NHPC Share Price Target From 2025 to 2030

NHPC Share Price Target From 2025 to 2030: NHPC Limited (National Hydroelectric Power Corporation) is a big public sector undertaking of India involved in hydroelectric power generation. NHPC was established in the year 1975 and comes under the Ministry of Power. The business of the company revolves around planning, developing, and implementing hydroelectric projects. NHPC ventured into wind and solar power businesses as a spin-off of the growth of the renewable energy business in India in the past few years.

Leadership and Market Presence

NHPC’s leadership falls under the umbrella of a group of managerial experts, and the Chairman and Managing Director of the company is Rajeev Kumar Vishnoi. The company’s market capitalization stands at around ₹73,439 crore and hence one of India’s key players in the power sector.

Competitive Position

NHPC is faced with power generation giants like NTPC, Tata Power, and Adani Green Energy. NTPC is a giant in thermal power generation, but NHPC is a giant in hydroelectric power generation. Due to the need for clean energy, there are bright prospects for expansion by NHPC.

2. Financial Health: How Strong Is It?

Revenue & Profit Trends

NHPC has seen consistent top line and bottom line growth over the last five years. It possesses a good revenue base with long-term PPAs from state electricity boards. The major financial ratios are:

- EPS (Earnings Per Share): 2.70 (TTM)

- ROE (Return on Equity): 7.39%

- P/E Ratio: 27.08 (higher than industry P/E of 19.82, reflecting confidence of investors)

- Debt-to-Equity Ratio: 0.85 (comfortable)

Debt and Cash Flow Position

NHPC has good financial performance and is debt-managed satisfactorily. NHPC has high operating cash flows and thus is in good position to take on financing of future projects without necessarily taking big borrowings.

Financial Reports to Look For:

- Balance Sheet: Shows strong asset base

- Income Statement: Shows steady revenue growth

- Cash Flow Statement: Shows positive operating cash flow

3. Stock Performance: How Does It Perform?

Recent Price Trends

- The holding of NHPC has fluctuated between 52-week high of ₹118.40 and 52-week low of ₹71.00. The share is trading around ₹73.46.

Technical Indicators:

- RSI (Relative Strength Index): 41.2 (Neutral Zone)

- MACD (Moving Average Convergence Divergence): -0.7 (Bearish Signal)

- Day Momentum Score: 28.7 (Technically weak)

- ADX (Average Directional Index): 16.6 (Low trend strength)

Investor Sentiment

- Based on analysts’ estimates, 83% recommend positive Buy, 10% recommend hold, and 17% recommend sell.

4. Dividends & Returns: What Do Investors Receive?

- NHPC provides fixed dividend of 2.60% of the return. NHPC dividend is cyclical and is an investment commitment by long-term participants.

- NHPC never bought excess equity through repurchasing massive amount of its share but went ahead to increase renewable power assets.

5. Growth Potential: What’s Next?

Future and Growth Projects

NHPC is proactively growing its renewables energy business in the areas of hydro, solar, and wind power projects. Major projects in the pipeline are:

- Teesta-VI Hydroelectric Project (Sikkim)

- Dibang Multipurpose Project (Arunachal Pradesh)

- Floating Solar Power Projects in Kerala and Tamil Nadu

International Ventures

- Nepal and Bhutan potential sectors of cooperation in hydroelectric power are being focused by NHPC with a perspective of further growth in geographical presence.

