coforge Limited is a top IT solutions provider globally with best-in-class strengths in digital transformation, cloud, artificial intelligence, and analytics. It offers solutions to various industries like banking, financial services, insurance, travel, healthcare, and government offices.

Leadership Team

- The organization is led by CEO Sudhir Singh, who played a key role in establishing Coforge as a market leader in the competitive IT services industry. Leadership through innovation and customer-centric solutions and market expansion.

Market Position & Competitors

- Coforge has a very competitive landscape with major IT services players like Tata Consultancy Services (TCS), Infosys, Wipro, and HCL Technologies. It has a very strong brand reputation for quality solution delivery and strategic relations with global blue-chip clients.

Company Size & Market Capitalization

- Market Cap: ₹51,232 crore

- Employees: Over 21,000 professionals across the world

- Industry P/E Ratio: 29.38 (Coforge’s P/E ratio is significantly higher at 66.14, indicating likely high growth.)

2. Financial Health: How Healthy Is It?

Revenue & Profit Growth

- Coforge has consistently grown its revenue and profit over the past five years. Its focus on high-margin digital solutions has fueled its growth.

Debt vs. Equity

- Debt-to-Equity Ratio: 0.18 (Low debt level shows healthiness of finances.)

Earnings Per Share (EPS)

- EPS (TTM): ₹115.83 (Healthy indication of profitability and growth.)

Cash Flow Analysis

- Coforge has healthy cash flows that generate the capacity to invest in expansion, acquisitions, and dividend payout.

Financial Statement Highlights

- Balance Sheet: Leverage asset base with negligible leverage.

- Income Statement: Steady revenue and profitability growth.

- Cash Flow Statement: Healthy operating cash flows to support business.

3. Share Price Performance: How Does It Behave?

Stock Trends

- 52-Week High: ₹10,026.80

- 52-Week Low: ₹4,287.25

- Current Price: ₹7,595.00 (+15.19% over one year)

Volatility & Technical Indicators

- Momentum Score: 47.4 (Neutral)

- MACD (12,26,9): -301.0 (Bearish signal)

- RSI (14): 35.4 (On the verge of entering oversold area)

- Day ROC(125): 21.5 (Reflects long-term strength)

The company has been recording an extremely high rising trend for years with insignificant corrections and hence is a good long-term investment option.

4. Dividends & Returns: What Do Investors Get?

- Dividend Yield: 0.92%

- Face Value: ₹10

- Book Value: ₹894.03

Coforge has been showing consistent dividend pay-out, indicating good financial health and shareholders’ return focus.

5. Growth Potential: What’s on the Horizon?

Expansion & New Markets

- Strategic expansion plans in Europe and North America.

- Increased emphasis on cloud and AI solutions.

Strategic Acquisitions

- Historically, the company has made strategic acquisitions of niche players to enhance its bouquet of offerings and increase its market reach.

Innovation & R&D

- The company spends huge amounts on research and development of new technologies like machine learning, automation, and cybersecurity.

6. External Factors: What Can Impact the Stock?

Economic & Industry Trends

- Higher IT spending across the world will be in favor of Coforge.

- Every industry is witnessing a growing demand for digital transformation.

Government Regulations

- The IT industry in India has pro-growth policies.

- Foreign data protection laws can impact business.

