Lemon Tree Hotels Share Price Target From 2025 to 2030

Lemon Tree Hotels Share Price Target From 2025 to 2030: Lemon Tree Hotels Ltd. is an Indian hospitality chain operating in the mid-market and luxury segments. Set up by Patu Keswani in 2002, the group has expanded large over the years and offers value-for-money luxury experiences across geographies. It operates several brands:

- Lemon Tree Premier (luxury hotels)

- Lemon Tree Hotels (mid-market hotels)

- Red Fox Hotels (value segment)

Leadership and Market Position

- CEO: Patu Keswani

- Market Capitalization: ₹10,180 crore

- Number of Employees: More than 3,000

- Industry Peers: Indian Hotels Company Ltd. (Taj), EIH Ltd. (Oberoi), ITC Hotels

2. Financial Health: How Strong Is It?

Lemon Tree Hotels has shown steady financial growth with growth driven by growth in tourism, business travel, and the expanding middle class. Financial metrics of interest are:

Revenue & Profit Trends

Revenue and profit have grown steadily over the past five years as a result of growth and rising occupancy.

- Earnings Per Share (EPS): 2.28, with decent increase.

- Return on Equity (ROE): 10.01%, denoting sound management.

Debt vs. Equity

- Debt to Equity Ratio: 2.23, demonstrating high proportion of borrowed money but with under-control debt because of steady cash inflow.

Cash Flow and Sustainability

- Regular flow of money to the firm through hotel businesses that are subsequently used for development and growth measures.

Key Financial Reports

- Balance Sheet: Reflects a robust asset base, but debt is something to be cautious about.

- Income Statement: Revenue and profit margins are also recovering post-pandemic.

- Cash Flow Statement: Positive operating cash flow, which is supporting growth and debt management.

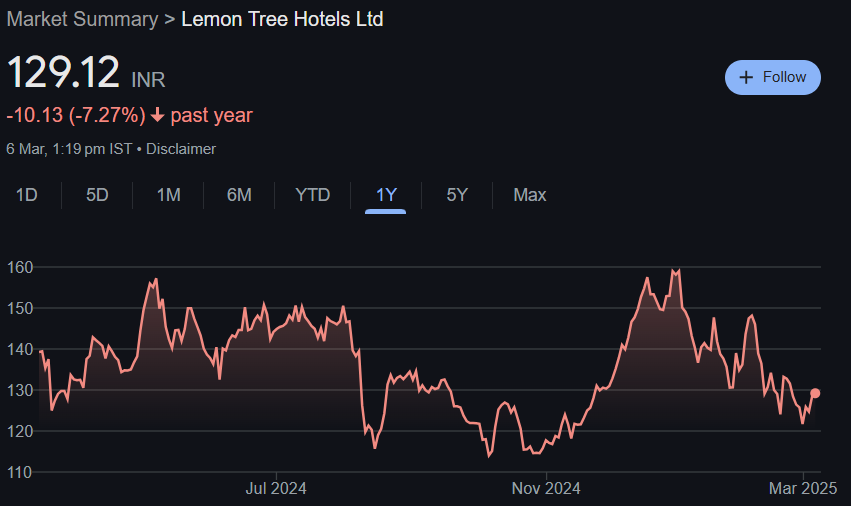

3. Stock Performance: How Does It Act?

Lemon Tree Hotels stock has fluctuated in the last year but is still a robust stock in the hospitality industry.

Recent Performance

- 52-Week High: ₹162.40

- 52-Week Low: ₹112.29

- Current Price: ₹129.20

- P/E Ratio: 56.88, indicates investor optimism but overvaluation.

Technical Indicators

- Momentum Score: 39.2 (Neither bull nor bearish, Neutral)

- RSI (Relative Strength Index): 45.6 (Neither overbought nor oversold, Neutral)

- MACD (Moving Average Convergence Divergence): -3.7 (Bearish signal)

4. Dividend & Returns: What Do Investors Get?

- Lemon Tree Hotels is not distributing dividends currently as it is concentrating on reinvestment and growth. Investors have only capital appreciation to look forward to.

5. Growth Potential: What’s Next?

Lemon Tree Hotels has a aggressive growth strategy with a vision of increased market share and financial performance.

Future Expansion Plans

- New Hotel Openings: New hotel launches in India and abroad.

- Strategic Partnerships: International brand partnerships for visibility.

- Technological Innovations: Investment in digital platforms to improve customer experience.

- Mergers & Acquisitions: Acquisitions to create strength in market presence.

6. External Factors: What Can Affect the Stock?

There are several factors outside Lemon Tree Hotels’ control that may impact its share price performance:

- Economic Trends: Interest rates, inflation, and GDP growth influence discretionary holiday expenditures.

- Industry Trends: Increasing competition from global and domestic hotel groups.

- Government Policies: Tax, tourism, and infrastructure development policy.

