V2 Retail Share Price Target From 2025 to 2030

V2 Retail Share Price Target From 2025 to 2030: V2 Retail Limited is among India’s value retail leaders, which retails value fashion and lifestyle products in numerous categories. On March 24, 2025, the share price of the company started at ₹1,644.00, the highest at ₹1,698.45, and lowest at ₹1,601.95. Market cap of ₹5,930 crore and P/E of 84.81, V2 Retail has been such a growth stock. This in-depth analysis examines the company’s fundamentals, its health from a financial perspective, share performance, growth opportunities, and provides share price forecasts from 2025 through 2030.

Company Basics: Who Are They?

V2 Retail Limited is a value retailer selling in the provision of lifestyle and clothing products at affordable prices to Indian consumers. V2 Retail offers men’s, women’s, and children’s clothing, accessories, and home furnishings. As of December 2024, V2 Retail has 158 stores spread in 14 states and hopes to have 250 stores two years from now (Business Standard).

The firm is headed by Whole-Time Director Akash Agarwal, who played a key role in formulating the firm’s growth and expansion strategies. V2 Retail’s competitive strategy is underpinned by its emphasis on the value segment to reach price-conscious customers seeking quality products at reasonable prices. Its nearest competitors are Trent’s Zudio, Reliance Retail’s Yousta, Aditya Birla Fashion and Retail’s Style Up, and InTune by Shoppers Stop (Financial Express).

Financial Health: How Healthy Is It?

V2 Retail has demonstrated good financial growth in the past few years. The company achieved a revenue of ₹1,165 crore in FY2024, a healthy growth from ₹1,150 crore in FY2023. The company has strategized to end FY2025 with revenue of ₹1,800 crore and ₹2,800 crore by FY2027.

The debt-to-equity ratio of the company is 2.25, which indicates moderate reliance on borrowing. The twelve-month trailing Earnings Per Share (EPS) is ₹20.01, indicating the profitability of the company. No particular cash flow figures are mentioned, but the reinvestment policies and plans for expansion of the company indicate the focus on keeping the company operational and expanding.

Stock Performance: How Does It Act?

In the past year, the company’s stock has recorded high growth, with the 52-week high being ₹2,097.00 and the low being ₹409.00, rising by 299.64%. The stock volatility can be ascertained from its Average True Range (ATR) of 96.4, showing high price volatility. The P/E ratio of 80.93 indicates that the share is quoted at a premium relative to earnings, as is the situation with high growth stock expectations.

Dividends & Returns: What Do Investors Get?

Presently, V2 Retail has no dividend yield, and hence the firm reinvests profit in growth and operational enhancement instead of paying profits to investors. Although such a strategy may not bring returns to the investor in the short term, it is in the best interest of the company’s growth strategy and value creation in the long term.

Growth Potential: What’s Next?

V2 Retail has expansionary growth plans, such as increasing its store chain to 250 stores in the next two years and achieving a revenue target of ₹2,800 crore by FY2027. The company is also concentrating on customer experience through revamped store formats and introducing an e-commerce website to offer an omnichannel shopping experience (Business Standard).

External Factors: What Can Push the Stock?

There are certain extrinsic factors upon which the V2 Retail share price depends, including:

- Economic Trends: Interest rate and inflation, which impact what people will pay.

- Industry Trends: Customer tastes changing, and competition gleaned from other traders.

- Government Policies: Retail working regulations and the direct foreign investment policies.

