Patel Engineering Share Price Target From 2025 to 2030

Patel Engineering Share Price Target From 2025 to 2030: Patel Engineering Ltd. was established in 1949 and has since been the backbone of India’s infrastructure development. Patel Engineering is a market leading company with a market capitalization of ₹3,623 crore. The company is engaged in special niches such as hydroelectric project, tunnels, dams, and real estate and is known for its use of complex construction processes.

The firm diversified its project portfolio during the past seventy years to cover various types of infrastructure projects. From highway and bridge construction projects to township and real estate development projects, the firm has been diversified. Its operationally excellent and value-driven management by Managing Director Kavita Shirvaikar has been successful. Innovation and quality have been the drivers for them, and because of this, the firm is placed in the competitive market.

Financial Well-being

A five-year view of the financial record of Patel Engineering provides an insight into growth and resilience. It has reported a consolidated net profit of ₹140.35 crore for the year ended March 2024, up 78% from the previous year. This has been supported by a revenue increase of 11% to ₹1,343.18 crore over the same period. Its debt equity ratio stands at 0.40, and there is conservative leverage and excessive dependence on borrowing. Its share earnings have also been on the rise, and the recent rise was a 3.85% year-on-year rise, which is proof of growing profitability and return to shareholders. The company’s positive cash flow also serves to improve the capacity of the company to fund operations and invest in future growth plans.

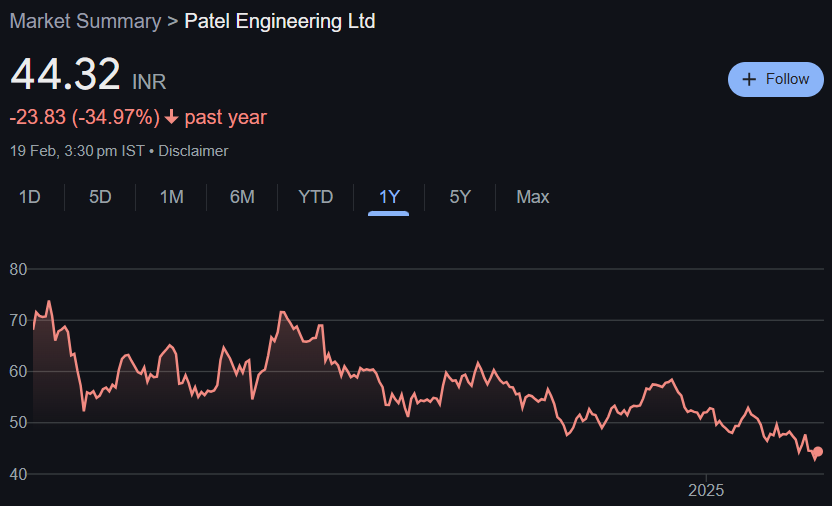

Stock Performance

The 12-month stock performance of Patel Engineering has been volatile. Its 52-week high was ₹75.00, while its low was as much as ₹42.60. On the last available data, the stock had opened at ₹43.00, and its high had reached ₹44.65 with a low of ₹42.80 on the day. Price-to-Earnings (P/E) is 12.48, lower than the industry average P/E of 25.89, and can also be a sign of undervaluation. The technicals have been polarizing:

- Momentum Score: 27.6, technical weakness.

- MACD: Bearish interpretation of -1.6.

- RSI: 34.5, at oversold levels.

These are the types of levels that will control short-term investors but may vary for longer trends based on market and company conditions.

Dividends and Returns

No dividends are paid by Patel Engineering at present, with a dividend yield of 0.00% being evidence. No dividends are being paid by the company, and that probably indicates they are reinvesting profits in growth and expansion projects. While this strategy does result in capital appreciation, long-term investors can do without being swayed by the desire for income in the short term.

Growth Potential

Patel Engineering’s robust order book of ₹18,663 crore as of March 31, 2024, reflects a healthy project pipeline. Company’s focus strategy in hydroelectric projects, tunnels, and underground enables it to benefit from India’s push in infrastructure development. Moreover, the management’s focus on cost control and operational efficiency will enhance profitability further. Though there is no word on product launch or acquisition, the firm’s current pipeline of projects and sector knowledge signal a robust growth trend.

External Factors

A couple of external factors would have the potential to affect the performance of Patel Engineering:

- Economic Trends: Economic trends in terms of interest rates and inflation may affect project prices and funding.

- Industry Trends: Industry trends such as regulatory and technological changes may affect operating dynamics.

- Government Policies: Government development and funding schemes can be opportunities or threats.

