IGIL Share Price Target From 2025 to 2030

IGIL Share Price Target From 2025 to 2030: International Gemmological Institute (India) Ltd. (IGIL) is a leading grading and certification company of diamonds, gemstones, and jewelry authenticity. It certifies individuals, retailers, and jewelers too, to provide quality assurance in gemstone trade.

Leadership and Management

The company is headed by a team of experienced finance and gemology professionals. Leadership emphasizes keeping international standards, establishing credibility and trust among consumers.

Market Size and Competitive Position

- Market Capitalization: ₹14,190 crore

- Industry: Gemstone grading and certification

- Competitors: GIA (Gemological Institute of America), HRD Antwerp, and local grading organizations.

IGIL has a competitive edge in the Indian marketplace with a strong leading market share position in jewellery grading services.

2. Financial Health: How Strong Is It?

Revenue & Profit Growth

IGIL has provided consistent revenue growth in the last five years. Increased acceptance among jewelers and retailers has driven higher profitability as well as profits.

Debt vs. Equity

- Debt-to-Equity Ratio: 0.14 (low debt, financial stability)

- It uses less debt and more equity, reducing the risk of financing.

Earnings Per Share (EPS)

- Current EPS (TTM): 9.89

- Industry P/E Ratio: 28.47

- IGIL P/E Ratio: 31.91 (suggests middle valuation)

Cash Flow and Liquidity

IGIL enjoys good cash flow, and in light of the strength of the same, it can finance operations, improve service, and pay shareholders.

3. Stock Performance: How Does It Perform?

Recent Stock Performance

- 52-Week High: ₹642.30

- 52-Week Low: ₹318.00

- Current Price: ₹328.00

The stock has fallen by -30.38% in the past one year, so it can be underpriced.

Volatility and Techno Trends

- RSI (14): 25.4 (Overbought and should increase)

- MACD: -46.0 (Bearish)

- ADX: 37.7 (Stock trending weakly)

4. Dividends & Returns: What Do Investors Get?

- Dividend Yield: 0.74%

- Regular Dividend Payments

- No recent stock buyback

IGIL is favourably compared to industry peers and offers stable returns, ideal for long-term investors.

5. Growth Potential: What’s Next?

Future Expansion Plans

- Expansion into new markets for gemstone certification

- Increased adoption of blockchain technology for digital certification

- Deeper collaborations with global jewelry brands

Potential Mergers & Acquisitions

- IGIL can acquire smaller certifying firms to enhance market dominance.

Expected IGIL Share Price Target From 2025 to 2030

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹650 |

| 2026 | ₹950 |

| 2027 | ₹1250 |

| 2028 | ₹1550 |

| 2029 | ₹1850 |

| 2030 | ₹2150 |

6. External Factors: What Can Affect the Stock?

Economic & Industry Trends

- Global monetary policy and inflation

- Growing demand in luxury segment for certified stones

- Government trade policy for import and export of jewelry

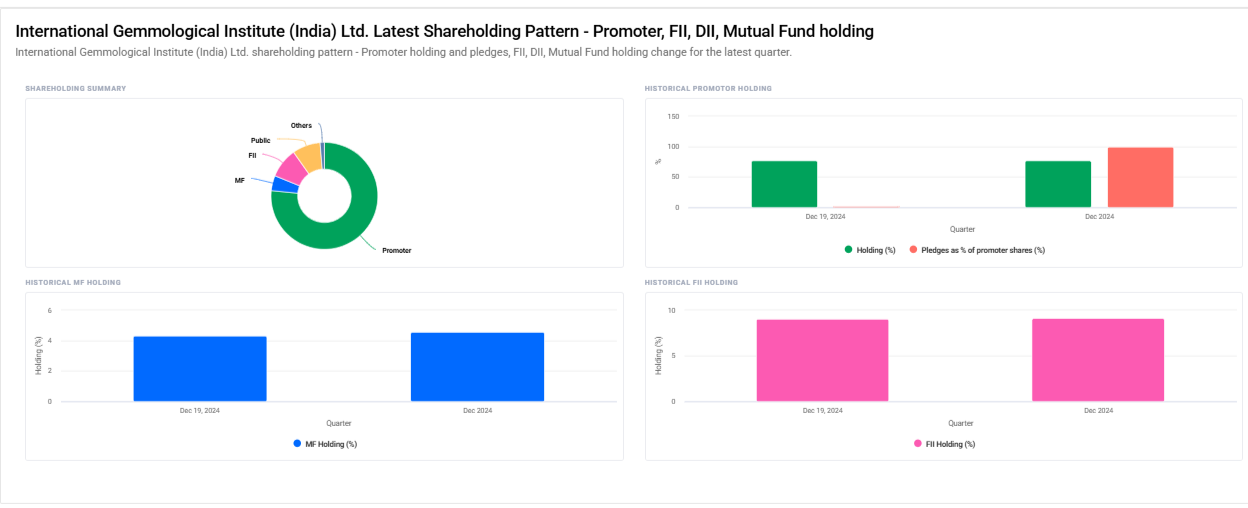

Institutional Investment Trends

- Promoters Hold: 78.55%

- Foreign Institutions: 9.10%

- Retail & Others: 8.47%

- Mutual Funds: 4.58%

- Other Domestic Institutions: 1.32%

Institutional investors believe in the long-term growth of the company.

7. Risk Factors: What May Go Wrong?

Market Risks

- Unprecedented volatility of the gemstone market

- Economic recessions affecting spending on luxuries

Business Risks

- Increased competition from global players

- Regulatory changes affecting certification procedures

Financial Risks

- Slumping revenues due to lower market demand

- Foreign exchange risks affecting foreign market sales

IGIL is a high performer in the gemstone certification industry with a healthy growth pattern. The company is currently undervalued and can rebound. Investors need to consider long-term potential and external market forces before investing.

Frequently Asked Questions (FAQs)

1. Is IGIL a good long-term stock to invest in?

Yes, because of its good fundamentals and growth pattern, IGIL is a good long-term investment.

2. Why has IGIL’s share price dropped in the last one year?

Market volatility and technical weakness are the causes of the drop, but the stock is strong.

3. What is the target price per share of IGIL in 2025?

The target price per share of IGIL in 2025 is ₹650.

4. Is IGIL paying dividends?

Yes, the dividend yield of IGIL is 0.74%.

5. What are the risks of investing in IGIL?

Volatility in the market, competition, and fluctuation in regulations are the key risks.

6. Why does IGIL compete with industry giants on what basis?

IGIL has a strong foothold in the Indian market and competes against global certification giants.

7. What will drive growth in IGIL’s share price?

Expansion in the market, usage of technology, and certified demand for stones will drive future growth.

Investors must conduct comprehensive research and examine market trends prior to investment.