IRB Infrastructure Share Price Target From 2025 to 2030

IRB Infrastructure Developers Ltd. is a top road infrastructure firm in India. The company develops highway construction, maintenance, and tolling on the Build-Operate-Transfer (BOT) and Hybrid Annuity Model (HAM) models. IRB plays a critical position in India’s infrastructure development chain with a portfolio of national highways, state highways, expressways, and urban roads.

Leadership Team

The organization is managed by Virendra D. Mhaiskar, the most critical force behind its growth and development. The highest management level includes highly experienced professionals with domain know-how in finance, project management, and construction.

Market Position

The organization is faced with competition from the industry giants of L&T Infrastructure, Dilip Buildcon, and Ashoka Buildcon. The organization is blessed with the benefit of taking up large infrastructure projects and having government orders on hand.

2. Financial Health: How Solid Is It?

Revenue & Profit Trends

- The company’s financials have seen consistent revenue growth in the last five years supported by effective project execution coupled with increasing collections of toll.

- Profitability was inconsistent, keeping in view business nature with huge capital expenditures.

Debt vs. Equity

- Debt-to-equity ratio: 1.35

- Regardless of high debt of IRB, the same is within affordable price given its cash flow steadiness from toll collections.

Key Financial Indicators

- Earnings Per Share (EPS): 10.69

- Return on Equity (ROE): 4.42%

- Dividend Yield: 0.63%

- Book Value per Share: 23.08

The firm receives consistent cash returns in terms of toll returns and thus remains financially sound irrespective of being debt-ridden.

3. Stock Performance: How Does It Act?

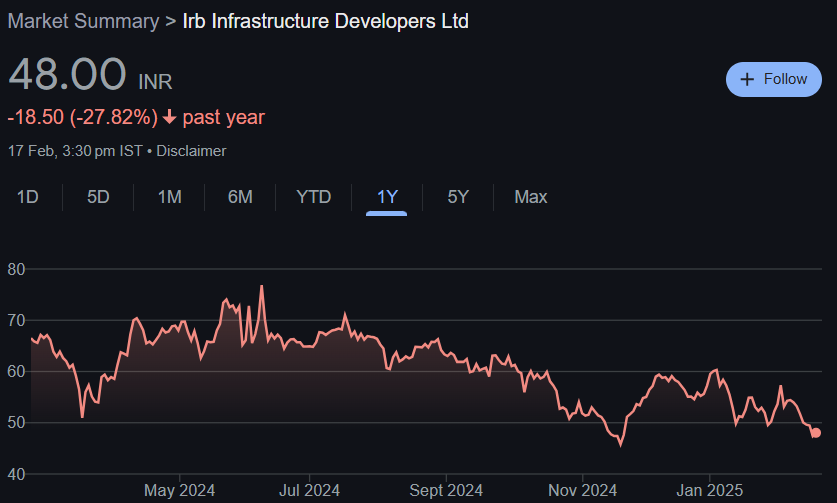

Recent Stock Trends

- 52-week high: ₹78.15

- 52-week low: ₹45.06

- Current price: ₹48.00

The stock has fallen for the last one year, losing 27.82%, reflecting negative investor sentiment. But that is a buying opportunity for long-term investors.

Technical Analysis

- RSI (14): 34.2 (Marginally oversold levels)

- MACD: -1.3 (Below signal line, reflecting bearish trend)

- Day Momentum Score: 27.1 (Technically weak)

- Rate of Change (ROC-21): -13.7 (Reflects downward momentum)

4. Dividends & Investor Returns

Dividend Policy

- Dividend Yield: 0.63%

- Dividend Payouts: Historically low as the company invests in projects.

Although dividend payments are not the attractant of an investor, IRB Infrastructure assures long-term investors potential capital gains.

5. Growth Potential: What’s Next?

Plans for Expansion

- Toll’s New Road Projects: IRB continues to secure mega road deals under government programs like Bharatmala Pariyojana.

- Heavy Order Book: A number of schemes in the pipeline, which offer revenue visibility.

- Government Support: Increased government spending on infrastructure is good for IRB’s long-term horizon.

Future Catalysts

- Increased traffic on highways enhancing toll revenue.

- Public-Private Partnerships (PPP) offering new avenues of growth.

- Airport infrastructure schemes diversification.

6. External Factors Impacting the Stock

Macroeconomic Factors

- Interest Rates: Increase in interest rates can impact project finance.

- Inflation: Increase in raw material prices can reduce profit margins.

- Government Policies: Change in toll policies or regulations can affect revenue.