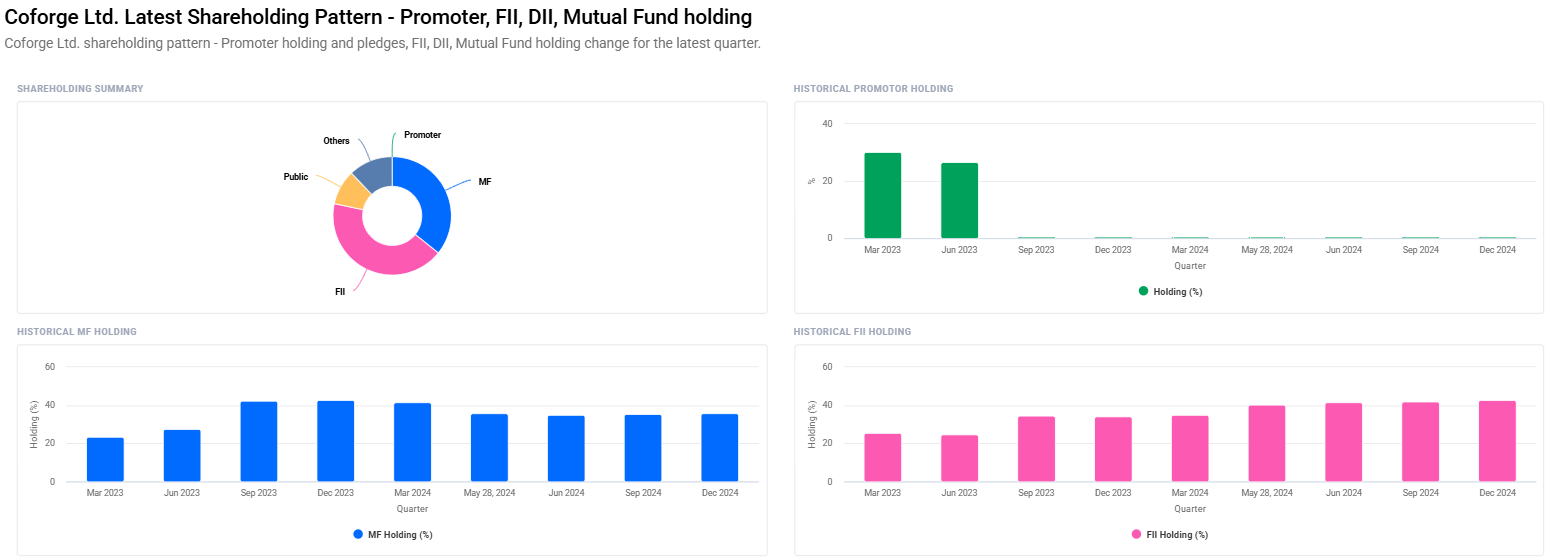

Institutional Investors

- Foreign Institutional Investors (FII): 42.55% (From 42.09%)

- Mutual Funds: 35.80% (From 35.52%)

- Institutional Holdings: 90.41%

Higher institutional buying is a ray of hope for the long-term scenario of Coforge.

7. Risk Factors: What Can Go Wrong?

- Market Volatility: Stock of the IT industry is volatile.

- Competition: Unexpected competition from industry majors.

- Global Recession: IT spending could be impacted by economic recession.

- Currency Fluctuations: As it is an international firm, exchange rate risk exists.

Coforge Share Price Target (2025-2030)

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹11000 |

| 2026 | ₹17000 |

| 2027 | ₹23000 |

| 2028 | ₹30000 |

| 2029 | ₹37000 |

| 2030 | ₹44000 |

The above targets are considered with Coforge’s revenue growth, industry trend, and technical trend.

Frequently Asked Questions (FAQs)

1. Is Coforge a good long-term bet?

Yes, Coforge has sound fundamentals, consistent revenue growth, and increasing institutional holding, and hence is a safe long-term investment.

2. What is Coforge’s price target for 2025?

Price target for 2025 is ₹11,000, calculated and determined by market trend.

3. Does Coforce provide dividends?

Yes, Coforge is a suitable dividend stock for income investors with dividend yield of 0.92%.

4. What are some of the issues that an investor should think of before investing in Coforge?

Issues which investors should have in mind are market risk, competition, global economy, and foreign exchange rate.

5. In what ways is Coforce different from the rest of the industry?

Coforce competes against Infosys, TCS, and Wipro. Coforce has remained focused on differntiator spaces like digital transformation, AI, and cloud that provide it a differential advantage.

6. What ought to be the Coforce year 2030 stock price?

It should be at ₹44,000 in 2030 based on good numbers and globalisation.

Final Thoughts

Coforge Limited is a value IT services player with a good growth history. Its increasing top line, strategic acquisition, and healthy institutional holding make it a long-term investment opportunity. Global economic conditions and market volatility must be remembered carefully before making an investment.