Infosys Share Price Target From 2025 to 2030

Infosys Share Price Target From 2025 to 2030: Infosys Ltd. is a leader in technology services and consulting with an outpost in Bengaluru. It offers business consulting, IT solutions, and industry clients from the banking, healthcare, manufacturing, and retail sectors digital transformation.

Leadership

Salil Parekh is the CEO and Managing Director of Infosys Ltd. Infosys during his leadership has been focusing on cloud computing, artificial intelligence, automation, and digital transformation in order to compete with other companies.

Market Position

Infosys is a ₹6.99 lakh crore market cap company and ranks among the leading Indian IT services companies competing with TCS, Wipro, HCL Technologies, and multinational giants like Accenture.

2. Financial Health: How Strong Is It?

Revenue & Profit Growth

Infosys has registered consistent revenue and profit growth over the past five years as demand for cloud and digital solutions has picked up. Stability is provided by the firm order book and long-term client agreements in the globe.

Debt vs. Equity

- 0.09 is an excellent Debt-to-Equity ratio with minimal reliance on debt and excellent financial health.

Earnings Per Share (EPS)

- EPS (TTM) of 66.58 reflects growth in earnings on a consistent basis. Rising EPS reflects rising profitability, which is good news for investors.

Cash Flow & Dividend Yield

- The company provides good cash flows, which are suitable for optimal operation and spending on research and development.

Dividend Yield: 2.61%, thus apt for income-starved investors.

3. Stock Performance: How Does It Behave?

Key Stock Parameters

- 52-week high: ₹2,006.45

- 52-week low: ₹1,358.35

- Current Price: ₹1,693.00 (as of latest available data).

- P/E Ratio: 26.50 (practically industry average of 29.17)

- P/B Ratio: 9.62

Technical Indicators

- Momentum Score: 42.8 (Neutral)

- RSI (14): 25.9 (Oversold, and hence the possible bounce-back)

- MACD: -36.5 (Bearish trend)

- MFI: 6.0 (Oversold, and hence the likely recovery)

- Day ATR: 40.9 (Normal volatility)

4. Dividends & Returns: What Do Investors Get?

- Infosys is renowned for offering dividends and buybacks to investors on a quarterly basis.

- Dividend Yield: 2.61%, which is superior to industry average.

- The company has been regularly conducting stock buybacks, which indicates a positive outlook towards long-term growth.

5. Growth Potential: What’s Next?

Growth Plans

- Infosys is placing strong bets on AI, cloud, security, and automation. Its strong partnerships with industry pioneers in the cloud like Microsoft Azure, AWS, and Google Cloud are propelling future revenue growth.

Market Opportunities

- Growing demand for digital transformation solutions.

- Expansion in North America and Europe.

- Higher government and enterprise IT expenditure.

6. External Drivers: What Can Alter the Stock?

Economic Trends

- The Infosys top line would be affected by inflation, interest rates, and global economic slump.

Industry Trends

- There is growing demand for AI, blockchain, and cloud computing, and Infosys is benefiting from it.

- Regulatory environment and data protection legislation can be a drag.

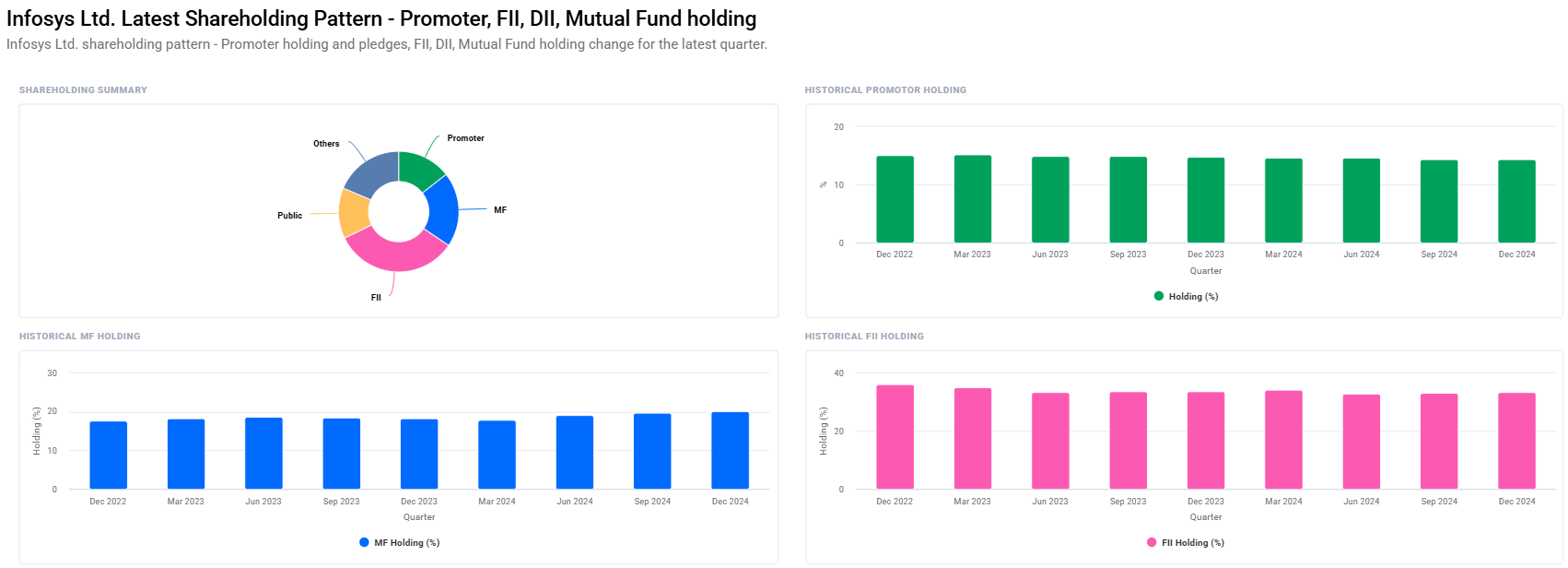

Institutional Investors

- 33.30% of the ownership of Infosys is with Foreign Institutional Investors (FIIs), reflecting robust offshore interest.

- Mutual Fund holding rose from 19.70% to 20.05%.

7. Risk Factors: What Could Go Wrong?

- Market Risk: IT stock is vulnerable to the global economic climate.

- Business Risk: Higher competition from Accenture, TCS, and others.

- Regulatory Risk: Shift in immigration policy impacting the hiring of skilled IT staff.

- Currency Fluctuations: Rupee appreciation can lower export revenues.

Infosys Share Price Target in 2025 to 2030

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹2000 |

| 2026 | ₹2700 |

| 2027 | ₹3400 |

| 2028 | ₹4100 |

| 2029 | ₹4800 |

| 2030 | ₹5500 |

FAQs For Infosys Share Price

1. Is Infosys a good long-term investment?

Yes, with strong finances, stable growth, and technology leadership, Infosys is a long-term investment for shareholders.

2. Will Infosys’ stock price hit 5000 INR in 2030?

Following growth trends, Infosys can hit ₹5500 in 2030, but market risk needs to be computed.

3. What are the investment risks of Infosys?

Global economic recessions, policy changes, and stiff competition are the key risks.

4. Does Infosys pay dividend?

Yes, Infosys possesses a stable dividend yield of 2.61% and can be a nice stock for investors who are paying dividends.

5. Should I purchase Infosys shares now?

The stock is oversold (RSI 25.9) and may be a long-term buying opportunity.