Paras Defence And Space Share Price Target From 2025 to 2030

Paras Defence And Space Share Price Target From 2025 to 2030: Paras Defence and Space Technologies Ltd. Is a famous Indian area and defence era organization. The employer is worried inside the designing, growing, and manufacturing contemporary defence electronics, optoelectronics, and area-based totally technology for Indian defence companies, area studies centers, and international defence companies.

Company Overview

- Industry: Defence & Space Technology

- Market Cap: ₹3,629 Cr

- P/E Ratio: 67.57

- P/B Ratio: 6.41

- Debt-to-Equity Ratio: 0.15

- ROE: 9.59%

- EPS (TTM): Not to be had

- Book Value: ₹140.55

Leadership and Competitive Position

Paras Defence enjoys an skilled management, that’s actively engaged in research and development. With India growing its defence and area spending dedication, Paras Defence can look ahead to getting advantages from government orders as well as from plans of privatization.

Financial Health and Performance

Paras Defence has reported accurate increase over the past three years. With increasing marketplace capitalization, the company is still very volatile. Some of the sizeable monetary highlights are furnished below:

- Revenue Growth: The organisation has been reporting steady revenue increase with government orders and growing defence technology call for.

- Debt Management: The 0.15 debt-to-fairness ratio shows that the employer is having properly manipulate over borrowed price range and fairness financing.

- Profitability: Though the Return on Equity (ROE) is average at 9.59%, the destiny incomes capability of the company is good given its strategic positioning in a excessive-worrying sector.

- Stock Volatility: The stock has been risky with a 52-week excessive of ₹1,592.70 and a 52-week low of ₹610.00.

Paras Defence And Space Share Price Performance Analysis

Technical Indicators

- Momentum Score: 27.2 (Weak technical strength)

- MACD (12, 26, 9): -40.4 (Strong bearish signal)

- ADX: 14.8 (Weak trend strength)

- RSI (14): 38.9 (Not oversold but vulnerable momentum)

- MFI: 57.8 (Neutral liquidity energy)

- ATR: 58.6 (High charge variations)

- ROC (125): -30.1 (Negative lengthy-term momentum)

Despite quick-term technical weaknesses, the inventory has lengthy-time period growth possibilities due to the rise in authorities investments in the defence industry.

Paras Defence Share Price Target from 2025 to 2030

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹1600 |

| 2026 | ₹2600 |

| 2027 | ₹3600 |

| 2028 | ₹4600 |

| 2029 | ₹5600 |

| 2030 | ₹6600 |

The Paras Defence And Space Share Price is predicted to peer substantial growth, propelled by using growing defence budgets, cutting-edge technological collaborations, and government policies encouraging indigenous defence manufacturing.

Growth drivers For Paras Defence And Space Share Price

1. Government Orders and Defence Expenditure

- India’s push for defence production indigenisation in its ‘Make in India’ initiative.

- Increased spending on space and satellite packages.

- Satisfactory order book from defence businesses which includes DRDO and ISRO.

2. Growth and Innovation

- Investment in studies and development.

- Launch of defence electronics and aerospace answers products.

- Partnership with foreign defence contractors.

