Urja Global Share Price Target From 2025 to 2030

Urja Global Share Price Target From 2025 to 2030: Urja Global Ltd. is an Indian firm that deals in the renewable energy business. It offers solar power, electric vehicle (EV), and battery technology solutions. The firm engages in the production of solar panels, lithium-ion batteries, and other renewable energy items.

Who Are the Owners?

Urja Global is led by a board of professionals in energy and sustainability. The management is set on increasing the company’s reach in the field of renewable energy, banking on the vision for green energy projects of India.

How Large Is the Company?

- Market Capitalization: ₹732.29 Crore

- Employees: The company has a lean infrastructure with a focus on sustainable and scalable energy solutions.

- Industry Position: It competes with other renewable power players such as Tata Power Renewable Energy, Adani Green Energy, and ReNew Power. As a small-cap company in spite of it all, its specialization in solar and EV infrastructure projects it for expansion in the future.

2. Financial Health: How Strong Is It?

Revenue & Profit Growth

Urja Global’s top line has been fluctuating in the past, considering the fact that it has been transforming its business model as well as geography. Nonetheless, the emphasis by the company on the increasing renewable space holds potential in the future.

Debt vs. Equity

- Debt to Equity Ratio: 0.04 (Extremely low debt, reflecting high financial health)

- Return on Debt Employed (RDE): 1.16%

Earnings Per Share (EPS)

- EPS (TTM): 0.03 (Need to improve for greater investor confidence)

- P/E Ratio (TTM): 463.00 (Very high, and this could reflect overvaluation or high growth potential)

Cash Flow Position

- It needs a healthy cash flow to fund operations and invest in new technology. Investors should keep an eye on Urja Global’s quarterly reports to observe whether it has a good cash position.

Key Reports to Watch:

- Balance Sheet: To observe that assets and liabilities

- Income Statement: To verify revenue and expenses

- Cash Flow Statement: To view cash inflows and outflows

3. Stock Performance: How Does It Act?

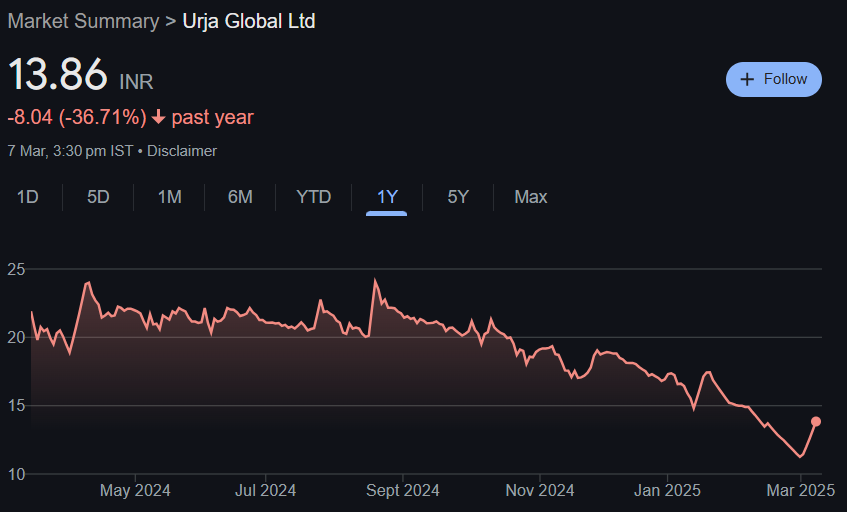

Latest Stock Details

- Open Price: ₹13.54

- High Price: ₹13.86

- Low Price: ₹13.54

- Previous Close: ₹13.86

- Market Cap: ₹730 Crore

- P/B Ratio: 19.95 (Above industry average, indicating overvaluation)

- 52-Week High: ₹25.45

- 52-Week Low: ₹10.87

Technical Indicators

- Momentum Score: 34.1 (Stock is technically weak)

- MACD (12, 26, 9): -0.6 (Bearish signal)

- RSI (14): 55.7 (Neutral; oversold below 30, overbought above 70)

- ADX: 39.9 (Indicates strong trend movement)

- ROC (21): -7.0 (Negative momentum)

