U Y Fincorp Share Price Target From 2025 to 2030

U Y Fincorp Share Price Target From 2025 to 2030: U Y Fincorp Ltd. is a finance and investment business company. It is an NBFC offering credit facilities to corporate as well as individual organizations. It focuses on asset-backed finance, finance to corporates, and investment in financial assets to a large extent.

Who Owns the Company?

U Y Fincorp is managed by a board of management consisting of seasoned finance professionals in credit lending and investment management. The board of directors and the CEO predominantly have the responsibility of determining company strategy, risk, and operation efficiency.

Market Capitalization & Size

As of the most recent available information, U Y Fincorp’s market cap is INR 364.69 Cr, and it is a small-cap financial institution. Company size and valuation are that of an expanding company in the NBFC space rivaling other mid-cap financial institutions.

Competitive Position

U Y Fincorp rivals other financial institutions and NBFCs that provide similar investment and credit products. Some of the largest players are:

- Bajaj Finance

- Muthoot Finance

- Manappuram Finance

Although with higher market capitalizations, U Y Fincorp is carving out a niche in growth segments of lending.

2. Financial Health: How Strong Is It?

Revenue & Profit Growth

Historical financials of the company are on:

- Five-year revenue trends show moderate growth.

- Healthy profit margins but to be yet optimized relative to industry majors.

- EPS of 0.81 shows limited earning power but room for future improvement.

Debt vs. Equity

0.01 Debt-to-Equity ratio indicates U Y Fincorp’s cautious use of borrowings and renders it financially conservative as opposed to leveraged competitors.

Cash Flow Strength

Cash flow is one to watch to avoid the company accumulating too much debt in growing.

Major financial statements to watch

- Balance Sheet: Accounts for assets, liabilities, and capitalization.

- Income Statement: Revenue, expense, and profit trends.

- Cash Flow Statement: Fluctuation in money inflows and outflows.

3. Stock Performance: What Does It Do?

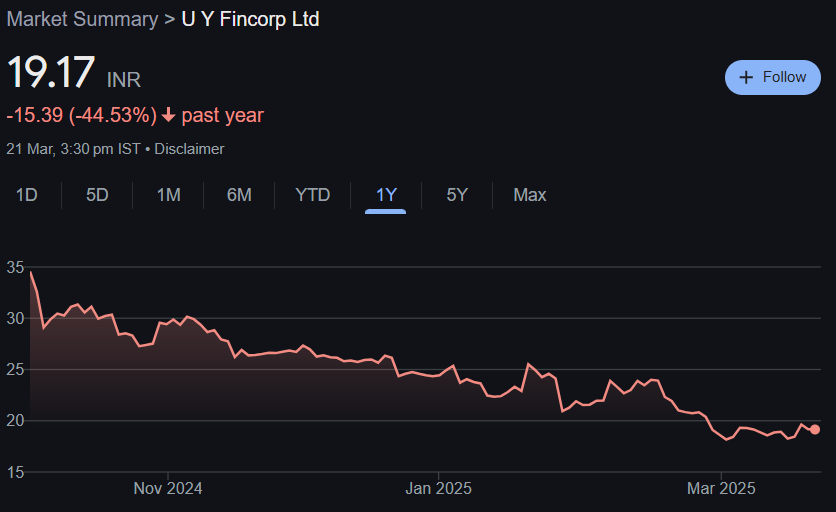

Recent Trend

- 52-week high: INR 39.40

- 52-week low: INR 17.89

- Current price: INR 19.17

The company has also faced mammoth volatility, falling 44.53% in the last one year. While it’s close to its lower band, investors will have to look out for if it’s a buying opportunity or further falling is on the menu.

Technical Indicators

- MACD (-0.8) shows a downtrend.

- ADX (18.5) suggests weak trend strength.

- RSI (43.8) shows the stock neither oversold nor overbought.

- ROC (-13.6, -36.2) supports bearish momentum.

As there is technical weakness, short-term investors need to be cautious, while long-term investors can take this as a possible accumulation phase.

