Wall Street Stunned as Nvidia’s AI Chips Drive Insane Growth!

Stock markets around the world were buzzing today as investors eagerly waited for Nvidia’s latest earnings report. As the undisputed leader in AI hardware, the company has been at the center of the artificial intelligence revolution, and its performance is being closely watched. A strong report could fuel even more excitement around AI, while a disappointing one could shake confidence in the sector.

Nvidia’s Numbers Are Through the Roof

The company’s most recent financial reports completely dispelled any doubts about Nvidia’s supremacy. A 78% increase over last year’s $22.1 billion, the company’s fourth-quarter sales of $39.3 billion was astounding. Even more remarkable is the fact that net income almost doubled, reaching $22.09 billion from $12.29 billion the previous year.

But what is the true game-changer? Sales of Nvidia’s Blackwell AI chips alone totaled $11 billion. Nvidia’s sales for the entire year soared to $130.5 billion, a 114% rise over the previous year. These figures, which are unprecedented in the computer sector, demonstrate how far ahead Nvidia is among its rivals.’

CEO Jensen Huang: “AI Demand Is Off the Charts”

Jensen Huang, Nvidia’s outspoken CEO, made it clear that the demand for AI computing is only getting bigger. He pointed out that cutting-edge AI models—like DeepSeek’s R1—require up to 100 times more computing power than previous generations. This means companies and research labs around the world are scrambling to get their hands on the latest Nvidia chips.

“AI is growing at an insane rate,” Huang said. “Companies are building massive AI factories, and the demand is only accelerating.”

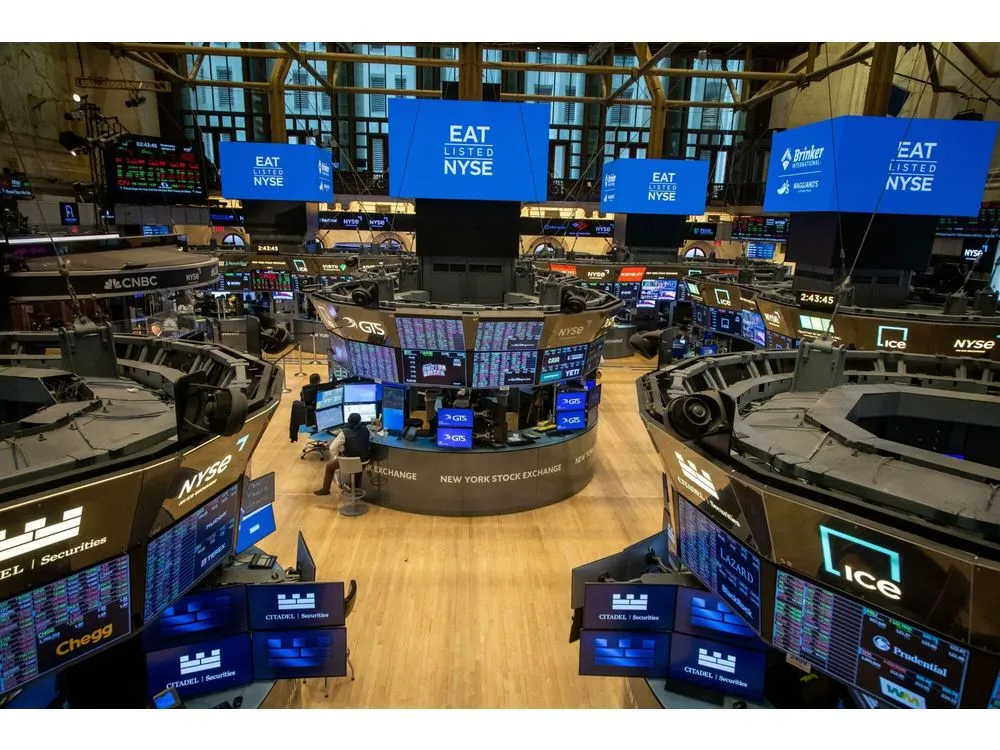

How the Markets Reacted

With Nvidia posting such insane numbers, markets saw mixed reactions. Japan’s Nikkei 225 gained 0.2%, and Australia’s ASX 500 edged up 0.3%. But it wasn’t all positive—China’s Shanghai Composite slipped 0.5%, and Hong Kong’s Hang Seng fell 0.8%, as investors worried about broader economic trends. South Korea’s Kospi also dropped 0.9%.

What Else Is Shaping the Market?

Investors are monitoring any new U.S. tariffs on imports from Canada, Mexico, and Europe in addition to Nvidia’s progress. Global markets may be shook by these trade policies, which would increase uncertainty. Even if AI stocks are growing, investors are still wary because to rising interest rates and inflation.

Nvidia Stays on Top—For Now

While competitors are trying to catch up, Nvidia remains the king of AI hardware. The company has locked in deals with major cloud providers and continues to push the boundaries of computing power. With demand at an all-time high, Nvidia’s latest results show that the AI revolution is just getting started—and they’re leading the charge.