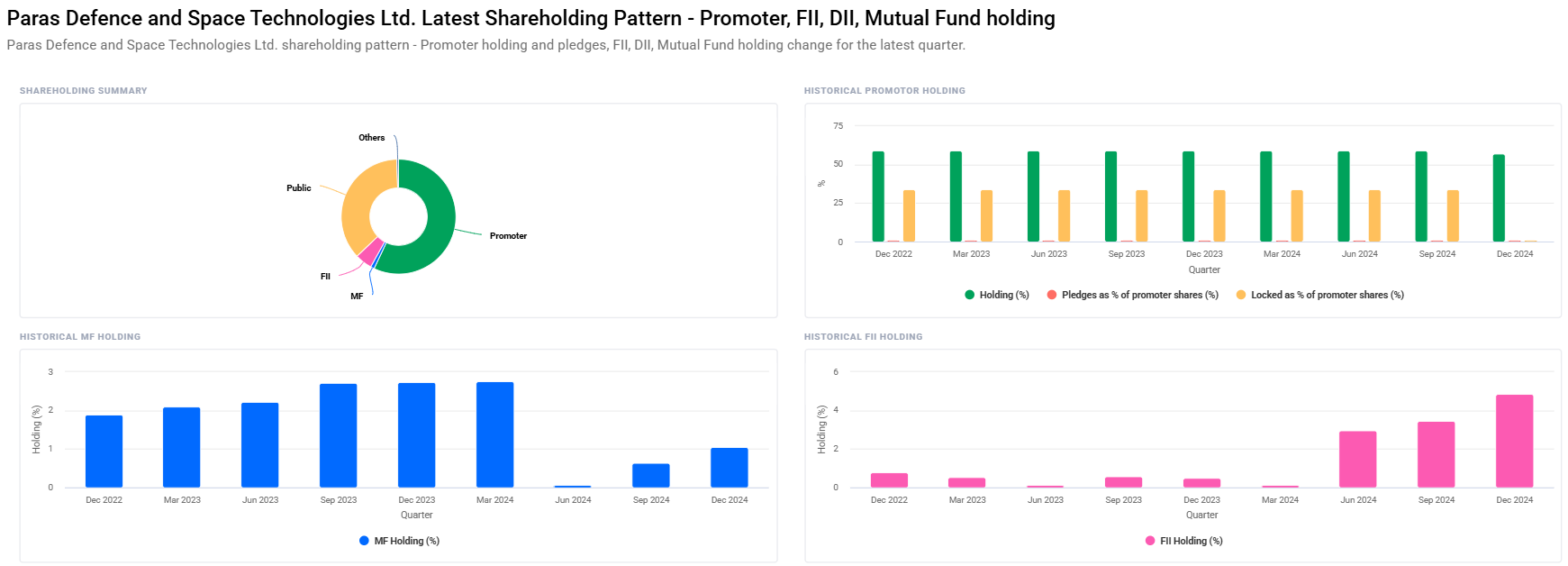

3. Institutional and Retail Investors

- Institutional preserving rose to 6.32% from 4.09%.

- Mutual price range also improved their protecting, indicating that they’ve an increasing confidence inside the business enterprise.

Risk Factors to Keep in Mind

- Market Volatility: High charge volatility history has been recorded via the organization.

- Competitive Landscape: Extremely excessive opposition from different defence agencies domestic as well as international.

- Regulatory Issues: Defence and space industries are highly regulated, with policy changes impacting business enterprise operations.

- Macroeconomic Factors: Economic downturns, geopolitical tensions, and inflation degrees can influence inventory overall performance.

FAQs For Paras Defence And Space Share Price

1. Is Paras Defence a terrific lengthy-term funding?

Yes, as a result of its publicity to defence and area technologies, that are boom industries, and rising authorities support for indigenous production.

2. Why is the inventory so risky?

Paras Defence is a gap participant and its shares may be driven by way of defence orders, government rules, and geopolitical activity.

3. Does Paras Defence offer dividends?

No, as the company is not but providing dividends, however employing income in growth and enlargement.

4. What are the important thing drivers of inventory appreciation?

Government contracts, R&D milestones, growth in defence budgets, and strategic collaborations with foreign companions.

5. What do investors need to be careful approximately?

Stock volatility, regulatory risks, and opposition in the defence industry.

Paras Defence and Space Technologies Ltd. Is probable to enjoy foremost boom inside the following couple of years. Although the stock can enjoy brief-term volatility, its long-term potentialities are shiny due to growing authorities defence expenditure and the development of era. Investors searching for lengthy-time period returns in the defence industry must make this stock considered one of their portfolio diversification choices.