Reliance Industries Share Price Target From 2025 to 2030

Reliance Industries Share Price Target From 2025 to 2030: Reliance Industries Limited (RIL) is India’s largest diversified business interest conglomerate and the market leader in oil and gas, telecom, retail, and digital services. This article is a comprehensive review of RIL’s financial well-being, stock performance, growth prospects, risk factor, and stock price target expectations for 2025-2030.

What Does the Company Do?

Reliance Industries has business presence in industries:

- Oil & Gas: Refining, petrochemical, and exploration

- Telecommunications: Jio, India’s largest telecom operator

- Retail: Reliance Retail, India’s largest retail chain

- Digital Services: Jio Platforms for internet and content streaming

- Green Energy: New greenfield investments in solar and hydrogen energy

Leadership Team

- Mukesh Ambani: Chairman and Managing Director

- Isha Ambani, Akash Ambani, and Anant Ambani: Next-gen leadership key members

Market Capitalization

- 16.23 lakh crore INR (as of latest available data)

- Among India’s market cap leaders

Competitive Position

- Key Competitors: Adani Group, Tata Group, Bharti Airtel (telecom), BPCL, and HPCL (oil and gas)

- Market Leadership: Leadership in a number of industries with consistent revenue streams

2. Financial Health: How Strong Is It?

Revenue & Profit

- Growth in last 5 Years: Reliance has consistently increased revenues and profits from each business segment.

- Earnings Per Share (EPS): 51.13 INR (TTM), reflecting healthy profitability.

Debt vs. Equity

- Debt-to-Equity Ratio: 0.44, reflecting moderate debt burden on Reliance.

- Cash Flow Strength: Strong operationally driven cash flow for growth and investment.

Key Financial Reports

- Balance Sheet: High asset base with high liquidity.

- Income Statement: Consistent revenue growth from various business segments.

- Cash Flow Statement: Strong positive cash flow, supporting expansion in new businesses.

3. Stock Performance: How Does It Perform?

Recent Stock Performance

- 52-Week High: 1,608.80 INR

- 52-Week Low: 1,193.30 INR

- Current Price: 1,202.00 INR

Technical Indicators

- RSI (14): 36.2 (weak but not oversold)

- MACD: -12.8 (extremely strong bearish signal)

- ADX: 22.5 (weak momentum)

- MFI: 25.9 (shows possibility of reversal)

4. Dividends & Returns: What Do Shareholders Receive?

- Dividend Yield: 0.42% (low but stable)

- Stock Buybacks: Implemented from time to time to uphold investor sentiment.

- Return on Equity (ROE): 8.29% (average return)

5. Growth Potential: What Lies Ahead?

New Developments

- Renewable Energy Expansion: Enormous investment in green power and hydrogen fuel.

- Jio 5G Rollout: 5G network rollout for telecom leadership.

- Retail Expansion: E-commerce growth and offline penetration.

- Mergers & Acquisitions: Strategic collaborations in digital and energy ventures.

Global Expansion

- USA & Middle East: Expansion of the petrochemical business.

- Southeast Asia & Africa: Expansion of telecom and retail presence.

6. External Factors: What Can Drive the Stock?

Economic Trends

- Inflation & Interest Rates: Increasing interest rates affect borrowing expense.

- Crude Oil Prices: Impacts Reliance’s refining and petrochemical business.

Industry Trends

- Telecom Industry Growth: Rising usage of data is in Jio’s favor.

- Clean Energy Push: Clean energy investment worldwide is in the pipeline of RIL’s new investments.