4. Growth Potential: What’s Next?

Future Prospects

Urja Global is betting on India’s solar revolution. The company is building its pipeline in:

- Solar Power Projects (Solar energy adoption with government subsidy)

- Electric Vehicles (EVs) (Partnership opportunities with battery technology)

- Lithium-Ion Battery Manufacturing (EV and storage tech demand rising)

Urja Global Share Price Target From 2025 to 2030

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹30 |

| 2026 | ₹45 |

| 2027 | ₹60 |

| 2028 | ₹75 |

| 2029 | ₹90 |

| 2030 | ₹105 |

Growth track reflects growth in the use of renewable energy and possible government subsidies.

5. External Factors: What May Affect the Stock?

- Economic Trends: Global economic trends, inflation, and interest rates may affect the performance of the stock.

- Industry Trends: Renewable energy sector is changing, and government policy decides.

- Government Policies: Tax incentives and subsidies drive growth.

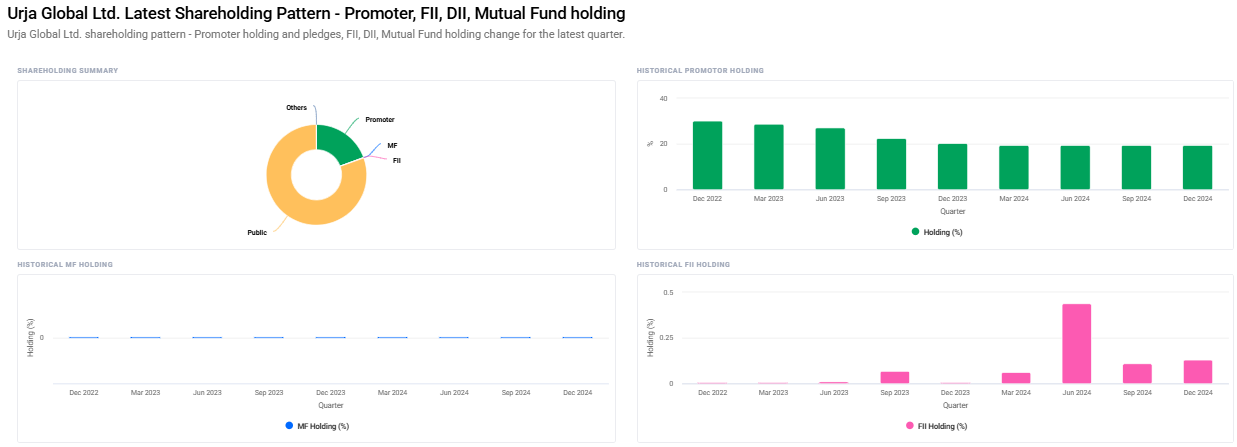

- Institutional Investors: Holdings total rose from 0.11% to 0.13% in Dec 2024 quarter.

6. Risk Factors: What Can Go Wrong?

- Market Risk: Stock market fluctuation may influence prices.

- Business Risk: Competitive pressures by major players.

- Financial Risk: Unwholesome profitability and volatile profits.

- Regulatory Risk: Government policy shift may influence growth.

7. FAQs For Urja Global Share Price

Q1: Is Urja Global a good long-term investment stock?

A: Urja Global is favorable on the higher side in the renewable energy industry, but extremely volatile and risky from a financial perspective. Long-term investors might look for the company’s revenue and profitability turn-around.

Q2: Does Urja Global pay dividends?

A: No, as of now the company does not pay dividends but invests and expands.

Q3: Why is the P/E ratio of Urja Global high?

A: The high P/E ratio reflects high future growth expectations by the investors but also shows that the stock is overvalued.

Q4: What are the key threats associated with investing in Urja Global?

A: The key threats are financial instability, competition, and vulnerability to government policy.

Q5: Will Urja Global benefit from the EV and solar energy boom in India?

A: Yes, if it performs on its expansion plan. There is intense competition in the sector, however.

Urja Global is a interesting but risky wager in the renewable energy field. With expectations of growth high on its mind, one needs to keep an eye out for the company performing on its strategy. With growth potential in the stock, one needs to analyze financials, market trends, and competition forces before making the wager.