NBCC Share Price Target From 2025 to 2030

NBCC Share Price Target From 2025 to 2030: NBCC (India) Ltd., previously known as National Buildings Construction Corporation, is a housing ministry, urban affairs, public sector undertaking. It provides project management consultancy, real estate development, and engineering procurement & construction (EPC) services. NBCC has a market capitalization of approximately ₹21,803 crore and is among the largest players in India’s infrastructure and urban development.

It is spearheaded by a seasoned management with a focus on sustainability and innovation. It faces competition from other infrastructure and construction companies such as L&T, IRCON, and NCC Ltd.

Financial Health and Performance

Revenue & Profitability

NBCC has delivered steady revenue growth in the past five years driven largely by government orders and real estate development. Volatility in the infrastructure sector and regulatory policy have affected its margins, however.

- Market Cap: ₹21,803 crore

- P/E Ratio (TTM): 43.41

- Industry P/E: 28.15

- Return on Capital (ROC): 23.85%

- EPS (TTM): ₹1.88

- Book Value: ₹8.88

Debt vs. Equity

- NBCC doesn’t have debt, and in an industry starved of capital, that is a huge plus. Its balance sheet is in good shape to allow it to invest in growth without cutting back on pennies.

Cash Flow and Sustainability

- Its liquidity position is strong thanks to government scheme support. Its ability to finance the business at low levels of borrowings is in the best interest of long-term investors.

Stock Performance and Technical Analysis

Current Market Trends

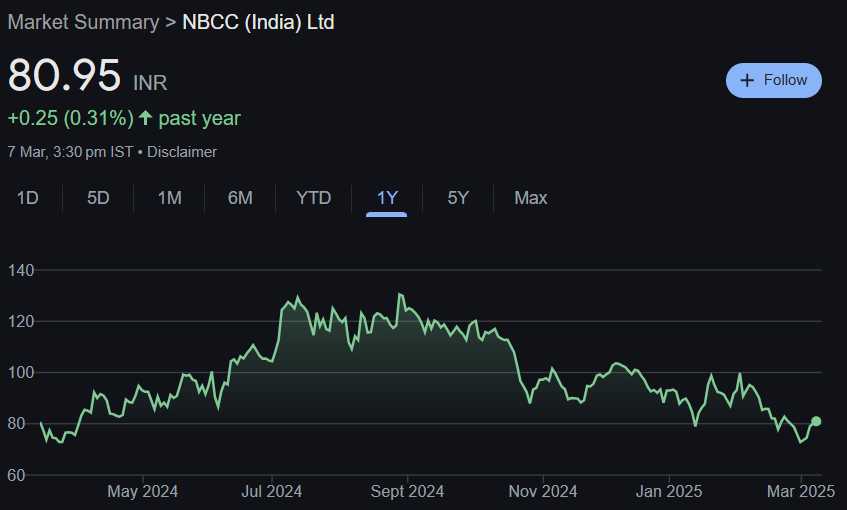

- Opening Price: ₹80.19

- 52-Week High: ₹139.83

- 52-Week Low: ₹70.07

- Dividend Yield: 0.52%

- Promoter Holding: 61.75%

- Foreign Institutional Investors (FII): 4.15%

- Mutual Fund Holdings: 3.30%

Technical Indicators

- Momentum Score: 34.7 (Technically weak)

- MACD: -3.2 (Bearish signal)

- RSI: 46.6 (Neutral)

- ADX: 22.2 (Weak trend strength)

- MFI: 51.6 (Neutral)

NBCC Share Price Targets (2025-2030)

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹150 |

| 2026 | ₹220 |

| 2027 | ₹300 |

| 2028 | ₹380 |

| 2029 | ₹460 |

| 2030 | ₹550 |

Growth Potential and Future Outlook

Expansion Plans

- NBCC is launching new projects in full swing in India, particularly smart city projects, affordable housing, and commercial infrastructure. It is also laying emphasis on opportunities overseas.

Government Policies

- Being a part of government housing and urban development programs, NBCC has the thrust policies like Smart Cities Mission, PMAY, and investment in infrastructure.

Innovation and Sustainability

- NBCC is adopting green building technology, virtual project management, and sustainable infrastructure practices, keeping pace with international standards with maximum efficiency.

Risk Factors to be Evaluated

- Market Risk: Industry stock market trend and economic downtrends pose the risk of affecting share prices.

- Regulatory Issues: State regulations and litigations in courts can slow down projects.

- Competitive Risk: Competing companies with favorable funding support can disrupt the market leadership of NBCC.

- Operational Slippage: Official approval and availability problems can postpone project schedules.

FAQs For NBCC Share Price

1. Is NBCC a good long-term investment?

NBCC’s government backing, order book, and absence of debt are making it a good long-term investment, but one has to keep the risks in the market in mind.

2. What is the 2025 NBCC share price?

The analysts are providing a target price of ₹150 in 2025, due to growth and demand for infrastructure.

3. Does NBCC issue dividends?

Yes, NBCC pays a dividend of approximately 0.52% and therefore provides an average-of-the-pack opportunity for dividend yield investors.

4. What will drive growth for NBCC?

Urban development plans, government mandates, and diversification into new sectors will propel the growth.

5. Should I buy NBCC stock today?

Investors might consider technicals, direction in the market, and risk considerations before acting.

NBCC is one of the largest strengths in India’s infrastructure space with good fundamentals and rational growth prospects. Investors should take a serious research and keep market conditions in sight before investing