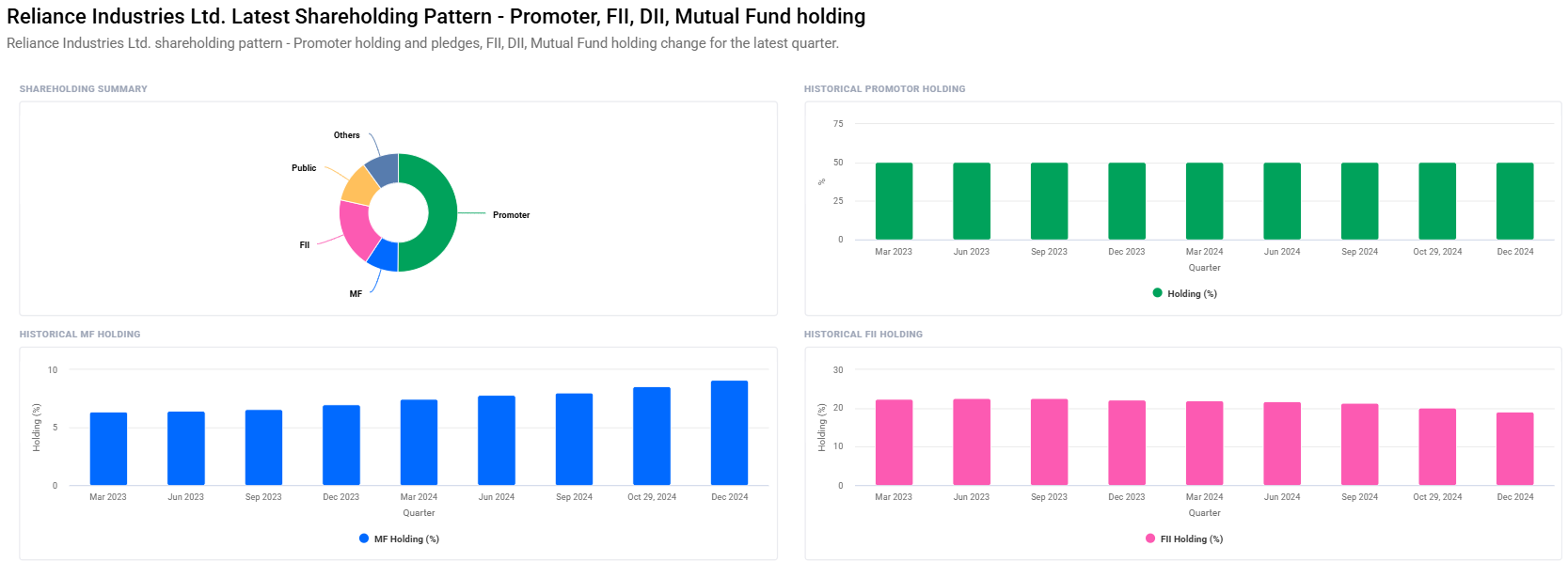

Action by Institutional Investors

- Royalty Holders: 50.13% (short of 50.24%)

- Foreign Institutional Investors (FIIs): Reduced holding from 21.30% to 19.16%

- Mutual Funds: Raised holding from 8.03% to 9.14%

7. Risk Factors: What Can Go Wrong?

- Market Risk: Slumps in global economies can affect stock price.

- Business Risk: Any serious operating failure or regulatory challenge can damage revenue.

- Financial Risk: High debt would be a concern if top-line growth decelerates.

- Political Risk: The policies of the government could affect telecom and energy businesses.

8. Share Price Target Forecast (2025-2030)

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹1650 |

| 2026 | ₹2050 |

| 2027 | ₹2450 |

| 2028 | ₹2850 |

| 2029 | ₹3250 |

| 2030 | ₹3650 |

FAQs For Reliance Industries Share Price

1. Is Reliance Industries a good long-term growth investment?

Yes, Reliance has a diversified business plan, sound finances, and ongoing expansion plans, so it is a good long-term investment.

2. Why is the Reliance stock price lagging in recent times?

The stock is technically weak now with bearish signals such as low RSI and MACD. Fundamentals are strong.

3. What are the major growth drivers of Reliance Industries?

- Renewable energy expansion growth

- Jio telecom service growth

- Reliance Retail and digital businesses growth

- Worldwide petrochemical ventures expansion

4. What are some of those risks one should remember before investing in Reliance?

- Oil price volatility

- Telcom and retail business-related regulation changes

- competition from Tata, Adani, and world champions

5. How often Reliance pays a dividend?

Dividend payment every year from Reliance because the company is still investing into profits to spur growth and for smaller dividend payments.

Reliance Industries remains a market leader in certain industries, with good growth prospects and strong financial support. Technicals in the short term are weak, but the long term is good. Investors have to compute the risks taken and the growth potential before investing.