Tata Motors Share Price Target From 2025 to 2030

Tata Motors Limited is certainly one of India’s main vehicle manufacturers and a key participant within the worldwide automotive industry. The business enterprise, a part of the Tata Group, operates in a couple of segments such as passenger automobiles, commercial vehicles, and electric mobility answers. Tata Motors owns renowned manufacturers consisting of Jaguar Land Rover (JLR) and has a robust presence in global markets.

- CEO & Leadership: As of 2025, the corporation is led by using a sturdy management crew under the Tata Group’s leadership.

- Market Capitalization: ₹2.54 Lakh Crore

- Industry Rivals: Competes with Mahindra & Mahindra, Maruti Suzuki, Ashok Leyland, Hyundai, and global giants like Tesla and Toyota.

Financial Health: How Strong Is It?

Tata Motors has proven sturdy economic performance in latest years, pushed by using its electric powered car (EV) expansion, price-reducing measures, and extended call for for commercial vehicles.

- Revenue & Profit Growth: The enterprise has shown constant revenue growth over the past 5 years, fueled by way of its strong product portfolio and developing EV market.

- Debt to Equity Ratio: 1.05 (slight debt, however doable because of increasing profitability)

- Earnings Per Share (EPS): ₹86.30 (displaying consistent boom)

- Return on Equity (ROE): 32.99% (robust profitability indicator)

- Cash Flow: The company maintains solid cash waft, taking into account similarly investments in innovation and enlargement.

Key Reports

- Balance Sheet: Strong belongings and doable liabilities

- Income Statement: Growing sales streams from passenger, industrial, and EV segments

- Cash Flow Statement: Positive coins waft with strategic investments

Stock Performance: How Does It Behave?

- 52-week High: ₹1,179.00

- 52-week Low: ₹667.05

- Current Price: ₹688.40

- P/E Ratio: 6.04 (undervalued compared to industry P/E of 20.90)

- Market Volatility: The stock has experienced fluctuations but remains a protracted-term growth candidate.

Technical Indicators

- RSI (14-Day): 38.6 (slightly bearish)

- MACD: -18.9 (bearish momentum)

- ADX: 26.7 (slight fashion power)

- MFI: 44.1 (impartial)

Dividends & Returns: What Do Investors Get?

- Dividend Yield: 0.92%

- Book Value per Share: ₹274.54

- Stock Buybacks: Tata Motors has periodically carried out inventory buybacks, displaying self belief in its lengthy-time period increase capacity.

Growth Potential: What’s Next?

Key Growth Drivers

- Electric Vehicle Expansion: Tata Motors leads India’s EV segment with the Nexon EV and Tigor EV, with plans to release new fashions.

- Jaguar Land Rover Turnaround: JLR’s electrification strategy and fee-cutting measures are enhancing profitability.

- Commercial Vehicle Demand: Infrastructure development and accelerated e-commerce activities are riding demand.

- Global Expansion: Strengthening presence in Europe, Africa, and Southeast Asia.

- Strategic Partnerships: Collaborations with tech companies for self sustaining driving and battery generation.

External Factors Affecting the Stock

- Economic Trends: Interest quotes, inflation, and global demand fluctuations.

- Government Policies: EV incentives, tax advantages, and emission rules.

- Industry Trends: Transition to electric and hydrogen automobiles.

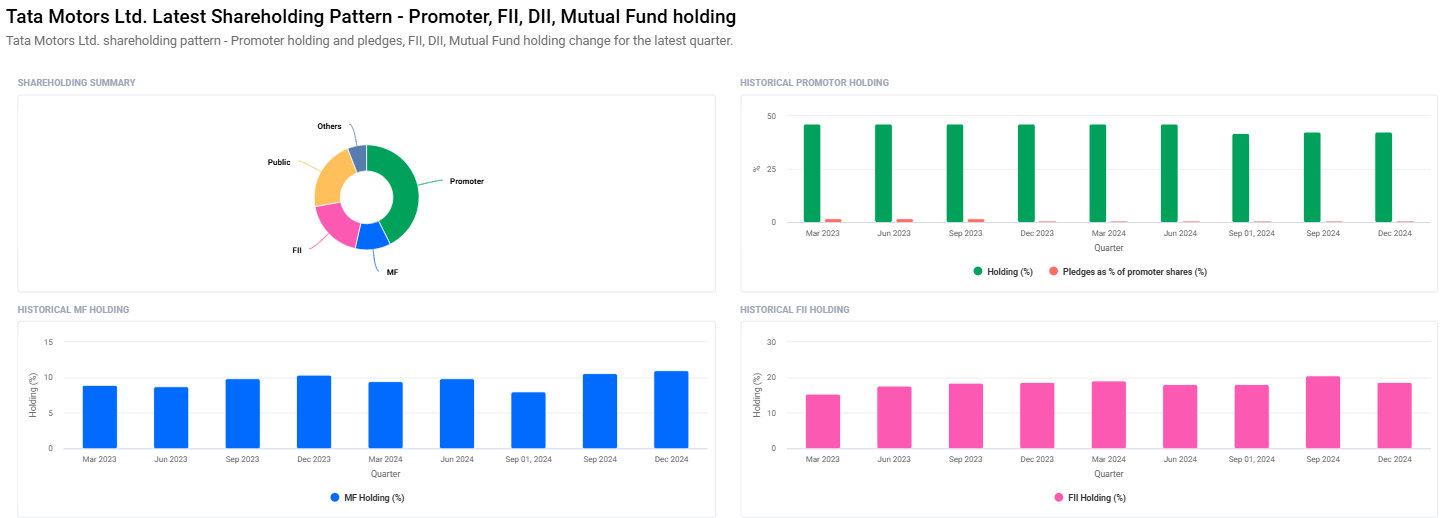

- Institutional Investor Activity: FIIs and mutual price range increasing/reducing stakes.

Risk Factors: What Can Go Wrong?

- Market Risk: Economic downturns affecting demand.

- Business Risk: Competition from international giants.

- Financial Risk: High debt ranges if no longer controlled properly.

- Geopolitical Risks: Trade limitations, supply chain disruptions.

Tata Motors Share Price Target (2025-2030)

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹1200 |

| 2026 | ₹1700 |

| 2027 | ₹2200 |

| 2028 | ₹2700 |

| 2029 | ₹3200 |

| 2030 | ₹3700 |

These projections are based totally on modern-day industry trends, business enterprise overall performance, and global economic conditions.

Frequently Asked Questions (FAQs) For Tata Motors Share Price

1. Is Tata Motors an excellent investment for the long term?

Yes, Tata Motors suggests strong growth ability because of its leadership inside the EV area, improving financials, and global growth method.

2. What elements can drive Tata Motors’ inventory price up?

Key factors consist of EV adoption, strong JLR sales, government regulations favoring electric powered mobility, and value-slicing projects.

3. What are the dangers of investing in Tata Motors?

Market volatility, competition, regulatory modifications, and financial downturns are key dangers.

4. Will Tata Motors keep to dominate the EV market in India?

With competitive growth and new EV launches, Tata Motors is well-positioned to maintain its dominance.

5. Should I spend money on Tata Motors stock in 2025?

If you have an extended-term investment horizon, Tata Motors is a promising option due to its growth trajectory and economic health.

Tata Motors gives a compelling investment opportunity, mainly for long-term buyers. With its leadership in EVs, strategic expansions, and improving financials, the corporation has sturdy capability to deliver huge returns over the next decade.