MCX Share Price Target From 2025 to 2030

MCX is short for Multi Commodity Exchange of India Ltd. MCX is India’s leading commodity derivatives exchange. MCX provides trading in a variety of commodity derivatives like metals, energy, and agri commodities. MCX provides price discovery and trade, industry, and investor risk management.

Leadership and Management

- MCX possesses deep leadership experience and rich exposure to the financial markets and commodity trade. The board of directors and CEO have fostered compliance, innovation, and market development.

Market Position

- Market Capitalization: INR 28,474 Crore

- Industry Competitors: National Commodity & Derivatives Exchange (NCDEX), Indian Commodity Exchange (ICEX)

- Competitive Advantage: Biggest commodity exchange in India, strong technology infrastructure, and regulatory compliance

2. Financial Health: How Strong Is It?

Key Financial Indicators (Recent Figures)

- Revenue & Profit Growth: Five-year consistent revenue growth

- Debt to Equity Ratio: 0.00 (Zero debt company with good financials)

- Earnings Per Share (EPS): INR 100.48 (Indicates consistent profitability)

- Return on Equity (ROE): 21.90% (High return to equity shareholders)

- Dividend Yield: 0.14% (Low, indicating consistent dividends)

Key Reports:

- Balance Sheet: Good asset base with zero debt

- Income Statement: Consistent revenue and net profit growth

- Cash Flow Statement: Sufficient cash surplus and operating cash inflow

3. Stock Performance: How Does It Behave?

Current Figures in the Stock

- Open: INR 5,670.00

- High: INR 5,775.10

- Low: INR 5,500.45

- Market Cap: INR 28,474 Cr

- P/E Ratio: 55.57 (High, but fine for growth opportunities)

- 52-Week High: INR 7,048.60

- 52-Week Low: INR 2,917.85

- Volume of Shares Trading: 3,16,241 shares

Technical Analysis

- Momentum Score: 52.8 (Neutral)

- MACD: -92.4 (Indications of bear trend)

- RSI: 45.7 (Neutral, not overbought or oversold)

- ADX: 24.1 (Indications of weak strength of trend)

- ROC (21 Days): -2.6 (Weakly bearish)

- ATR: 243.5 (Proportional to volatility of stock)

4. Dividends & Returns: What Do Investors Get?

- Dividend Yield: 0.14% (Low & consistent)

