Diffusion Engineers Share Price Target From 2025 to 2030

Diffusion Engineers Share Price Target From 2025 to 2030: Diffusion Engineers Ltd. is a major engineering and manufacturing company with wear-resistant applications, welding alloys, and repair technology. It provides solutions for steel industries, power, rail, and mining and increases the efficiency and lifespan of industrial equipment.

Leadership & Market Position

- It has strong leadership committed to innovation and expansion strategies.

- Market Capitalization: ₹1.04K Cr (as of latest available data)

- Competitors: Certain other engineering companies like Ador Welding and Esab India are major competitors.

2. Financial Health: How Strong Is It?

It is essential to be aware of the financial position of Diffusion Engineers Ltd. in order to plan for the long term.

Revenue & Profit Trends

- Diffusion Engineers Ltd. has seen moderate revenue growth in the past five years.

- Company’s P/E ratio is 32.39, which shows moderate valuation compared to the industry P/E of 40.18.

Debt vs. Equity

- Debt-to-equity ratio: 0.18, showing good balance sheet with negligible reliance on debt.

Earnings Per Share (EPS)

- EPS (TTM): ₹8.53, showing sustained earnings generation.

Cash Flow

- The company has stable cash flow, showing stability in operations and future growth.

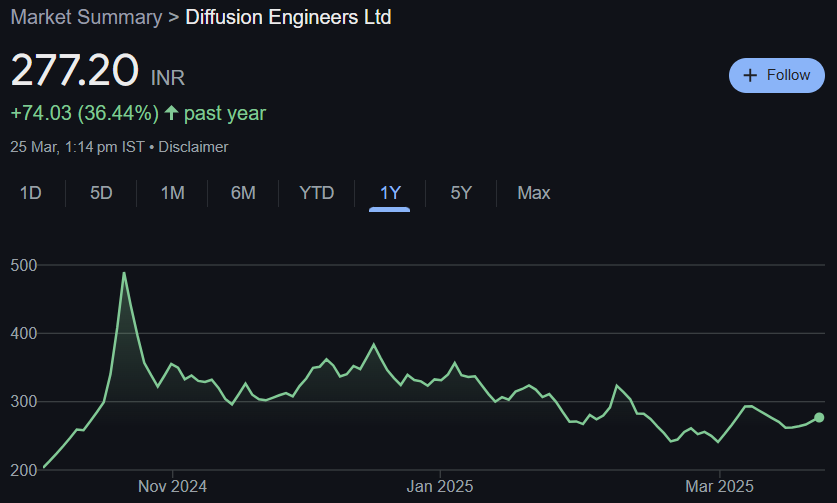

3. Stock Performance: How Does It Behave?

Diffusion Engineers Ltd. stock performance has been mixed, following market directions and industry growth.

Major Stock Information

- 52-week high: ₹489.96

- 52-week low: ₹193.05

- Current Price: ₹277.20

Technical Analysis

- RSI (14): 49.7 – The stock is neutral.

- MACD: -3.0 – A sign of bearishness.

- ADX: 12.6 – Reflects weak trend strength.

- MFI: 85.9 – Reflects overbought levels.