6. External Factors: What Can Affect the Stock?

Economic & Industry Trends

- Government Support: Supportive government policies to alternative energy

- Regulatory Risks: Reform in tariff or environmental policy

- Inflation & Interest Rates: Affects borrowing cost and viability of project

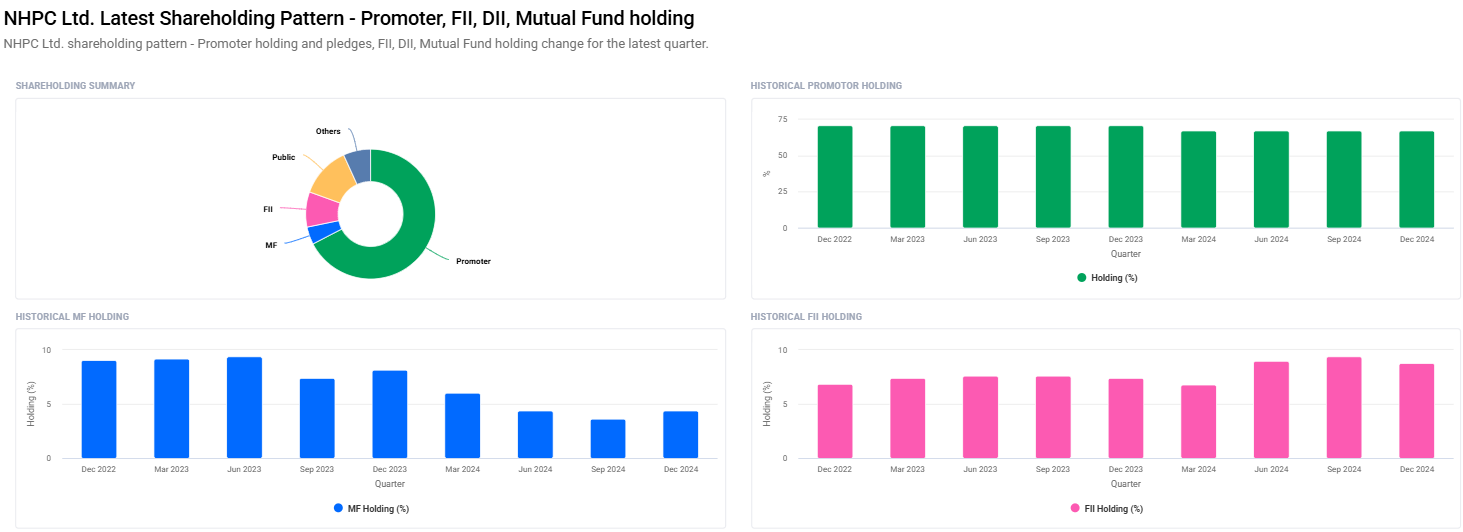

- Institutional Investors: FII holding have fallen from 9.38% to 8.77%, reflecting indifference of foreigners

7. Risk Factors: What Can Go Wrong?

- Market Risks: Volatility in stock market affecting investor sentiment

- Business Risks: Environmental clearance delays, Reliance on government orders

- Financial Risks: Higher cost of borrowing with increased interest rates

- Political & Global Risks: Geopolitical tensions forcing border crossing plans

NHPC Share Price Target 2025-2030

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹120 |

| 2026 | ₹170 |

| 2027 | ₹220 |

| 2028 | ₹270 |

| 2029 | ₹320 |

| 2030 | ₹370 |

Price Prediction Rationale:

- Growing hydro and solar power production

- Growing government support for renewables

- Intermittent returns and periodic dividends

- Foreign business development

FAQs For NHPC Share Price

1. Is NHPC a good long-term investment?

Yes, NHPC is a good long-term investment because of stable revenue, low debt, and government support for renewable energy.

2. What is NHPC’s 2025 share price target?

2025 price estimate: ₹120.

3. Why has NHPC stock become volatile?

The stock has become volatile due to external drivers like interest rates, regulatory framework, and market sentiment.

4. Does NHPC pay dividends?

Yes, NHPC is a dividend stock with a dividend yield of 2.60% and is highly appropriate for dividend investors.

5. Can NHPC touch ₹370 by 2030?

Yes, with anticipated growth in renewable energy and fiscal prudence, NHPC can achieve ₹370 by 2030.

NHPC is a sound investment concept in the clean energy domain. Although in the short term, it is volatile, its growth prospects for the next ten years are positive. Investors can invest in NHPC for long-term stable returns and appreciation of capital in the next ten years.