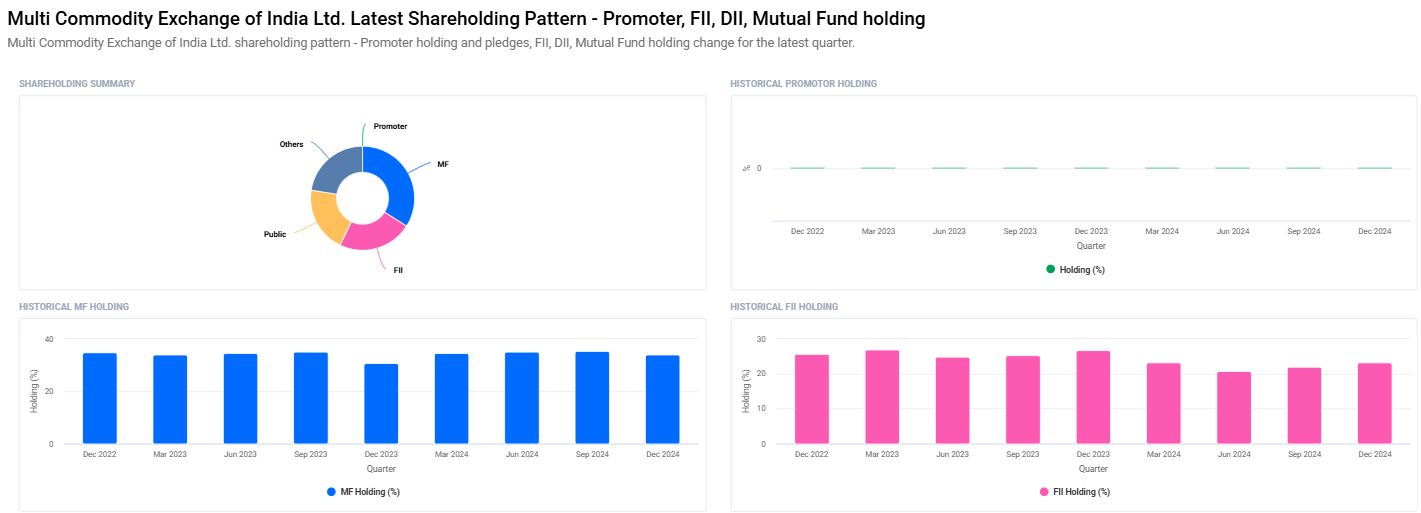

- Mutual Funds: 34.00%

- Foreign Institutional Investors (FII/FPI): 23.13%

- Other Domestic Institutions: 22.27%

- Retail & Others: 20.61%

5. Growth Potential: What’s the Future?

- New Product Launches: Launch of recently emerging products of commodity derivatives

- Market Expansion: Increasing institutional investor participation

- Digital Transformation: AI & blockchain convergence to fuel trading infrastructure

- Global Partnerships: Cross-border trade exchange collaborations

6. External Factors: What can affect the stock?

- Economic Trends: Commodity price volatility, interest rate fluctuations, and inflation

- Regulatory Changes: Regulation of trading commodity derivatives by SEBI

- Institutional Buying & Selling: Fluctuation in FII/MF holding leads to stock prices

- Global Market Trends: Global demand for gold, silver, and crude oil commodities

7. Risk Factors: What Can Go Wrong?

- Market Volatility: Fluctuation in the commodity market affects trading volumes

- Regulatory Risks: Excessive SEBI regulation is a hindrance

- Technological Disruptions: Cyberattacks and technical faults

- Competition: Growing competition from other exchanges

MCX Share Price Target (2025-2030)

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹7100 |

| 2026 | ₹11100 |

| 2027 | ₹15100 |

| 2028 | ₹19100 |

| 2029 | ₹23100 |

| 2030 | ₹27100 |

FAQs For MCX Share Price

1. Is MCX a good long-term investment?

Yes, MCX is debt-free, financially robust, and has leadership in the commodity exchange business, so it is a good long-term investment.

2. Why is MCX’s P/E ratio high?

MCX is a niche segment with high growth potential, so it will have a premium P/E compared to traditional stock exchanges.

3. What are the external factors which can cause MCX share price to fluctuate?

MCX share price is extremely sensitive to world commodity prices, economic mood, SEBI policies, and institutional investor sentiment.

4. Is MCX paying dividend?

Yes, but in the prudent form of dividend yield of 0.14% because the company is inclined towards investment and expansion instead of giving a high dividend.

5. What are the risks involved in investing with MCX?

Market. volatility, regulatory overhaul, and technology disruption are some of the risks to MCX investors.

6. How is MCX unique from the other exchanges?

MCX is India’s biggest commodity exchange with a gargantuan market share, but still, it has its competitors in NCDEX and ICEX.

7. What do technical indicators suggest in relation to MCX’s share?

MCX is presently in a neutral trend with its momentum reading at 52.8, i.e., neither overbought nor oversold.

8. Institutional investor sentiment towards MCX?

Institutional investors hold nearly 79.40% of MCX shares, reflecting their faith in its long-term future.

9. Will MCX share price touch INR 27,000 in 2030?

As per growth estimates and accounting, INR 27,000 is a realizable goal if the firm remains market leader and launches product offerings.

10. What investors are waiting for in the future growth of MCX?

The investors should observe the volumes in the world of trading, releases from the regulators, and earnings to establish the long-term future of MCX.

MCX continues to be a big player in the commodity trading landscape of India with huge growth potential. While risks always exist, its strong fundamentals, absence of any debt, and planned strategic expansion in the pipeline make it a good long-term investment opportunity. Always research well and keep an eye on market trends before investing.