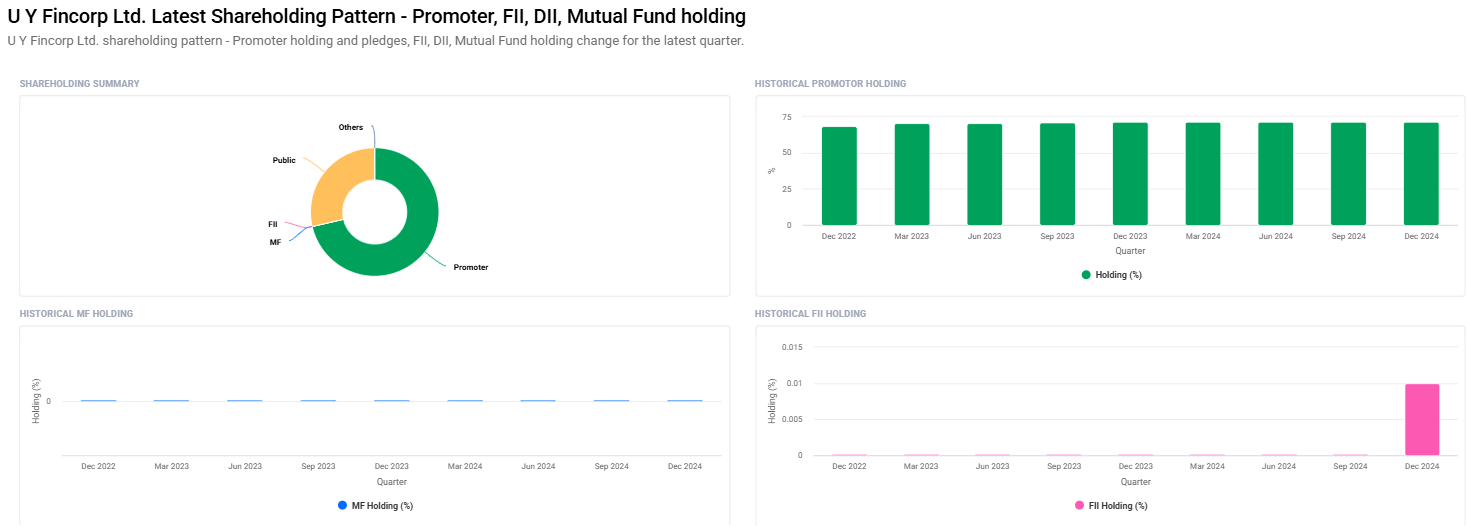

4. Dividends & Returns: What Do Investors Get?

- Dividend Yield: 0.00% (No dividend available as on date)

- Promoter Holding: 71.38% (unchanged last quarter)

- Institutional Investors: Holding rose from 0.00% to 0.01%

Though it hasn’t announced dividend so far, its promoter holding and marginal gain in institutional interest are signs of the better future to come.

5. Growth Potential: What’s Next?

Future Plans for Expansion

- U Y Fincorp will surely grow its book of loans with emphasis on newer segments of borrowers.

- Diversification in digital lending could prove to be a growth engine.

- Possible acquisition and mergers would enhance market standing.

Expected Share Price Targets

On technical as well as fundamental analysis, target prices are as under:

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹40 |

| 2026 | ₹65 |

| 2027 | ₹90 |

| 2028 | ₹115 |

| 2029 | ₹140 |

| 2030 | ₹165 |

Depending on the growth rate which the company is maintaining.

6. External Factors: What Can Affect the Stock?

Economic Trends

- Interest Rate Cycles: Increase in interest rates will be having its impact on loan demands.

- Inflation: Increased inflation will reduce profitability of lending.

Industry Trends

- Regulations of RBI NBFC would impact business operations.

- Increased competition for digital lenders.

Government Policies

- Policy interventions by the government regarding NBFC terms of lending.

- Effect of tax policy on financial institutions.

7. Risk Factors: What Can Go Wrong?

Market Risks

- General stock market volatility affecting small-cap stocks.

- Declining interest in financial sector stock by business investors.

Business Risks

- Decline in loan recovery that restrains profitability.

- Growth-preventing leadership decisions which disable.

Financial Risks

- Declining income as a result of economic recessions.

- Breakdown in business cash flow management that triggers fiscal pressures.

Long-term investment should be factored while investing in U Y Fincorp with poor current technicals but good future growth prospects. Investors can consider its growth strategies, financials, and positioning in the market before investing.

Frequently Asked Questions (FAQs)

1. Should U Y Fincorp be invested long term?

It has good promoters support and growth prospects, but technical weakness currently demands long-term players to be patient.

2. Why is the U Y Fincorp share lower in the past year?

Share has been down due to market, negative technicals, and perhaps decreased investor confidence.

3. Is U Y Fincorp paying dividends?

No, the company is not paying dividends at this point.

4. What are the greatest risks to invest for U Y Fincorp?

Risk is volatility in the marketplace, decline in financials, and change in the regulatory regime in favor of NBFCs.

5. Can U Y Fincorp grow to INR 165 by 2030?

It cannot be achieved unless there is consistent growth, diversification of lending business, and financial tightening persist.