Jaiprakash Power Share Price Target From 2025 to 2030

Jaiprakash Power Share Price Target From 2025 to 2030: Jaiprakash Power Ventures Ltd. (JPVL) is an Indian company that deals in power generation and cement. It deals in hydroelectric and thermal power generation and has a good amount of experience in construction and infrastructure. JPVL is a member of diversified Jaypee Group conglomerate dealing in cement production, construction, and real estate.

Leadership and Market Presence

- CEO: It is headed by experienced professionals in the power and infrastructure sector.

- Market Capitalization: Approximately ₹9,156 crore.

- Industry Position: Competes with other power majors like NTPC, Tata Power, and Adani Power.

2. Financial Health: Is Jaiprakash Power Ventures Ltd. Strong?

Revenue & Profit Trends

The top line of JPVL has seen the cyclical trends of the past few years along with the industry trend. The firm has made profits but at the expense of heavy debt dependency.

Debt vs. Equity

- Debt-to-Equity Ratio: 0.33, indicating moderate leverage, which is a positive observation compared to its peers who are similarly leveraged.

- ROE: 13.68%, which means acceptable profitability to its equity shareholders.

Critical Financial Ratios

- P/E Ratio: 7.34, which is less than the industry P/E ratio of 19.82, thus suggesting that it appears undervalued.

- P/B Ratio: 0.76, meaning the share is cheaper than its book value and therefore might be attractive to value investors.

- Earnings Per Share (EPS): 1.82, which proves consistency in profitability.

3. Stock Performance: How is JPVL doing?

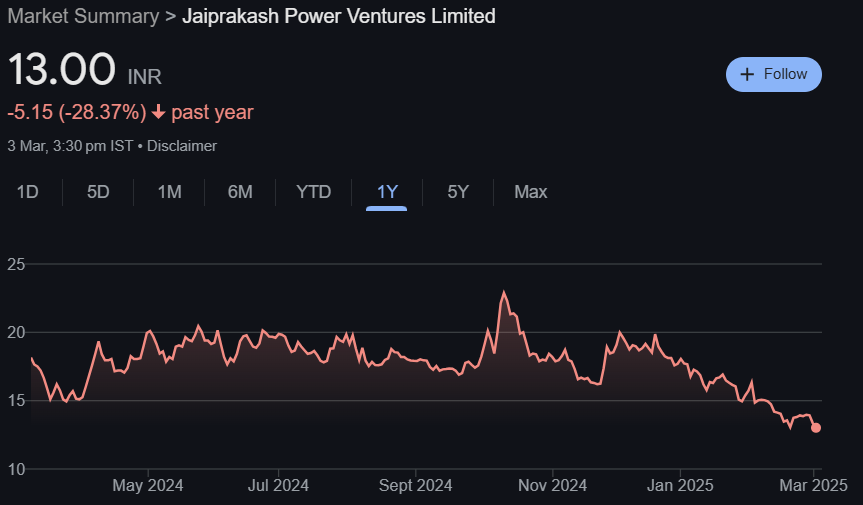

Analysis of Last Year

- Decline in Stock Price: -28.37% in the last year, proving market volatility and investor concern.

- 52-Week High: ₹23.77

- 52-Week Low: ₹12.36

- Current Price: ₹13.00

Technical Indicators

- Momentum Score: 35.7, indicating a neutral technical position.

- RSI (Relative Strength Index): 33.3, near oversold levels, indicating a potential lead to reversal.

- MACD (Moving Average Convergence Divergence): -0.6, indicating bearish momentum.

- ROC (Rate of Change – 21 Days): -15.1, downward trend.

4. Dividend & Returns: Investor Benefits

JPVL does not pay any dividends at present, with a policy of debt repayment and reinvestment. Nevertheless, it is a good long-term capital growth stock.

5. Growth Potential: Future of JPVL

Expansion Plans

- JPVL is investing in renewable energy sources, promoting the Indian government’s green energy policy.

- The revenue streams will improve with the help of government policies favoring infrastructure and power schemes.

- Power sector mergers and acquisitions provide a scope for expansion.

6. External Drivers Pushing JPVL

- Economic Trends: Increase in demand for power in India is advantageous for JPVL.

- Government Policies: Energy subsidy and infrastructure development policies are favorable to expansion.

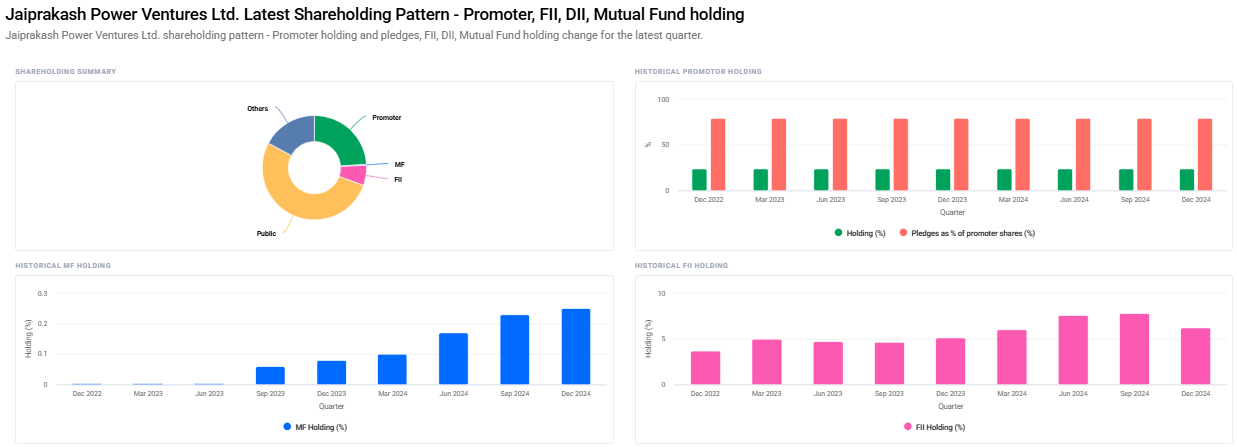

- Institutional Investors: FII holdings have reduced, which can be seen as a short-term conservatism.

7. Risk Considerations to Remember

- Market Risk: Fluctuation in the stock market impacts JPVL.

- Business Risk: Vulnerability to government policy and regulation.

- Financial Risk: Debt is in control but to be monitored.

- Global Risk: Change in energy regulation or economic recession.

8. Jaiprakash Power Share Price Target From 2025 to 2030

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹24 |

| 2026 | ₹36 |

| 2027 | ₹48 |

| 2028 | ₹60 |

| 2029 | ₹72 |

| 2030 | ₹84 |

Investment Outlook

- On JPVL’s valuation today and growth prospects, it is a long-term, moderate-risk investment opportunity for investors willing to catch the power sector boom.

Frequently Asked Questions (FAQs)

1. Is Jaiprakash Power Ventures Ltd. a good long-term investment?

Yes, JPVL is a growth stock due to increasing energy demand, but investors need to monitor financial health and industry trends.

2. What are the reasons behind the erosion of the share price of JPVL in the past year?

The stock has come under pressure due to market conditions, institutional investor selling, and general industry trends.

3. What are the future prospects of JPVL?

The future prospects of JPVL can be led by long-term growth due to its foray into renewable energy and government incentives for power infrastructure.

4. Does the company offer dividend?

No, JPVL does not pay dividends now but favors reinvestment and debt repayment.

5. What are the investment risks of JPVL?

The significant risks are regulatory change, financial leverage, and market volatility.