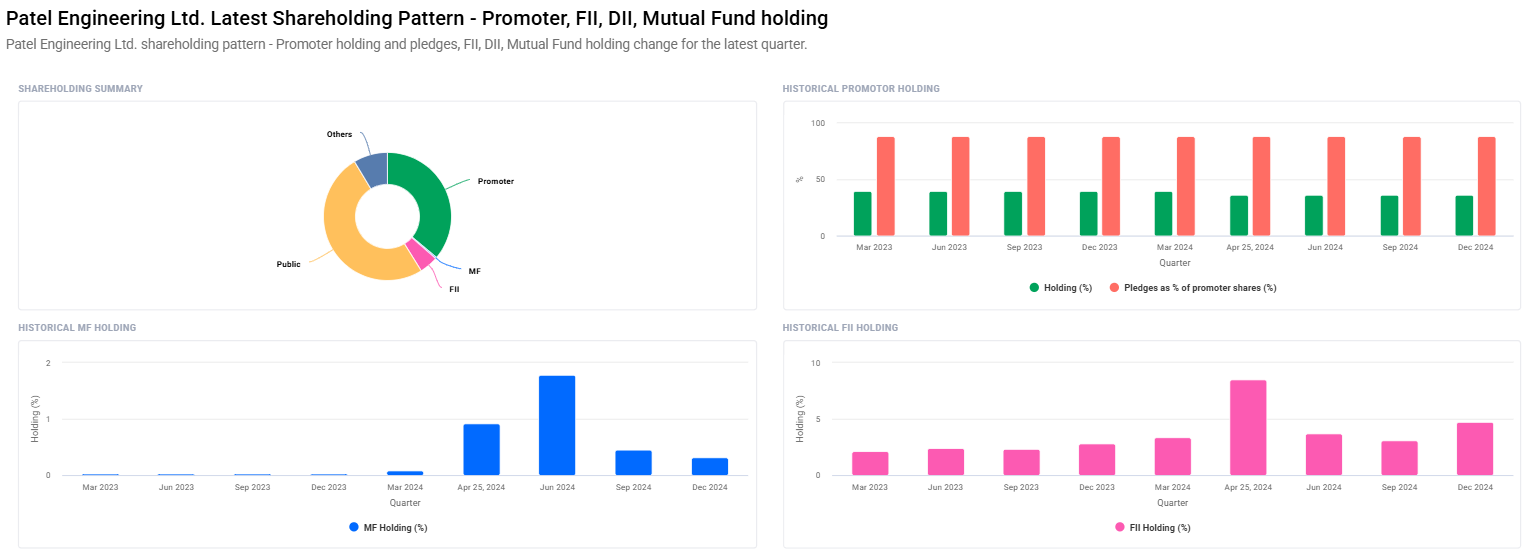

- Institutional Investors: Foreign Institutional Investors (FIIs) of 3.09% to 4.74% for the December quarter is an indication of increasing optimism regarding the company’s future.

Risk Factors

Investors should be careful to watch out for potential threats:

- Market Risk: General stock market fluctuation affects share prices.

- Business Risk: Project delays or cost escalations will affect profitability.

- Financial Risk: Despite a favorable debt-to-equity ratio, high growth in debt will be difficult.

- Political/Global Risk: Business influence can be there due to geopolitics or inadequate policy reforms.

Patel Engineering Share Price Targets (2025-2030)

Patel Engineering’s share price targets based on available financial inputs, market mood, and the expected growth prospect for the future are as follows:

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹80 |

| 2026 | ₹115 |

| 2027 | ₹150 |

| 2028 | ₹185 |

| 2029 | ₹220 |

| 2030 | ₹260 |

These estimates have been made taking into account revenue growth, stringent cost controls, and positive market conditions. The investors have to make a personal choice after doing personal research on the market conditions.

Frequently Asked Questions (FAQs) For Patel Engineering Share Price

What is the business that Patel Engineering Ltd. is engaged in?

The business activities of Patel Engineering include infrastructure projects like dams, tunnels, hydroelectric projects, highways, bridges, and real estate development.

Who is the Managing Director of Patel Engineering?

It is led by Managing Director Kavita Shirvaikar, with an emphasis on operational efficiency and shareholder value.

How healthy in terms of cash is Patel Engineering today?

Patel Engineering has recorded a net profit of ₹140.35 crore, 78% up year-on-year, on sales of ₹1,343.18 crore. The debt-equity ratio of 0.40 of the company is reassuring, indicating sound finances.

Is Patel Engineering a good bet to invest in?

Patel Engineering has a strong order book of ₹18,663 crore with rising growth trend. The investors must consider market volatility, risk of project implementation, and economy while making an investment decision.

What are the risks involved in investing in Patel Engineering?

Market risks, risk of project implementation, leverage of funds, and government policies affect share performance. The investors must consider these factors.

Does Patel Engineering pay dividend?

Patel Engineering never paid any dividend till date, thus reinvests for growth.

What is the long term target price of Patel Engineering shares?

Shares are likely to reach ₹260 in 2030, provided consistent growth in revenue and positive market.

Patel Engineering Ltd. is a solid performer in India’s infrastructure space with a reasonable project pipeline and improved finances. Short-term volatility is unavoidable, but long-term investors can potentially weather the company’s steady growth. Investors must try to do some serious research and look at market trends before making any move.