The Secret Behind AB InBev’s Success: Higher Prices, Bigger Profits, and Premium Beers!

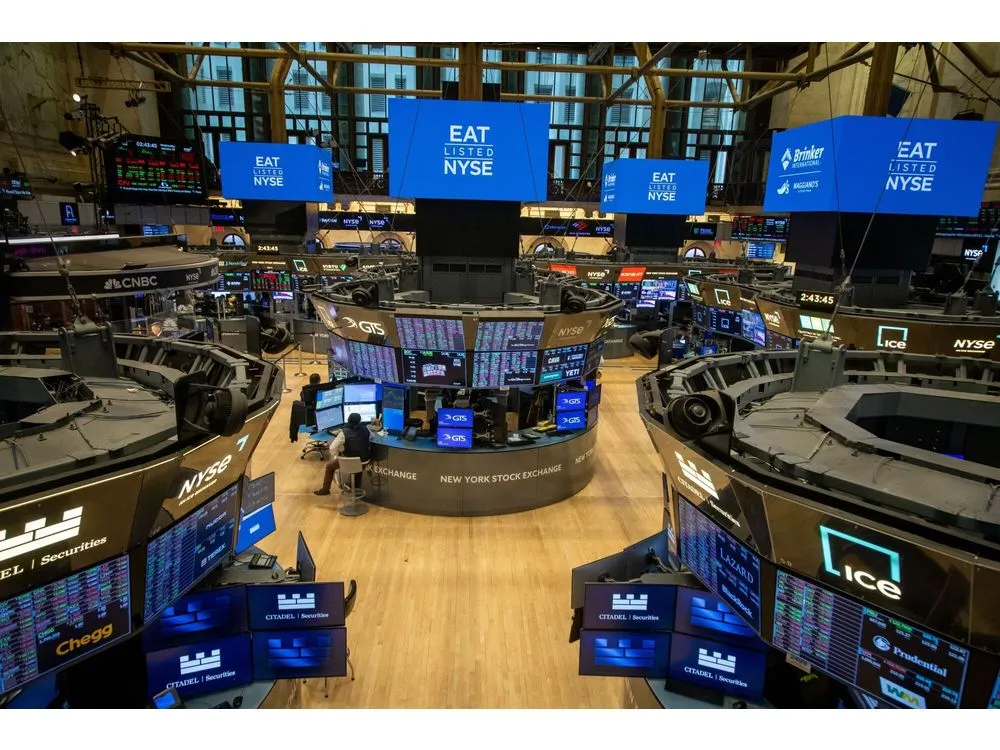

European stock markets had a strong finish today, lifted by better-than-expected earnings from major companies across different industries. Investors were encouraged by solid performances in finance, manufacturing, and consumer goods, showing that businesses are finding ways to grow despite economic challenges.

AB InBev’s Stock Surges 9% After Strong Earnings Report

Anheuser-Busch InBev (AB InBev), the largest beer manufacturer in the world, was one of the day’s biggest winners. When the business reported impressive quarterly earnings that surpassed forecasts, its stock shot up 9%.

AB InBev focused on premium brands and raised pricing to make up for the modest decline in overall beer sales. This tactic demonstrated that many customers are still prepared to pay more for premium drinks by increasing sales and improving profit margins.

Investors were happy with the results, as they showed that AB InBev’s pricing strategy is working, even in a tough market. The stock’s sharp rise reflects confidence that the company is well-positioned to keep growing in the future.

A Positive Sign for European Markets

Stock markets rose as a result of the favorable results released by a number of other significant European companies, in addition to AB InBev. Even if there are still worries about inflation and weaker global growth, today’s earnings reports indicate that companies are figuring out how to deal with these issues and continue to turn a profit.

According to analysts, businesses like AB InBev who have great brands, clever business plans, and devoted clientele will continue to do well. In the upcoming weeks, investors will be watching other earnings reports to see if this encouraging trend continues.