4. Dividends & Returns: What Do Investors Receive?

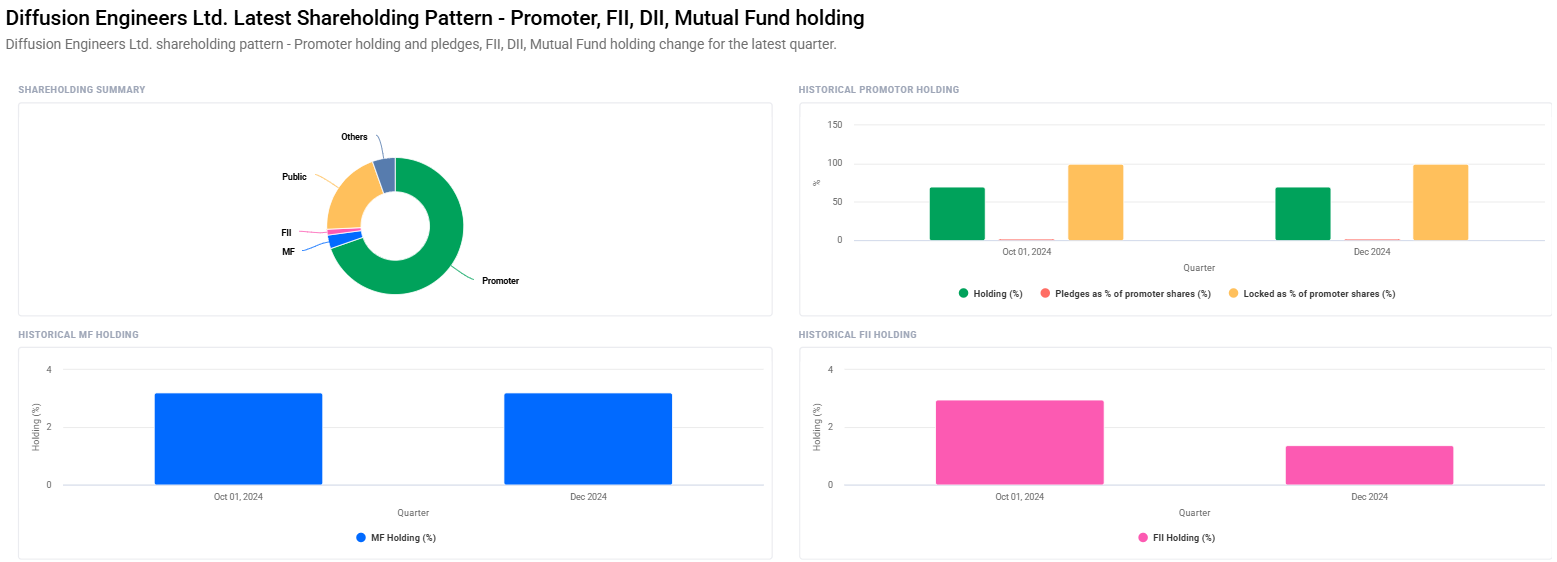

- Dividend Yield: 0.14% – Low dividend payout, suggesting reinvestment preference.

- Promoters’ Holding: 69.70% – Reflecting confidence in the firm.

- Retail & Others: 20.36% – Moderate retailing.

5. Growth Potential: What’s Next?

The firm is poised for growth, backed by:

- Emerging market expansion with high-end welding and engineering solutions.

- Possible mergers and acquisitions to cement its position.

- New technology adoption to boost operating efficiency.

Anticipated Share Price Targets (2025-2030)

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹500 |

| 2026 | ₹800 |

| 2027 | ₹1100 |

| 2028 | ₹1400 |

| 2029 | ₹1700 |

| 2030 | ₹2000 |

6. External Factors: What Can Affect the Stock?

There are a few variables that might influence Diffusion Engineers Ltd.’s share price performance:

- Economic Trends: Inflation and interest rates might impact industrial demand.

- Industry Rules: Manufacturing and welding technology policy changes might have an effect on business.

- Institutional Investors: Changes in big investor holding may have an impact on stock momentum.

7. Risk Factors: What Goes Wrong?

Investor risk evaluation prior to investing is necessary:

- Market Volatility: Global economic downturns may have an effect on share performance.

- Business Risks: Poor management decisions, falling demand, or inability to innovate.

- Regulatory Adjustments: Government regulations affecting the manufacturing industry.

- High Volatility: Fluctuation of prices from time to time may render it risky for short-term investors.

FAQs

1. Is Diffusion Engineers Ltd. a good investment in 2025-2030?

Yes, based on its financial health, growth prospects, and demand of the industry, it can be a good investment. However, investors should be cautious regarding market trends and risk factors.

2. Does the company pay dividends?

Yes, but with a low dividend yield (0.14%), which suggests a reinvestment policy.

3. How does it compare with the competition?

The P/E of the firm is below the industry average, which suggests undervaluation. But it is facing competition from industry giants such as Ador Welding and Esab India.

4. What should be the return anticipated from the stock in 2030?

Growth projections bring the stock to ₹2000 by 2030, if it continues growing steadily and the market remains good.

5. Do I invest now or wait?

As the stock is available at ₹277.20 currently, long-term investors can plan to enter step by step and keep an eye on technical indications to enhance entry points.

Investment in Diffusion Engineers Ltd. requires proper research and risk assessment. If the company keeps expanding, it can generate enormous returns by 2030.