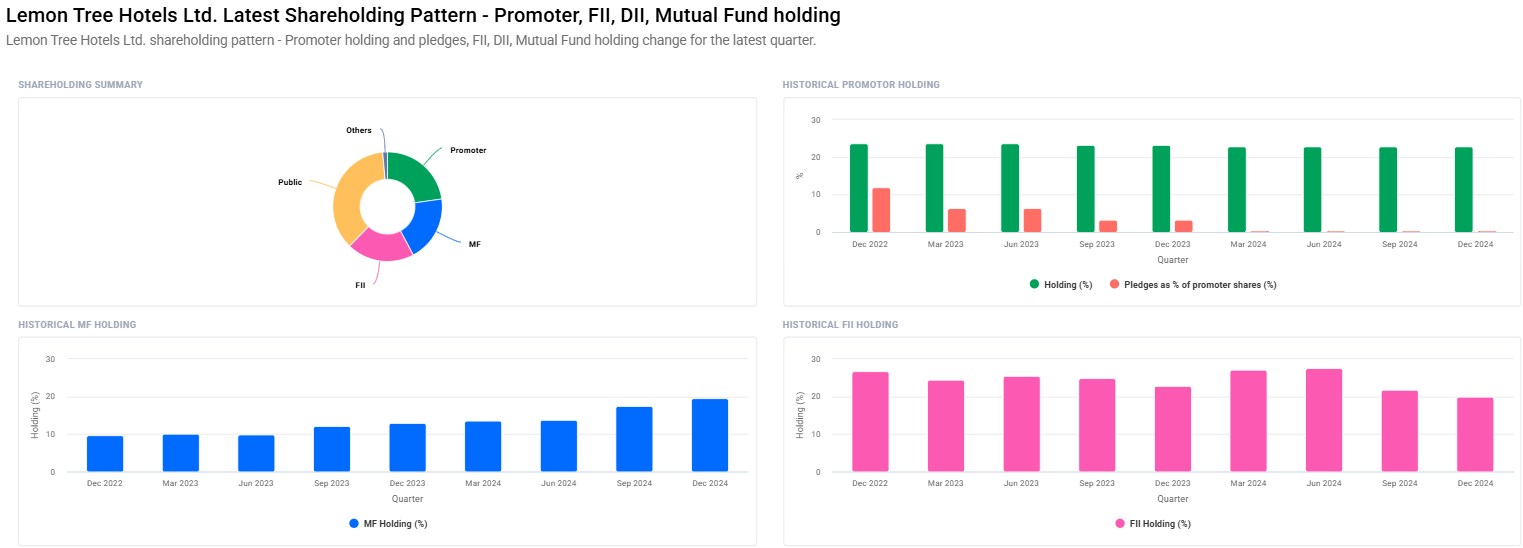

- Institutional Investors: Historical data reveal a slight decline in foreign institutional investor (FII) holding.

7. Risk Factors: What Can Go Wrong?

Though Lemon Tree Hotels has tremendous growth potential, investors need to be watchful of the following risks:

- Market Risk: Hotel stocks are cyclical in nature and exposed to economic stability.

- Business Risk: Competition with domestic and foreign brands.

- Financial Risk: Heavy debt will hit profitability if top line slows down.

- Geopolitical Risk: Changes in tourism policies, pandemic-led disruptions.

Lemon Tree Hotels Share Price Target (2025-2030)

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹170 |

| 2026 | ₹220 |

| 2027 | ₹270 |

| 2028 | ₹320 |

| 2029 | ₹370 |

| 2030 | ₹420 |

Frequently Asked Questions (FAQs)

1. Is Lemon Tree Hotels a good long-term investment?

Yes, with its solid market position, expansion strategy, and increasing occupancy levels, Lemon Tree Hotels does have long-term growth prospects. Investors only need to keep an eye on its debt ratio and industry trend.

2. Does Lemon Tree Hotels pay dividends?

No, Lemon Tree Hotels does not as yet pay dividends since it invests profit in expansion.

3. What are the investment risks in Lemon Tree Hotels?

Its main risks are economic downturns, competition, high gearing, and hospitality industry regulatory shocks.

4. Why is the P/E ratio of Lemon Tree Hotels high?

A high P/E ratio (at 56.88) indicates investor confidence in future growth but also that the stock is reasonably valued relative to earnings.

5. Where is Lemon Tree Hotels vis-a-vis peers?

Lemon Tree Hotels competes against Indian Hotels (Taj), EIH Ltd. (Oberoi), and ITC Hotels. It also has budget hotels as well as mid-budget hotels, bringing it lower on the pricing structure compared to groups of luxury hotels.

6. What are the primary drivers for the share price of Lemon Tree Hotels?

Revenue growth, occupancy levels, managing debt, growth plans, and market conditions drive it.

7. Will Lemon Tree Hotels share price reach ₹420 by 2030?

Based on existing growth projections and plans to expand, reaching ₹420 by 2030 is not an unrealistic hypothesis if business continues to operate at its glorious level and existing market trends remain optimistic.

Lemon Tree Hotels is an intriguing stock in Indian hospitality with solid growth plans. Risks as a mitigant, its trajectory towards growth is an intriguing long-term value play. Investors should monitor big finances, external factors, and direction in the marketplace before deciding.