Karnataka Bank Share Price Target From 2025 to 2030

Karnataka Bank Share Price Target From 2025 to 2030: Karnataka Bank Limited started in 1924 as a pioneering private sector bank in India. It has a headquarters at Mangaluru, Karnataka. It engages in various banking products and financial services, retail banking, corporate banking services, and digital banking. Business up to March 31, 2024, Karnataka Bank has registered all-time highest net profit of ₹1,306.28 crore with 11% year-on-year growth rate.

Financial Performance (2020-2024):

- 2020-2021: The pandemic hit the bank all over the world but yet it was strong because of proper financial management.

- 2021-2022: Karnataka Bank posted a net profit of ₹507.99 crore.

- 2022-2023: The bank posted an all-time net profit of ₹1,179.68 crore, 132% more than last year.

- 2023-2024: Net profit was ₹1,306.28 crore with business turnover of ₹1,71,059.49 crore.

Financial Health Indicators

- Revenue & Profit Growth: Two-year compounded net profit growth.

- Asset Quality: Gross Non-Performing Assets (GNPA) dropped to 3.53% as of March 2024 from 3.74% as of March 2023.

- Capital Adequacy: Capital to Risk Weighted Assets Ratio (CRAR) stood at 17.45% as of 2023, indicating a sound capital base.

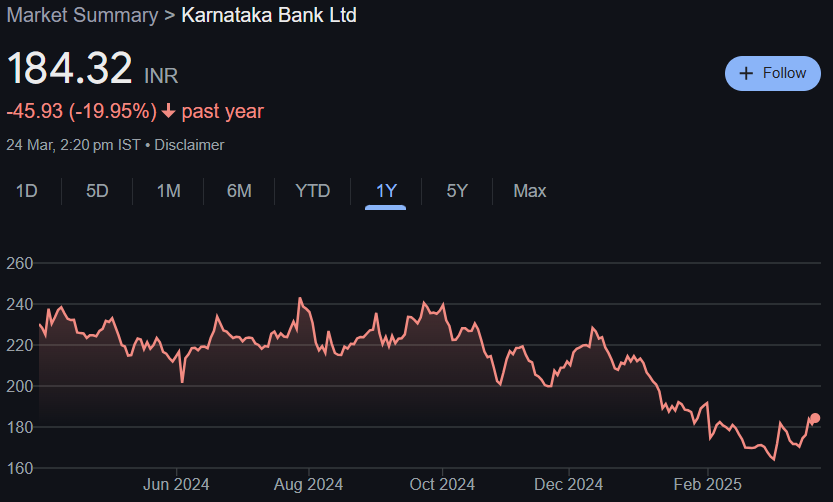

Stock Performance

- Current Metrics: The firm began at ₹182.44 on 24th March 2025, with intra-day high of ₹186.00 and intra-day low of ₹182.13. Market cap is ₹6,960 crore, and P/E ratio is 5.30.

- Volatility: The firm experienced volatility, with 52-week high of ₹245.00 and 52-week low of ₹162.20.

- Technical Indicators: Day MACD is red at -0.3 below centerline, pointing towards a bear trend, and Day RSI is 56.5 reflecting mid-point stand.

Dividends & Returns

Payment of common dividends has not been forgotten by Karnataka Bank in the short run or the long run. Karnataka Bank has, in 2024, considered paying an additional 55% dividend to shareholders. The dividend yield is around 2.98%, a reflection that the bank pays back value to their investors.

Potential for Growth:

The bank also established business turnover of ₹2 lakh crore for March 2026. Plans are to drive the digital banking drive, enhance asset quality, and expand the branch footprint geographically across the country.

External Factors:

Competitive forces, regulatory landscape, and economic outlook could bear upon the bank’s performance. Drive into digitalization and customer acquisition aggressively placed the bank well to battle the forces.

Risk Factors:

- Market Risk: Share price may be influenced by the ups and downs of the overall stock market.

- Business Risk: Decline in demand and management response would impact operations.

- Financial Risk: Funds borrowed with decreasing revenues are an area of concern.

- Regulatory Risk: Banks also face regulations that may influence profitability.

Share Price Targets (2025-2030):

Targets for Karnataka Bank share price are predicted by experts as below:

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹250 |

| 2026 | ₹430 |

| 2027 | ₹520 |

| 2028 | ₹610 |

| 2029 | ₹700 |

| 2030 | ₹800 |

According to the growth policy of the bank and trends in the market.

Frequently Asked Questions (FAQs):

What is the current dividend yield percentage of Karnataka Bank?

As of March 2025, about 2.98%.

What is the year-on-year change of net profit of Karnataka Bank?

The net profit has increased from ₹507.99 crore in 2022 to ₹1,306.28 crore in 2024.

What are Karnataka Bank’s growth objectives?

Karnataka Bank’s growth objective is ₹2 lakh crore business turnover by March 2026.

What affects the share price of Karnataka Bank?

Share price is affected by regulatory climate, bank’s balance sheet, and general economic scenario.

Is Karnataka Bank focusing on digital transformation?

In fact, the bank is making investment in digital programs towards enhanced customer experience and operational efficiency.