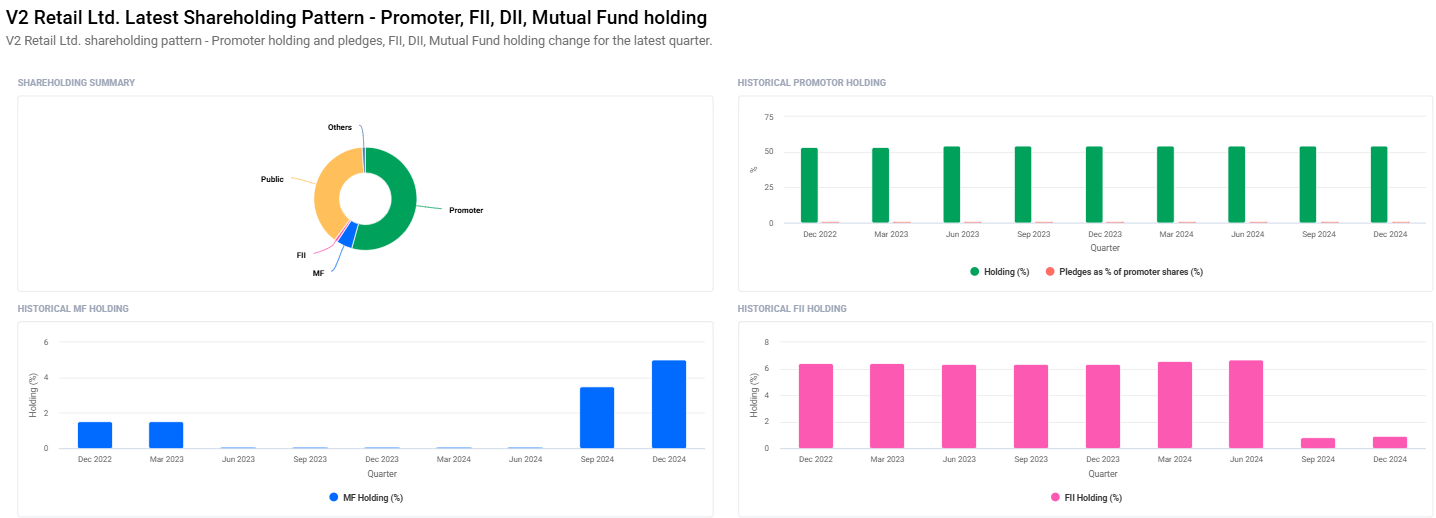

- Institutional Investors: Ownership pattern changing, which has a direct impact on stock price.

Risk Factors: What Can Go Wrong?

Investment in V2 Retail has some risks undertaken, i.e.

- Market Risk: Broad market volatility in shares has the ability to affect the company’s share price.

- Business Risk: Issues like management, declining demand, or conducting the business.

- Financial Risk: Heavy borrowings or declining revenues have the ability to hurt financial well-being.

- Political/Global Risk: Changes in regimes, political tensions among countries, or economic downturns might be challenging.

Share Price Targets from 2025 to 2030

On the basis of the industry and company growth plans, V2 Retail’s indicative share price targets are as follows:

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹2300 |

| 2026 | ₹4000 |

| 2027 | ₹5700 |

| 2028 | ₹7400 |

| 2029 | ₹9100 |

| 2030 | ₹10800 |

Targets have been given keeping in view the company growth plans, revenue growth estimates, and current market conditions. Targets should be taken as indicative and subject to modification on the basis of a wide range of internal and external variables by the investors.

A stock represents a company, and it should be understood as to what the business, funds, and strategy for growth in V2 Retail are before it can be taken into investment considering it an intelligent choice. Putting the company and its peers to a comparison as well as researching the overall state of the market will provide with the real perspective regarding its outlook.

Frequently Asked Questions (FAQs)

What is V2 Retail’s business?

V2 Retail deals in the business of value retailing, trading mass-market fashion and lifestyle goods throughout India.

Who are the major competitors of V2 Retail?

Major competitors are Zudio, Yousta, Style Up, and InTune.

Does V2 Retail provide dividends?

Presently, V2 Retail does not provide dividends because it invests profits in growth.

What is V2 Retail’s FY2027 revenue goal?

The company is working towards achieving a revenue goal of ₹2,800 crore by FY2027.

What are the reasons that can influence V2 Retail’s share price?

Economic environment, competition, government policies, and institutional investor actions.

Examining these reasons, investors will be able to make an informed choice regarding V2 Retail’s stock.