Institutional Investor Activity

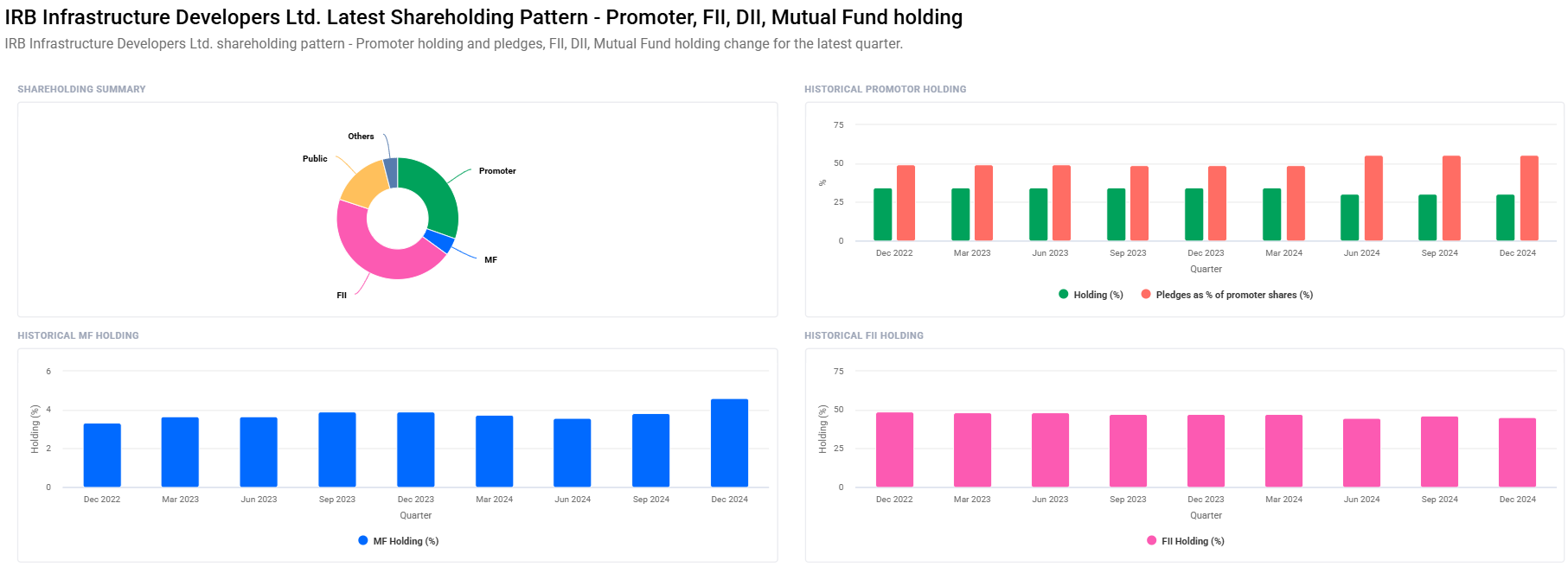

- Foreign Institutional Investors (FII): Down from 45.99% to 45.07%.

- Mutual Fund Holdings: Up from 3.84% to 4.61%.

- Promoter Holding: Unchanged at 30.42%, but pledged shares are high at 55.42%.

7. IRB Infrastructure Share Price Targets (2025-2030)

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹80 |

| 2026 | ₹110 |

| 2027 | ₹140 |

| 2028 | ₹170 |

| 2029 | ₹200 |

| 2030 | ₹230 |

Long-term is positive based on high government spending on infrastructure and revenue growth on toll plans.

8. Challenges & Risks For IRB Infrastructure Share Price

- Low Credit Ratings: IRB has high dependence on borrowings that could be bad in times when rates are high.

- Delayed Projects: Approval or acquittal of land can jeopardize project schedule timelines.

- Downward Swing Economy: Sluggish pace of business, a poor traveling environment may adversely impact profits.

FAQs For IRB Infrastructure Share Price

1. Is IRB Infrastructure a good long-term investment stock?

Yes, with infrastructure development being a thrust area for India, IRB has favorable long-term growth potential. But investors should be careful about debt and volatility.

2. Why did the IRB Infrastructure stock decline recently?

The stock has been under selling pressure due to high debt, weak technicals, and general market sentiment. But long-term investors may believe this is the entry point.

3. Does IRB Infrastructure offer dividends?

Yes, low dividends since the company is investing most of the returns in expansion.

4. What is IRB Infrastructure’s target share price in 2025?

IRB Infrastructure will focus on around ₹80 in 2025, supported by increasing toll collections and infra opportunities.

5. How is IRB Infrastructure performing relative to its peers?

IRB’s closest competitor is presented by L&T Infrastructure and Ashoka Buildcon. Its top-line growth is comforting while its increased leverage is a worry.

6. What are the most critical drivers of IRB’s share price?

- Government policy on infrastructure

- Trend in toll collections

- Interest rates/inflation

- Debt levels and institutional investor purchases

7. Is pledged promoter share a concern for an investor?

Yes, 55.42% of the promoter shareholding is pledged, and it can be detrimental if the company is financially struggling. But if the increase in revenues is not affected, then the damage would be contained.

8. What will be the IRB Infrastructure’s three-year share price target?

By 2030, the share will rise to ₹230 due to India’s thriving infrastructure industry and increasing toll revenues.

IRB Infrastructure Developers Ltd. ranks among the leading drivers of infrastructure growth in India with sufficient support from the government and order book. Even granting that debt would be a concern, the company’s long-term growth prospects and hence the appeal to patient investors on a 2025-2030 horizon make the firm a sound investment.